Recency Bias!!!

Walkner Condon Financial Advisors

FEBRUARY 6, 2024

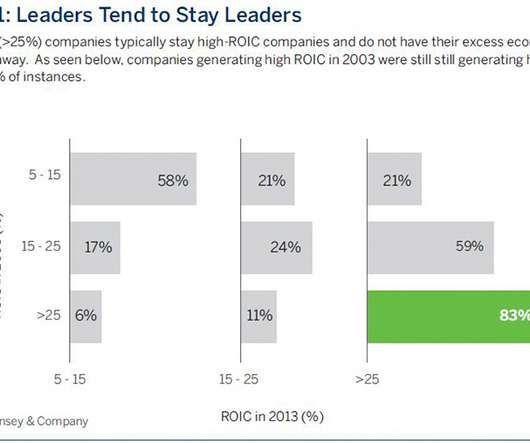

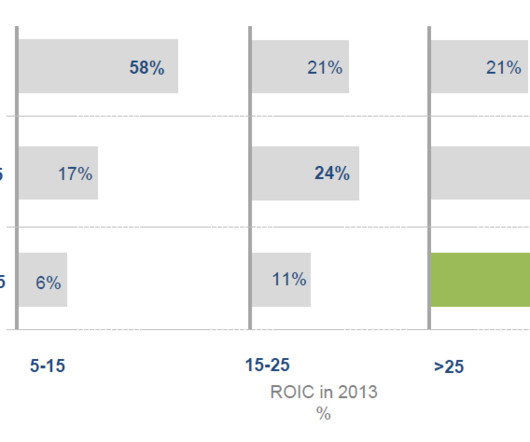

As these tables can take a while to be published or readily available, let’s for now break the past twenty years of available market data into two 10-year periods: 2003-2012 and 2013-2022. In the more recent decade not including 2023 (2003-2012), U.S. During the 2003-2012 period, U.S. Large Cap, Developed ex-U.S.

Let's personalize your content