Four Hard Investing Lessons From 2022 With Silver Linings

Validea

OCTOBER 19, 2022

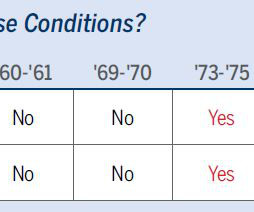

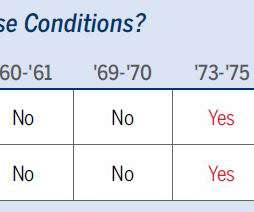

While some of that outperformance was due to improving fundamentals and earnings, most of it the returns came from the valuation investors assigned to these stocks. The chart below shows that of the tech sector’s 760% total return, 620% came from the change (increase) in valuation while 140% came from increasing earnings and dividends.

Let's personalize your content