Midyear Outlook 2022 | Navigating Turbulence | July 12, 2022

James Hendries

JULY 13, 2022

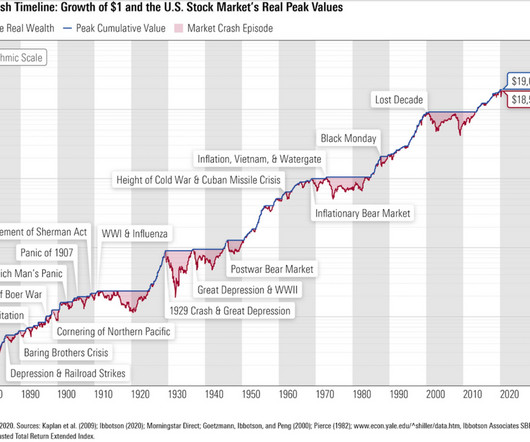

So far, this year hasn’t seen a full-blown crisis like 2008–2009 or 2020, but the ride has been very bumpy. Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Let's personalize your content