Just Put It All Into.

Random Roger's Retirement Planning

FEBRUARY 9, 2023

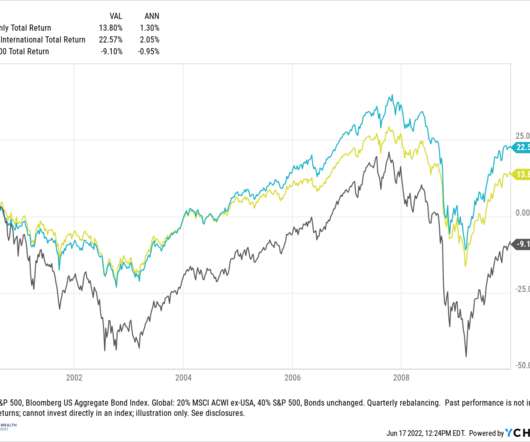

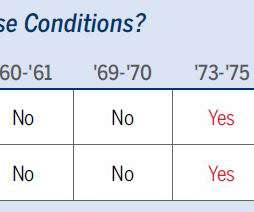

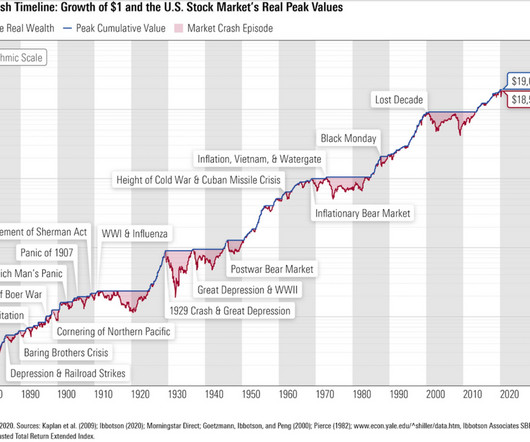

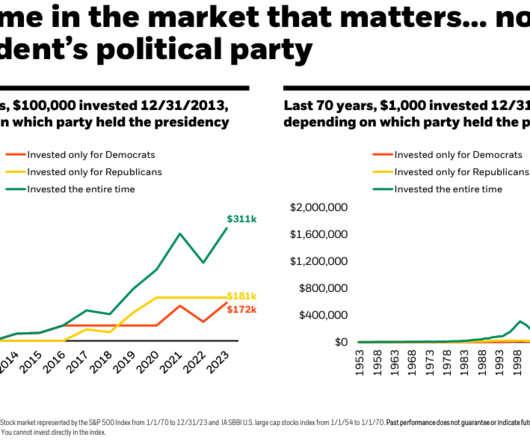

The funds did well in the Financial Crisis and they did well in 2022 but from 2009 onward, one of his two long standing funds has a negative annual growth rate and the one with a positive growth rate was less than 1/3 of a plain vanilla 60/40 portfolio.

Let's personalize your content