Investing is the Study of Human Decision Making

The Big Picture

AUGUST 23, 2023

Whether we are talking about important milestones in life or your asset allocation, don’t let your decision-making default setting be “auto-pilot.”

The Big Picture

AUGUST 23, 2023

Whether we are talking about important milestones in life or your asset allocation, don’t let your decision-making default setting be “auto-pilot.”

Brown Advisory

OCTOBER 28, 2016

Asset Allocation: Caution Toward High Dividend Yielding Stocks achen Fri, 10/28/2016 - 11:25 Why Have High Dividend Yielding Sectors Done Well This Year? In 2013, as the Fed ended its bond-purchasing program, U.S. Reach for yield. Interest-rate sensitivity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Brown Advisory

OCTOBER 28, 2016

Asset Allocation: Caution Toward High Dividend Yielding Stocks. In 2013, as the Fed ended its bond-purchasing program, U.S. Fri, 10/28/2016 - 11:25. Why Have High Dividend Yielding Sectors Done Well This Year? Reach for yield. Interest-rate sensitivity.

Carson Wealth

JANUARY 22, 2025

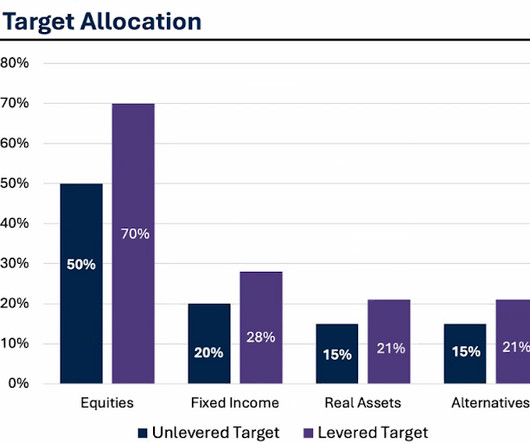

The process of diversifying among asset classes is known as asset allocation, and the exact composition should be based on your financial goals and risk profile. You can also further diversify within an asset class. So, assets may fluctuate widely within a year but still perform well in the long run.

Random Roger's Retirement Planning

NOVEMBER 21, 2024

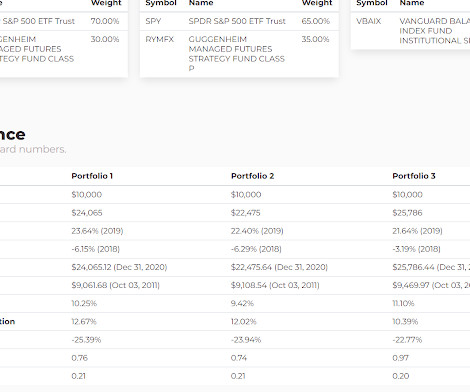

There's no fact sheet yet and while the holdings are available, the asset allocation is vague without calculating the spreadsheet yourself which I did (hopefully correctly). Plenty of other managed futures funds came onto the scene in 2013 and 2014 but I think RYMFX is the only one to test what was a terrible time for managed futures.

Random Roger's Retirement Planning

FEBRUARY 28, 2025

Based on Cambria's other multi-asset funds, ENDW will probably have fixed income duration but that's a space I will continue to avoid. The S&P 500 hit 1500 in March 2000, then again in the fall of 2007 and then the third and final time in January, 2013. The results. Most of us of course lived through that from 2000 through to 2009.

The Big Picture

MAY 9, 2023

SALISBURY: So I led the European Special Situations Group from 2008 to 2013. So what we find, and then of course we have a multi-asset solutions business where we talk to clients about the entirety of their portfolio, their strategic asset allocation models. So we start with a strategic asset allocation.

Let's personalize your content