MiB: Bill Dudley, NY Fed Chief

The Big Picture

FEBRUARY 16, 2024

Dudley explains how he became President of the NY Fed in January 2009 — right in the heart of the GFC. He describes that as a turning point in the banking crisis.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Big Picture

FEBRUARY 16, 2024

Dudley explains how he became President of the NY Fed in January 2009 — right in the heart of the GFC. He describes that as a turning point in the banking crisis.

Calculated Risk

JANUARY 8, 2023

In summary, we find evidence for a shorter lag in the peak response of inflation to a policy shock in the post-2009 period even after we adjust the shock definition to incorporate forward guidance and balance sheet policy. Foerster at the Kansas City Fed: Have Lags in Monetary Policy Transmission Shortened?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nationwide Financial

OCTOBER 26, 2022

In times of peaking pessimism and extreme bearishness, investors often try to parse how the financial markets are reflecting an array of risks. However, how might the market reflect its trepidations when trying to digest those risks? This behavior is like what was seen near the bottom in 2002, 2009, and 2020.

MarketWatch

MARCH 21, 2023

As financial markets turned to Wednesday’s policy update from the Fed, Treasury yields shot higher across the board, sending the 2-year rate BX:TMUBMUSD02Y to its biggest one-day jump since June 5, 2009. Meanwhile, U.S. stocks DJIASPXCOMP finished higher.

Darrow Wealth Management

FEBRUARY 26, 2025

Swings in the financial markets also highlight the benefitsand limitationsof diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. How do bonds perform during a recession?

Nationwide Financial

JANUARY 11, 2023

Two of the most significant developments in the financial markets during 2022 were the breakout of higher interest rates and the return of stock market volatility. For a glimpse of how volatile stocks were last year, consider the VIX Index, often used as a gauge of fear or stress in the stock market.

Trade Brains

FEBRUARY 16, 2024

The company recently made waves in the financial markets with its IPO with an astonishingly high Price-to-Earnings (PE) ratio of 292x! million units between Fiscal 2009 to Fiscal 2023 at an overall level. The stock has rallied 23 percent, from the day it got listed on December 29, 2023. It has also manufactured and delivered 3.09

Discipline Funds

AUGUST 22, 2024

This was the biggest revision since 2009 and very large by any measure. Americans are so rich that our currency is in huge demand by foreigners who want to do business with these wealthy consumers so they can obtain the currency that gives them access to the best financial markets in the world and the best goods and services in the world.

Nationwide Financial

MARCH 22, 2023

For investors, events in the financial markets over the last two weeks have underscored the importance of preparing for the unexpected. Market participants interpreted this as a potential half-point increase in the Fed funds target rate at the FOMC’s March 22 meeting. Fixed income volatility has unsettled equity markets, too.

Darrow Wealth Management

AUGUST 29, 2022

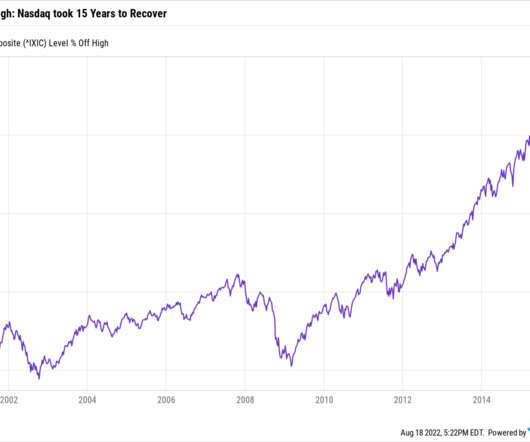

While the same set of circumstances that may be the hallmark of one crisis or market downturn won’t exactly mirror the next, the headlines probably have a lot more in common than you’d think. In the financial markets, the most extreme volatility is typically driven by bouts of uncertainty. which enjoyed gains of 30.7%

Investing Caffeine

MAY 2, 2022

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way.

Trade Brains

APRIL 14, 2023

In April 2009, Raju and nine others involved in the fraud were sentenced to jail by the honorable court. Closing Thoughts Securities and Exchange Board of India (SEBI) was established in India in the early 1990s to administer and regulate the functioning of the Indian securities markets.

BlueMind

DECEMBER 23, 2022

One of the most outstanding movies of the financial industry to this time, which was inspired by true events, Margin Call will take you on a roller coaster ride that spans over 24 hours. This drama series was inspired by Preet Bharara , an actual United States Attorney of the Southern District of New York in Manhattan from 2009 to 2017.

Nationwide Financial

OCTOBER 24, 2022

This is similar to the market behavior near the bottoms in 2002, 2009, 2011, and 2020, reflecting the willingness of institutional investors to dip their toe back in the water. Despite historic levels of investor pessimism, the S&P 500® Index has shown 2% gains in six sessions in the past month in an effort to bounce.

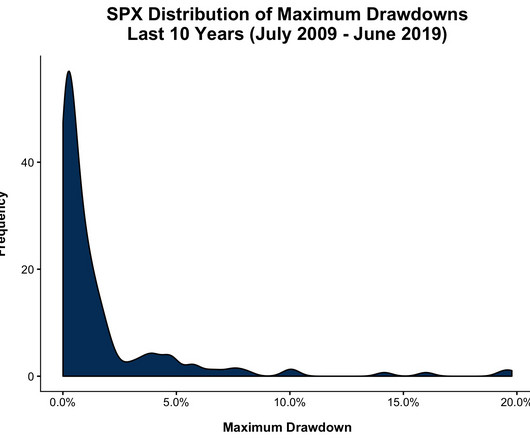

The Irrelevant Investor

JULY 3, 2019

When people look at financial markets, they see numbers and they hear narratives. There have been 342 new highs over the last ten years, the most of any ten-year period ever (well, technically March 2009 - Feb 2019 had 359). But data can hide the past and stories can distort the present. The Dow gained 8% from 1966-1982.

Investing Caffeine

JANUARY 3, 2022

The stock market has increased more than 7-fold in value since the 2009 stock market lows, even in the face of many frightening news stories (see Ed Yardeni’s list of panic attacks since 2009 ). COVID, inflation, and Federal Reserve monetary policies may dominate the headlines du jour but this is nothing new.

The Irrelevant Investor

JULY 18, 2018

The Pareto Principle is a feature of financial markets, not a bug. Going back a little farther to the bottom in 2009, the equal weight version has handily outperformed the cap-weighted version. Brands can triple and it still would not move the needle of the index as much as if Apple gains 1%. We are not in uncharted territory.

Nationwide Financial

OCTOBER 10, 2022

Markets surged at the beginning of the week, with the first back-to-back gains of 2.5% Recent Fedspeak was clear that neither financial market volatility nor slowing global growth will deter them from raising rates. The Treasury’s Office of Financial Research measure of stress in U.S.

Carson Wealth

MARCH 27, 2023

Think back to March 2003, March 2009, and March 2020. In 2003, the war in Iraq started after a three-year bear market; the global financial crisis was underway in 2009 and stocks dropped by half; and in 2020 the world shut down due to COVID-19. Why is this a good thing?

Trade Brains

SEPTEMBER 25, 2023

Market Cap ₹ 483.3 The company was renamed Maan Aluminium Ltd in 2009. Best Aluminium Stocks in India #4 – Maan Particulars Figures Particulars Figures CMP ₹ 87.25 Stock P/E 10.33 RoCE 43 % RoE 46.56 % Promoter Holding 65.38% Price To Book Value 3.47 Debt to Equity 0.42

The Better Letter

MAY 9, 2024

Typical thinking – thinking that should be cast to the dustbin of history – fails to grasp the complexity and dynamic nature of financial markets. The financial markets are simply too complex and too adaptive to be readily predicted. Those who cannot, should and will fall by the wayside.

Workable Wealth

JUNE 24, 2020

While this is true, most articles don’t tell you how to invest wisely, what role investments play in your wealth-building journey or even what the Market can tell you. . But you can’t do that without a clear understanding of what the financial market is, how it operates, and strategies to approach it. stock market.

Trade Brains

DECEMBER 21, 2023

All the Companies merged to form Summit Securities in 2009. The Company underwent an amalgamation which led to the merger of Brabourne Enterprises Ltd, Octav Investments, and CHI Investments. Summit Securities has an investment portfolio comprised of holdings in various listed and unlisted securities. 4903 Cr in FY23.

Carson Wealth

JUNE 12, 2023

Taking it one step further, new lows were made after the market rose 20% only three times, while the lows held 10 times. We found there were two times during the tech bubble that stocks gained 20% and again moved to new lows, and it also happened during the global financial crisis of 2007-2009.

Brown Advisory

NOVEMBER 29, 2016

1 Also, from fiscal year 2009 until fiscal year 2016, federal agencies cut annual grants to private and public organizations by 3.4% Such a reassessment is essential given that the range of positive and negative outcomes for financial markets has widened during the past year. Active managers in some market segments beyond U.S.

Brown Advisory

DECEMBER 2, 2015

After the 2008-2009 financial crisis, many clients could use loss carry-forwards to reduce taxes against gains taken in subsequent years. A family will then approach its portfolio—and any foul weather in financial markets—with confidence, increasing the likelihood of achieving its long-term goals. .

Brown Advisory

SEPTEMBER 12, 2016

The current wave of private credit resurgence sprung from the 2008—2009 financial crisis as the banking industry retreated from many kinds of traditional lending after the enactment of stricter regulation under the Dodd- Frank Act and the global banking accord known as Basel III. Demand is also robust.

Brown Advisory

SEPTEMBER 21, 2022

This means that an overwhelming majority have withstood the early 2000s recession in developed markets, the 2008 to 2009 Global Financial Crisis, and the Covid-19 global pandemic.

The Big Picture

DECEMBER 6, 2022

First of all, I think the amount of investors that participate in the financial markets is much smaller than it is in the U.S. And I think that the financial advisors are used, but not as widely used as they are in the U.S. And definitely, their retail market participation is significantly lower than you can see in the U.S.

Trade Brains

FEBRUARY 19, 2024

In the fiscal year 2009-10, Solar Industries India Limited expanded its operations into the defense sector. They have established one of the world’s most integrated facilities for ammunition. The company is the first Indian company to surpass an annual production of 300,000 metric tons of explosives.

The Better Letter

MARCH 24, 2022

” Financial markets exhibit the kinds of behaviors that might be predicted by chaos theory (and the related catastrophe theory ). Thus markets respond like systems ordered along the lines of self-organizing criticality – unstable, fragile and largely unpredictable – at the border of stability and chaos.

Trade Brains

JUNE 22, 2023

Thus, it has a first-mover advantage due to which ideaForge Technology is one of the few companies in India to enter the Unmanned Aerial Vehicle (UAV) market. It is also the first organization to manufacture VTOL UAVs in India in 2009, which is an aircraft that can depart, hover and land vertically.

Trade Brains

FEBRUARY 2, 2024

Vinay Sanghi has headed the organization since its inception in 2009. .) ₹ 21,360 EPS (TTM) ₹ 24.06 Stock P/E (TTM) 30.32 Promoter Holdings (%) 31.30% FII Holdings (%) 50.22% RoE 14.84% RoCE 13.39% Enterprise Value (Cr.) ₹ 24,789.60 Price to Book Value 4.5 High FII Holdings Stocks Under Rs 1000 #3: CarTrade Tech Ltd. CarTrade Tech Ltd.

Trade Brains

NOVEMBER 3, 2023

was originally founded in 2009 as a greenfield project for the manufacture of cast iron lumps using the submerged arc furnace method by first-generation entrepreneurs and technocrats with diversified and extensive industrial and commercial experience.

Trade Brains

DECEMBER 3, 2023

Market Cap (Cr.) From 2005-2009, the Company ventured into Active Trader Services & also offered online currency derivates. Particulars Amount Particulars Amount CMP 37,795.3 41,510 EPS ₹512.15 Stock P/E 80.9 RoE 46.45% RoCE 50.00% Promoter Holding (%) 45.10% FII Holding (%) 22.00% Debt to Equity 0.18 Price to Book Value 30.9

Trade Brains

AUGUST 25, 2024

Bitcoin , created in 2009 by Satoshi Nakamoto, is the most well-known and first cryptocurrency, operating on a blockchain with a proof-of-work system. Lack of regulation: The cryptocurrency market is not as regulated as traditional financial markets. As of May 2024, there are over 2.4 million cryptocurrencies*.

Brown Advisory

MARCH 1, 2016

Stock market volatility has spiked in response to immediate market concerns about energy prices, weakening economic growth in China and changes to monetary policy, as well as momentous capital-market shifts during the past 20 years. This year, financial markets are grappling with a long list of pressing questions.

The Big Picture

AUGUST 8, 2022

So, that was that and then comes the financial crisis. So, until the financial crisis of 2007 and 2009 or however you go — you actually time it, I was in this finance bubble. But anyway, so I was asked to write an essay for a book that was edited by a philosopher that was called “Just Financial Market?

The Better Letter

JANUARY 19, 2023

The S&P 500 had risen more than 600 percent since March 2009. More importantly, perhaps, the past 12 months have marked a generational shift for financial markets as the Fed repeatedly raised interest rates to try to contain the worst inflation in four decades. Not anymore. Stocks didn’t get that high again.

The Big Picture

OCTOBER 15, 2024

That was a global macro hedge fund, and so that’s a really fun part of finance where you just get to try to figure out at a high level what’s going on in the world and lots of arguments about politics and economics and history and financial markets. And you try to, on one hand it’s quantitative.

Brown Advisory

SEPTEMBER 19, 2023

This means that an overwhelming majority have withstood the early 2000s recession in developed markets, the 2008 to 2009 Global Financial Crisis, and the Covid-19 global pandemic. All but one of Sustainable International Leaders’ holdings have been around for at least 25 years.

Brown Advisory

SEPTEMBER 19, 2023

This means that an overwhelming majority have withstood the early 2000s recession in developed markets, the 2008 to 2009 Global Financial Crisis, and the Covid-19 global pandemic. All but one of Sustainable International Leaders’ holdings have been around for at least 25 years.

Brown Advisory

SEPTEMBER 21, 2022

This means that an overwhelming majority have withstood the early 2000s recession in developed markets, the 2008 to 2009 Global Financial Crisis, and the Covid-19 global pandemic.

Brown Advisory

SEPTEMBER 21, 2022

This means that an overwhelming majority have withstood the early 2000s recession in developed markets, the 2008 to 2009 Global Financial Crisis, and the Covid-19 global pandemic.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content