Six SVB Private Advisors Jumped to Cerity

Wealth Management

MARCH 30, 2023

The advisors have a shared history at KLS Professional Advisors Group in New York, a family office-focused RIA acquired by Boston Private in 2004.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2004 Related Topics

2004 Related Topics

Wealth Management

MARCH 30, 2023

The advisors have a shared history at KLS Professional Advisors Group in New York, a family office-focused RIA acquired by Boston Private in 2004.

Wealth Management

SEPTEMBER 17, 2024

billion wealth management firm since 2004, previously serving as chief wealth officer and lead advisor. Dougal Williams has been with the $2.5

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Calculated Risk

OCTOBER 31, 2022

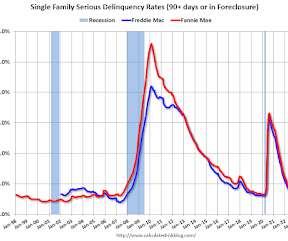

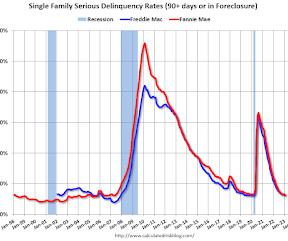

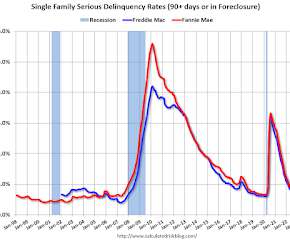

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.41% are seriously delinquent (down from 2.48% in August). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

DECEMBER 28, 2022

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.15% are seriously delinquent (down from 2.34% in October). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

APRIL 28, 2023

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 1.93% are seriously delinquent (down from 2.04% in February). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

JANUARY 30, 2023

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.16% are seriously delinquent (down from 2.15% in November). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

DECEMBER 1, 2022

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.34% are seriously delinquent (down from 2.41% in September). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

The Big Picture

JUNE 3, 2023

His interest in the subject started in 2004, when he was studying technology and psychology at Stanford University. He cofounded Tikehau in 2004 with Antoine Flamarion, a colleague at Deutsche Bank, and runs the US division.

Alpha Architect

NOVEMBER 8, 2024

Their findings also provide support for Andrew Lo’s The Adaptive Markets Hypothesis (2004). Once anomalies are well recognized by the market they decline and may even disappear, though limits to arbitrage can allow them to persist. Markets Becoming More Efficient: The Disappearing Index Effect was originally published at Alpha Architect.

Calculated Risk

JANUARY 10, 2023

This graph is for South Lake Tahoe since 2004 through December 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Calculated Risk

MAY 9, 2023

This graph is for South Lake Tahoe since 2004 through April 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Calculated Risk

OCTOBER 11, 2022

Here is the expanded series from the MBA of mortgage credit availability that includes the bubble years (2004 - 2006). Look at that huge increase in mortgage credit availability back in the 2004 - 2006 period (remember “fog a mirror, get a loan”, NINJA loans: No Income, No Job or Assets?).

Calculated Risk

AUGUST 31, 2022

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.60% are seriously delinquent (down from 2.75% in June). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

JUNE 6, 2023

This graph is for South Lake Tahoe since 2004 through May 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Calculated Risk

OCTOBER 1, 2022

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.48% are seriously delinquent (down from 2.60% in July). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

NOVEMBER 9, 2022

This graph is for South Lake Tahoe since 2004 through October 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is distorted by the mix, but this is the available data.

Calculated Risk

OCTOBER 11, 2022

This graph is for South Lake Tahoe since 2004 through September 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is distorted by the mix, but this is the available data.

Calculated Risk

SEPTEMBER 13, 2022

This graph is for South Lake Tahoe since 2004 through August 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is distorted by the mix, but this is the available data.

Calculated Risk

MARCH 27, 2023

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.04% are seriously delinquent (down from 2.11% in January). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

APRIL 9, 2023

This graph is for South Lake Tahoe since 2004 through March 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

The Big Picture

OCTOBER 25, 2024

Prior to joining Mercedes, Toto spent time in the investment world, founding his own company Marchfifteen in 1998 and Marchsixteen in 2004. This week, we speak with Toto Wolff , Team Principal & CEO of the Mercedes-AMG PETRONAS F1 Team. In 2009 Toto combined his passion for racing and business by investing in the Williams F1 Team.

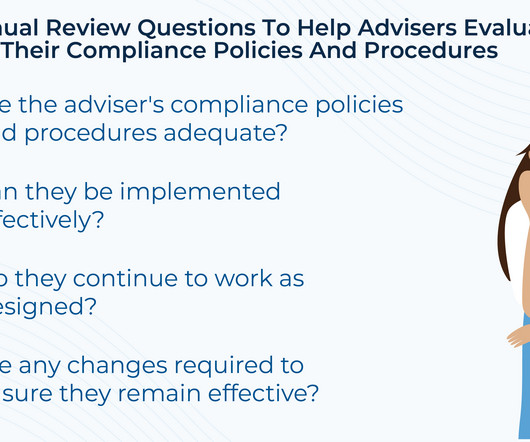

Nerd's Eye View

OCTOBER 11, 2023

Rather, when the Compliance Rule originally went into effect in 2004, the adopting release described only 3 elements that should be considered in an annual review: 1) compliance matters in the previous year (e.g., Notably, the exact formatting, length, level of detail, and overall content of annual reviews are not prescribed by the SEC.

Calculated Risk

JANUARY 5, 2023

The Zillow index started in 2014, the ApartmentList index started in 2017, and CoreLogic in 2004. Today, in the Calculated Risk Real Estate Newsletter: Rents Continue to Decline More than Seasonally Normal A brief excerpt: OER and rent of primary residence have mostly moved together.

Calculated Risk

DECEMBER 12, 2022

This graph is for South Lake Tahoe since 2004 through November 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

The Big Picture

APRIL 17, 2025

Duration and leverage issues are well known, but lets discuss adding risk: In 2004, I walked into my offices conference room to hear a rep from Lehman Brothers pitch a higher-yielding fixed income product: AAA-rated, safe as Treasuries, but yielding 200-300 basis points more. All of these strategies have been money-losers this century.

Calculated Risk

FEBRUARY 8, 2023

This graph is for South Lake Tahoe since 2004 through January 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

The Big Picture

OCTOBER 7, 2022

2000s : Kept rates too low for too long following 9/11 and dotcom implosion – FOMC Rate did not get over 1% until 2004. Consider the errors of just the past few years and you can see the biggest mistake they make seems to be either arriving way too late to the party or once they are there, is overstaying their welcome.

Calculated Risk

JULY 29, 2022

Click on graph for larger image By vintage , for loans made in 2004 or earlier (1% of portfolio), 2.75% are seriously delinquent (down from 2.86% in May). The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Calculated Risk

MARCH 3, 2023

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices).

Calculated Risk

FEBRUARY 6, 2024

. • In the absence of any meaningful private-labeled securities market, the rise in FHA delinquencies is worth watching, as FHA and VA loans can be early indicators of broader mortgage performance trends • While low credit score lending hit a record low, by count, in 2023, 90% below the years leading up to the great financial crisis, FHA and VA products (..)

Calculated Risk

FEBRUARY 2, 2023

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. As an example, if a house price was $200,000 in January 2000, the price would be almost $339,000 today adjusted for inflation (69.5%

Calculated Risk

MARCH 1, 2024

For Fannie, by vintage, for loans made in 2004 or earlier (1% of portfolio), 1.62% are seriously delinquent (down from 1.67% the previous month). These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Big Picture

AUGUST 2, 2024

In 2004, he co-authored Beating the Business Cycle: How to Predict and Profit From Turning Points in the Economy. Moore, at Columbia University in 1990; they formed ECRI with Anirvan Banerji in 1996. He serves on the board of governors for the Levy Economics Institute of Bard College.

Calculated Risk

JANUARY 10, 2024

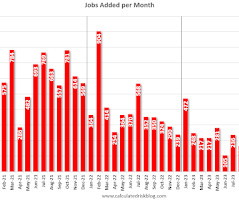

Change in Payroll Jobs per Year (000s) Total, Nonfarm Private Public 1997 3,406 3,211 195 1998 3,048 2,735 313 1999 3,181 2,720 461 2000 1,938 1,674 264 2001 -1,733 -2,284 551 2002 -515 -748 233 2003 125 167 -42 2004 2,038 1,891 147 2005 2,528 2,342 186 2006 2,092 1,883 209 2007 1,145 857 288 2008 -3,549 -3,729 180 2009 -5,041 -4,967 -74 2010 1,027 (..)

The Big Picture

NOVEMBER 20, 2023

19, 2023 Who Cares Wins : The Global Compact Connecting Financial Markets to a Changing World Swiss Federal Department of Foreign Affairs, United Nations, 2004 _ 1: WSJ: “Conventional funds also lost money, but the pain was more acute for climate and other thematic products hit by high-interest rates and other factors.”

The Big Picture

JUNE 10, 2023

He cofounded Tikehau in 2004 with Antoine Flamarion, a colleague at Deutsche Bank. This week, we speak with Mathieu Chabran, co-founder of Tikehau Capital. The firm is a global alternative asset manager with $40B in AUM manged in 13 offices around the world.

Nerd's Eye View

JUNE 21, 2023

However, the early 2000s were plagued by a variety of SEC enforcement actions that alleged fiduciary duty violations – primarily involving trading abuses by investment advisory personnel – which led the regulator to create a rule (that became effective in 2004) requiring all SEC-registered investment advisers to adopt and enforce a written (..)

A Wealth of Common Sense

AUGUST 2, 2024

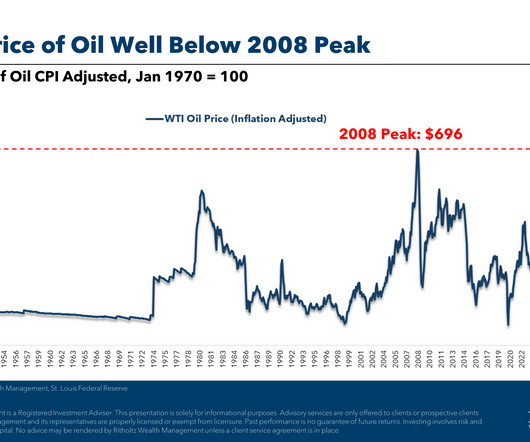

Torsten Slok shared a chart of gas prices going back to 2004: The average price over this 20+ year timeframe is around $3/gallon which isn’t too far from current levels. I enjoy reading and writing but I’m a visual learner. I like charts. Here are some crazy charts I’ve been thinking about lately. gallon in 2008.

The Big Picture

MARCH 8, 2024

He is responsible for commercial businesses worldwide, and has been with Blackrock since 2004. Be sure to check out our Masters in Business next week with Mark Wiedman, BlackRock’s Head of the Global Client Business. The firm manages over $10 trillion in client assets.

The Big Picture

OCTOBER 3, 2024

He also was one of the alums quoted by the New York Times in 2004 who was threatening to withhold future gifts if Harvard didn’t cut the compensation for money managers who at the time were delivering above-benchmark returns. He is Harvard Medical School, class of 1964, and at one time a regular and generous donor to the medical school.

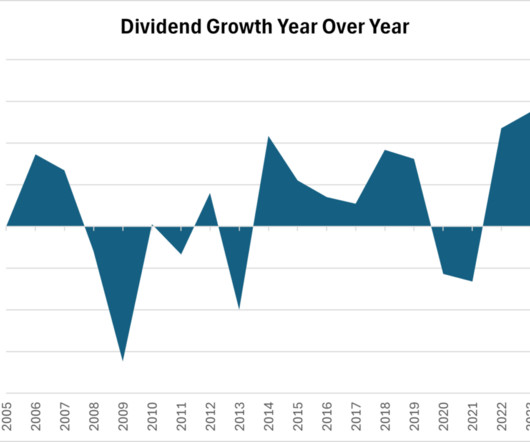

Darrow Wealth Management

FEBRUARY 9, 2025

Simulated portfolio income using historical dividends Imagine you invested $1,000,000 on the last day of 2004. Hypothetical simulation assumes $1M was invested on 12/31/2004, 50% in SPY and 50% in AGG, portfolio was never rebalanced, dividends not reinvested, and no other contributions/withdrawals in the account. Source: J.P.

Calculated Risk

AUGUST 7, 2023

This graph is for South Lake Tahoe since 2004 through July 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Calculated Risk

MARCH 12, 2023

This graph is for South Lake Tahoe since 2004 through February 2023, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Calculated Risk

AUGUST 12, 2022

This graph is for South Lake Tahoe since 2004 through July 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average). Note: The median price is distorted by the mix, but this is the available data.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content