U.S. Bank Failures, 2001 – Present

The Big Picture

MARCH 22, 2023

Bank failures since 2001, scaled by amount of assets in 2023 dollars. Bank Failures, 2001 – Present appeared first on The Big Picture. The post U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2001 Related Topics

2001 Related Topics

The Big Picture

MARCH 22, 2023

Bank failures since 2001, scaled by amount of assets in 2023 dollars. Bank Failures, 2001 – Present appeared first on The Big Picture. The post U.S.

Calculated Risk

FEBRUARY 27, 2025

An index of 100 is equal to the level of contract activity in 2001. "It (Last year's cyclical low point in July 2024 was revised from 70.2 Year-over-year, pending transactions declined 5.2%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Calculated Risk

MARCH 27, 2025

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* a forward-looking indicator of home sales based on contract signings grew 2.0% in February. Year-over-year, pending transactions declined 3.6%.

Calculated Risk

OCTOBER 30, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – jumped 7.4% in September, the highest level since March (78.3). Year-over-year, pending transactions ascended 2.6%.

Calculated Risk

NOVEMBER 27, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – elevated 2.0% in October. Year-over-year, pending transactions expanded 5.4%. Homebuying momentum is building after nearly two years of suppressed home sales."

Calculated Risk

FEBRUARY 29, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 74.3 in January. Year over year, pending transactions were down 8.8%. The Northeast PHSI increased 0.8% from last month to 63.6, a decline of 5.5%

The Big Picture

APRIL 15, 2023

He helped to build out Blackstone’s PE business in Europe in 2001, moving to London in 2001. Baratta, who joined the firm in 1998, is also a member of the board of directors and serves on multiple management committees, as well as the firm’s investment committees.

Calculated Risk

OCTOBER 28, 2022

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slumped 10.2% in September. Year-over-year, pending transactions slid by 31.0%.

Calculated Risk

DECEMBER 30, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* a forward-looking indicator of home sales based on contract signings advanced 2.2% in November. Year-over-year, pending transactions improved 6.9%. Mortgage rates have averaged above 6% for the past 24 months.

Abnormal Returns

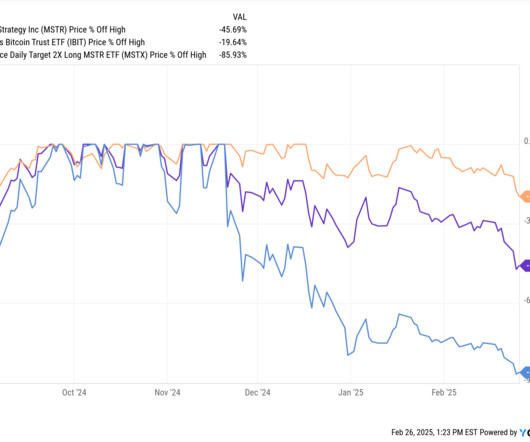

FEBRUARY 26, 2025

abnormalreturns.com) Mixed media Revisiting the 2001 movie 'A.I. (abnormalreturns.com) You can now follow us on Bluesky. bsky.app) Are you signed up for daily e-mail newsletter? Well, you should. Artificial Intelligence' in the age of actual AI. spyglass.org) AI-generated images are driving hair stylists crazy.

Calculated Risk

JUNE 27, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 70.8 Year over year, pending transactions were down 6.6%. Supply and demand movements suggest easing home price appreciation in upcoming months.

Calculated Risk

JUNE 29, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – dropped 2.7% Year over year, pending transactions fell by 22.2%. The Northeast PHSI climbed 12.9% from last month to 66.7, a decrease of 21.9% from May 2022.

Calculated Risk

MARCH 28, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 75.6 in February. Year over year, pending transactions were down 7.0%. The Northeast PHSI decreased 0.3% from last month to 63.4, a decline of 9.0%

Calculated Risk

MARCH 29, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* — a forward-looking indicator of home sales based on contract signings — improved 0.8% in February. Year-over-year, pending transactions dropped by 21.1%.

Calculated Risk

JANUARY 26, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 77.3 in December. Year over year, pending transactions were up 1.3%. The Northeast PHSI dropped 3.0% from last month to 62.3, a decline of 3.9%

The Big Picture

NOVEMBER 3, 2022

In March 2001, CPI ticked through the Fed’s 2% inflation target, and their reaction was. I don’t care what your personal theories on monetary policy might be, your thoughts on Milton Friedman, or who you plan on voting for next week. They remained on the emergency footing of zero.

Calculated Risk

APRIL 27, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI) * – a forward-looking indicator of home sales based on contract signings – waned by 5.2% Year over year, pending transactions dropped by 23.2%.

The Big Picture

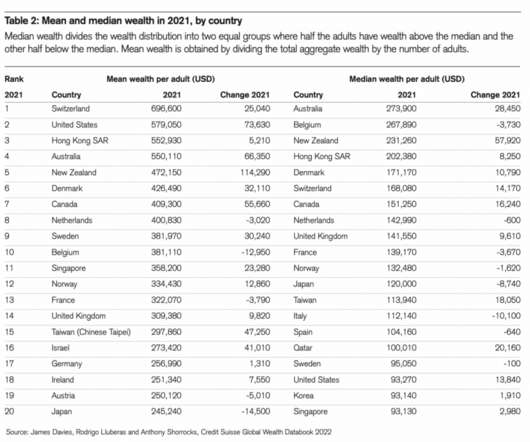

SEPTEMBER 22, 2022

Annual average gains: +6.6% (Avg 2001-2021). The actual data had some very interesting highlights, including some ginormous numbers: -Global Wealth: $463.6 trillion (end of 2021). Increase versus 2020: +9.8%. Aggregate global wealth: +12.7% (Fastest annual rate ever). Wealth per adult: $87,489. Real (inflation-adjusted) Wealth: +8.2%.

Calculated Risk

MAY 30, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 72.3 Year over year, pending transactions were down 7.4%. The Northeast PHSI fell 3.5% from last month to 62.9, a decline of 3.1% from April 2023.

Calculated Risk

FEBRUARY 27, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 8.1% in January. Year-over-year, pending transactions dropped by 24.1%. The Northeast PHSI rose 6.0% from last month to 68.7, a decline of 19.8%

Mish Talk

NOVEMBER 17, 2022

Strong Recession Signal Since 1990, the spread between 30-month T-Bills and the 10-year Treasury Note was only more inverted ahead of the 2001 recession. Since 1990, the spread between 30-month T-Bills and the 30-year long bond has only been more inverted a couple of times. This is a very strong recession signal.

Calculated Risk

JANUARY 27, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 2.5% in December. Year-over-year, pending transactions dropped by 33.8%.

Calculated Risk

SEPTEMBER 29, 2022

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 2.0% Year-over-year, pending transactions dwindled by 24.2%.

Calculated Risk

NOVEMBER 30, 2023

in October, the lowest number since the index was originated in 2001. An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – dropped 1.5% Year over year, pending transactions declined 8.5%. from last month to 64.8,

Abnormal Returns

AUGUST 17, 2023

Rates Mortgage rates are at levels not seen since 2001. axios.com) Global government bond yields are at 15-year highs. finance.yahoo.com) Markets Valuations don't matter in the short term. theirrelevantinvestor.com) Forecasting is hard, the GMO edition. ft.com) Companies Verily is setting the stage for a spinoff from Alphabet ($GOOGL).

Calculated Risk

AUGUST 2, 2024

in June to the highest level since 2001. Earlier: July Employment Report: 114 thousand Jobs, 4.3% The 25 to 54 years old participation rate increased in July to 84.0% from 83.7% The 25 to 54 employment population ratio increased to 80.9% from 80.8% the previous month.

Calculated Risk

JULY 27, 2022

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, dipped 8.6% Year-over-year, transactions shrank 20.0%.

Calculated Risk

APRIL 11, 2023

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Unemployment by Education This graph shows the unemployment rate by four levels of education (all groups are 25 years and older). in March.

Calculated Risk

FEBRUARY 10, 2023

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through January 2023. in January.

MarketWatch

JANUARY 31, 2023

stocks finished in the green on Tuesday as the Nasdaq cemented its best January performance since 2001 amid a broad-based rally in equities that saw some of 2022’s worst performers take the lead. The S&P 500 SPX gained 58.83 points, or about 1.5%, to finish January at 4,076.60, a gain of 6.2% for the month, according to Dow Jones Market Data.

Calculated Risk

SEPTEMBER 28, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – sank 7.1% Year over year, pending transactions fell by 18.7%. The Northeast PHSI declined 0.9% from last month to 62.6, a reduction of 18.2% from August 2022.

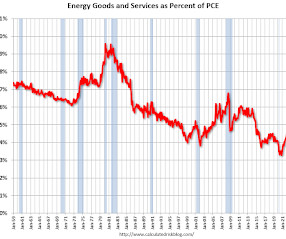

Calculated Risk

APRIL 29, 2024

As is the increase in energy prices during the 2001 through 2008 period. In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. In August March 2024, energy expenditures as a percentage of PCE were at 4.1% in June 2022.

Calculated Risk

APRIL 25, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 78.2 Year over year, pending transactions were up 0.1%. The Northeast PHSI increased 2.7% from last month to 65.1, a decline of 0.3% from March 2023.

Calculated Risk

AUGUST 24, 2022

An index of 100 is equal to the level of contract activity in 2001. "In The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slid 1.0% Year-over-year, pending transactions sank 19.9%. This month's very modest decline reflects the recent retreat in mortgage rates.

The Big Picture

SEPTEMBER 20, 2024

Before establishing SVP in 2001, Victor served as President of Cerberus Capital. This week, we speak with Victor Khosla, Founder and CIO of Strategic Value Partners. In the 1990s, he built and managed the distressed credit desk at both Citi and Merrill Lynch, establishing two of the top proprietary trading businesses.

The Big Picture

MARCH 15, 2023

563rd US bank failure since 2001 Source: Jim Reid, DB Sign up for our reads-only mailing list here. Bernstein was named to the Institutional Investor’s “All-America Research Team” 18 times and has been inducted into the Institutional Investor “Hall of Fame.” He is the author of “ Navigate the Noise: Investing in the New Age of Media and Hype.”

Calculated Risk

OCTOBER 2, 2023

As is the increase in energy prices during the 2001 through 2008 period. In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. In August 2023, energy expenditures as a percentage of PCE were at 4.3% of PCE, up from 4.1%

Calculated Risk

MAY 25, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – remained at 78.9 in April, posting no change from the previous month. Year over year, pending transactions dropped by 20.3%.

Calculated Risk

JULY 31, 2024

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – grew to 74.3 Y ear over year, pending transactions were down 2.6%. Multiple offers are less intense, and buyers are in a more favorable position.".

Calculated Risk

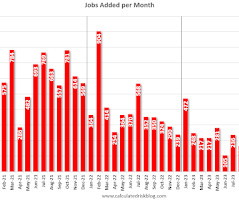

JANUARY 10, 2024

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997.

The Big Picture

MAY 8, 2023

The prime-age employment population ratio rose to the highest level since 2001 Source: @danielbzhao Sign up for our reads-only mailing list here. He is a member of the Management Committee and Co-Chair of the Asset Management Investment Committees, (private equity, infrastructure, growth equity, credit, and real estate).

Calculated Risk

DECEMBER 28, 2023

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – stayed at 71.6 in November. Year over year, pending transactions were down 5.2%. The Northeast PHSI rose 0.8% from last month to 64.4, a drop of 6.4%

Calculated Risk

DECEMBER 28, 2022

An index of 100 is equal to the level of contract activity in 2001. The Pending Home Sales Index (PHSI)* — a forward-looking indicator of home sales based on contract signings — fell 4.0% in November. Year-over-year, pending transactions dropped by 37.8%. The Northeast PHSI slipped 7.9% from last month to 63.3, a drop of 34.9%

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content