Just Put It All Into.

Random Roger's Retirement Planning

FEBRUARY 9, 2023

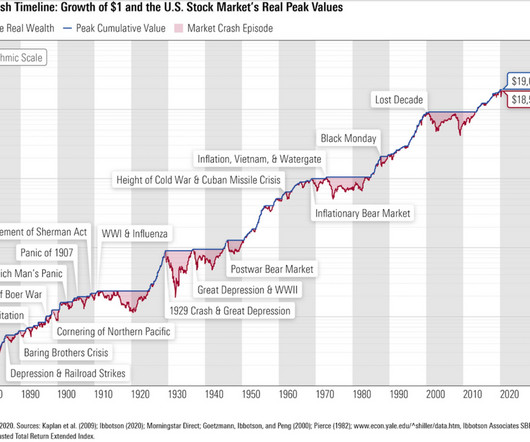

Anytime I talk about letting markets work for you over the long term and the role that an adequate savings rate plays in financial success, I will usually caveat that with assuming a proper asset allocation. Ten years is a reasonable time period but someone who bought in 2012 based on the previous ten years really got left behind.

Let's personalize your content