Conversation with the Portfolio Manager: Mid-Cap Growth Strategy

Brown Advisory

SEPTEMBER 20, 2017

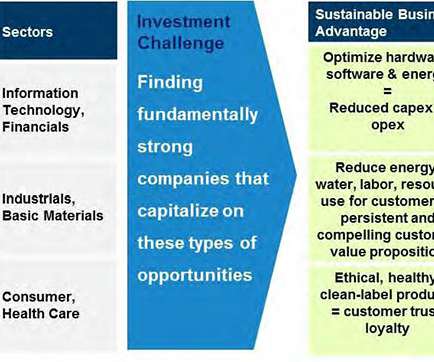

Conversation with the Portfolio Manager: Mid-Cap Growth Strategy achen Wed, 09/20/2017 - 16:43 Over time, the Brown Advisory small-cap growth team, led by Christopher Berrier and George Sakellaris, watched numerous successful investments compound and grow out of their investible universe.

Let's personalize your content