What Does the Relative Performance of Equal Weight S&P500 Mean?

The Big Picture

APRIL 26, 2023

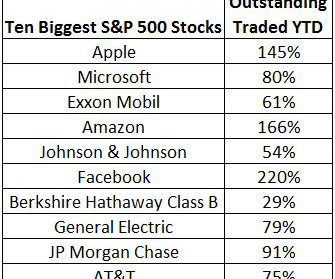

Desmond loved to ask professional portfolio managers “What percentage of stocks would you expect would be making new highs at the top day of the bull market when the Dow Jones was making its absolute high?” He noted that markets get increasingly narrow by cap size (capitalization) as longer secular bull markets approach their ends.

Let's personalize your content