Transcript: Mike Green, Simplify Asset Management

The Big Picture

AUGUST 20, 2024

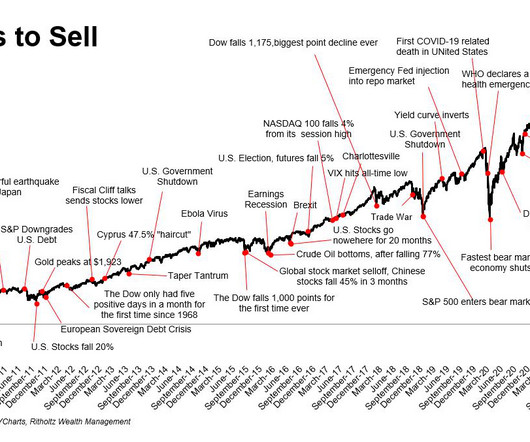

The transcript from this week’s, MiB: Mike Greene, Simplify Asset Management , is below. We have to pay attention to this, and we have to understand why this is potentially a risky asset. Precisely because we look at it and we’re like, wait a second, if this risk goes wrong, not only do I lose my assets, but I lose my job.

Let's personalize your content