Should You Worry About “Recession” Risk?

Discipline Funds

JUNE 6, 2023

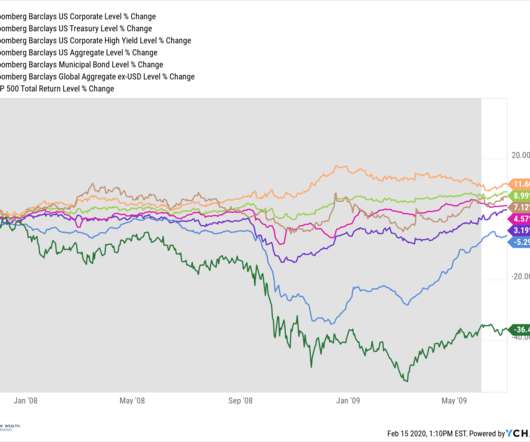

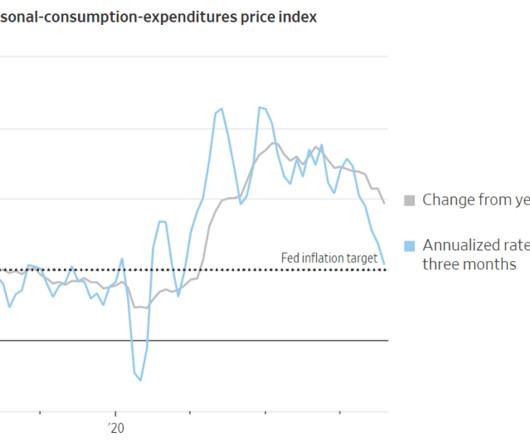

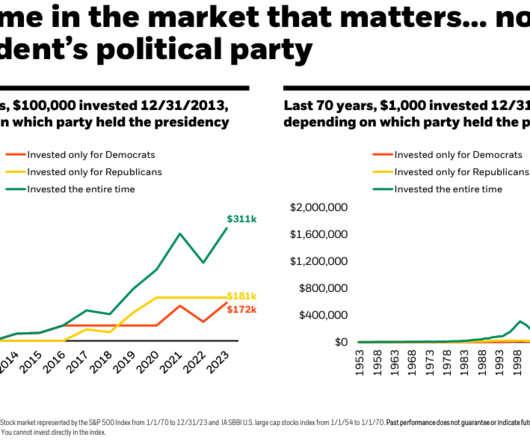

On one side you have optimists who have been saying that the US economy remains robust and on the other side you have pessimists who are worried about recession and a potential 2008 scenario. But the stock market is forward looking and thus far the economy and corporate profits are holding up better than expected.

Let's personalize your content