Market Commentary: Checking In on Market Fundamentals

Carson Wealth

APRIL 8, 2024

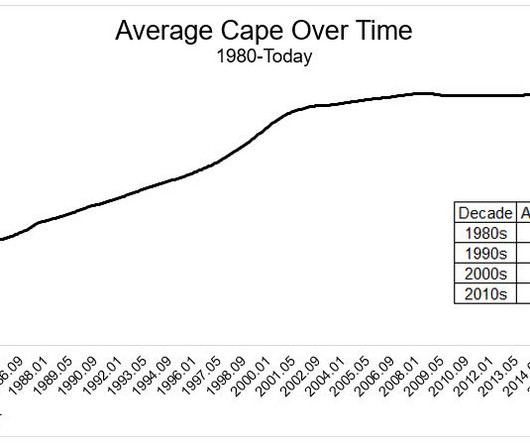

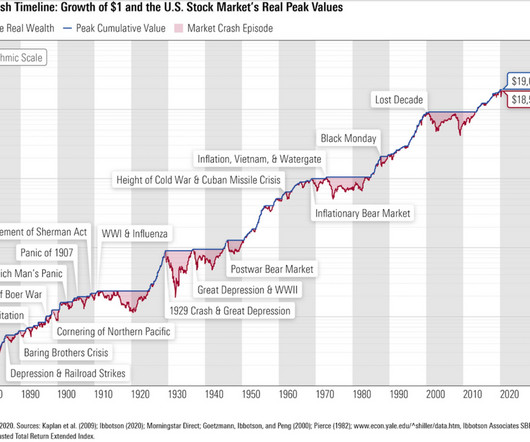

Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. gain, but not a bad number by any means. This is only the eighth time that has ever happened and the first time since the first quarter of 2012 (also an election year). Following the huge 11.2% median return.

Let's personalize your content