No Pain, No Gain

Investing Caffeine

MAY 2, 2022

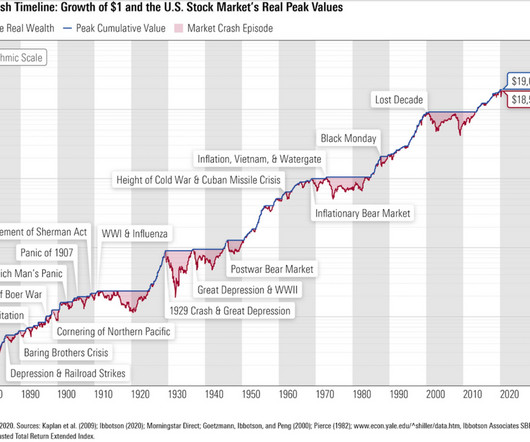

Although I have noted some of the key headwinds the economy faces above, it is worth noting that current corporate profits remain at/near all-time record highs (see chart below) and the 3.6% As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”.

Let's personalize your content