I Ran The Numbers And They Work!

Random Roger's Retirement Planning

APRIL 3, 2024

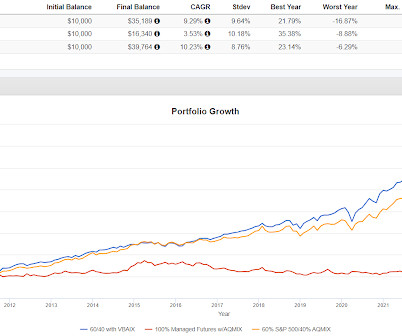

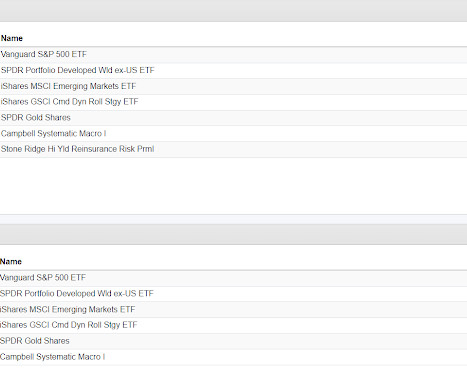

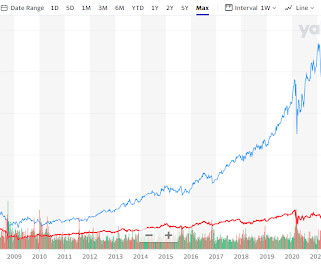

The 2010's was a rough decade for managed futures in nominal terms. 90/40 had a higher CAGR than traditional 60/40 but lower than 60% equities/40% managed futures in Portfolio 3. The advantage that both managed futures portfolios had over traditional 60/40 is how well they did in 2022.

Let's personalize your content