Preparing for the Sunset of the 2017 Tax Reform Act

Wealth Management

JUNE 21, 2024

Some strategic actions and best practices in the wake of the sunsetting of the 2017 Tax Reform and Jobs Act in 2025.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2017 Related Topics

2017 Related Topics

Wealth Management

JUNE 21, 2024

Some strategic actions and best practices in the wake of the sunsetting of the 2017 Tax Reform and Jobs Act in 2025.

Calculated Risk

MARCH 10, 2025

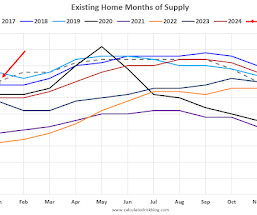

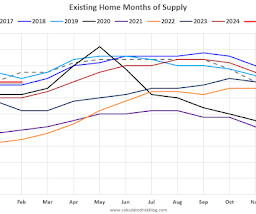

The following graph shows months-of-supply since 2017. The following graph shows months-of-supply since 2017. Note that months-of-supply is higher than 6 of the last 8 years, and at the same level as in 2017. Since both inventory and sales have fallen significantly, a key for house prices is to watch months-of-supply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Calculated Risk

NOVEMBER 27, 2024

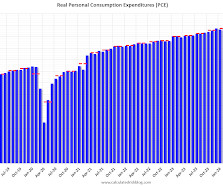

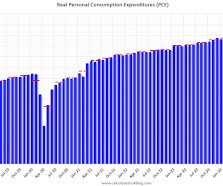

The following graph shows real Personal Consumption Expenditures (PCE) through October 2024 (2017 dollars). The PCE price index, excluding food and energy, increased 2.8 percent YoY, up from 2.7 percent in September, and down from the recent peak of 5.4 percent in February 2022. Click on graph for larger image.

Calculated Risk

APRIL 9, 2025

The following graph shows months-of-supply since 2017. The following graph shows months-of-supply since 2017. Note that months-of-supply is higher than 6 of the last 8 years, and at the same level as in 2017. Since both inventory and sales have fallen significantly, a key for house prices is to watch months-of-supply.

Calculated Risk

MARCH 20, 2025

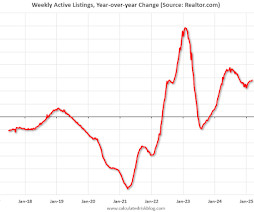

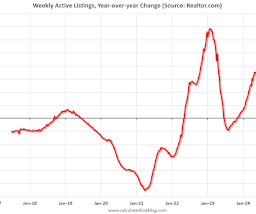

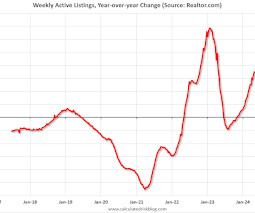

compared to the 2017 to 2019 same month levels. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 27.5% YoY, but still down 22.9%

Calculated Risk

FEBRUARY 16, 2025

compared to the 2017 to 2019 same month levels. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For January, Realtor.com reported inventory was up 24.6% YoY, but still down 24.8%

Wealth Management

MARCH 11, 2024

Fidelity shook up its senior management ranks last month.

Calculated Risk

MARCH 28, 2025

The following graph shows real Personal Consumption Expenditures (PCE) through February 2025 (2017 dollars). The PCE price index, excluding food and energy, increased 2.8 percent YoY , up from 2.7 percent in January, and down from the recent peak of 5.6 percent in February 2022. Click on graph for larger image.

Calculated Risk

FEBRUARY 5, 2025

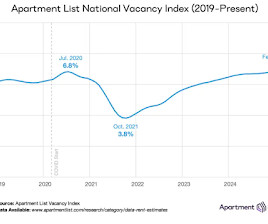

percent in January, the highest reading in the history of that monthly data series, which goes back to the start of 2017. On the supply side of the rental market, our national vacancy index ticked up to 6.9

Calculated Risk

DECEMBER 22, 2024

We can assume the 2017 Tax Cuts and Jobs Act (TCJA) will be extended. There were many promises made during the campaign that obviously will not happen (deport 20 million people, no taxes on tips, overtime or Social Security benefits, 200% tariffs, and on and on). 1) Economic growth: Economic growth was probably close to 2.8% Q4-over-Q4).

Calculated Risk

FEBRUARY 14, 2025

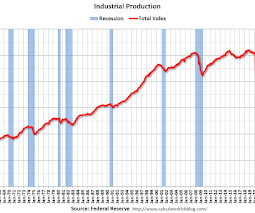

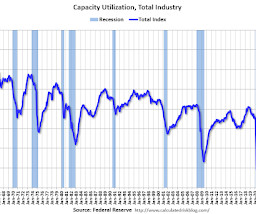

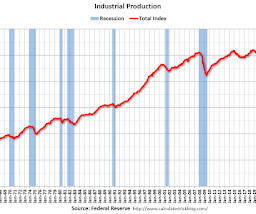

percent of its 2017 average, total IP in January was 2.0 Manufacturing output declined 0.1 percent in January, held down by a 5.2 percent decrease in the index for motor vehicles and parts. The index for mining fell 1.2 percent, while the index for utilities jumped 7.2 percent, as cold temperatures boosted the demand for heating.

Calculated Risk

APRIL 17, 2025

compared to the 2017 to 2019 same month levels. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 28.5% YoY, but still down 20.2%

Calculated Risk

MARCH 3, 2025

million SAAR in the January 2017-2020 period. However, sales in January, at 4.08 million on a seasonally adjusted annual rate basis (SAAR) were down from December and still historically low. Sales averaged almost 5.5 So, sales were still about 25% below pre-pandemic levels. Here is a look at months-of-supply using NSA sales.

Calculated Risk

APRIL 16, 2025

percent of its 2017 average, total IP in March was 1.3 The March decline was led by a 5.8 percent drop in the index for utilities, as temperatures were warmer than is typical for the month. In contrast, the indexes for manufacturing and mining grew 0.3 percent and 0.6 percent, respectively. percent above its year-earlier level.

Calculated Risk

JANUARY 31, 2025

The following graph shows real Personal Consumption Expenditures (PCE) through December 2024 (2017 dollars). The PCE price index, excluding food and energy, increased 2.8 percent YoY, unchanged from 2.8 percent in November, and down from the recent peak of 5.4 percent in February 2022. Click on graph for larger image.

Calculated Risk

JULY 31, 2022

Here is a graph from Mortgagenewsdaily.com that shows the 30-year mortgage rate since 2017. After reaching 6.28% on June 14th, 30-year mortgage rates decreased to 5.13% on Friday according to Mortgagenewsdaily.com. The 10-year Treasury yield has fallen to 2.66%, likely due to the weaker economy.

Wealth Management

OCTOBER 3, 2024

The abrupt firing this week of Dan Arnold, who took over as LPL's CEO in 2017 and once told the firm’s advisors that his mission was about “taking care of you, so you can take care of your clients,” is proving a shock.

The Big Picture

JANUARY 2, 2025

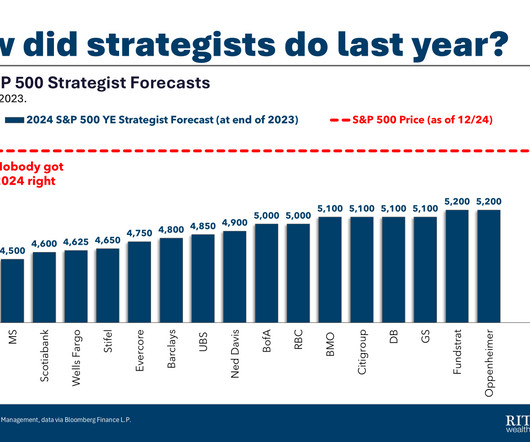

Source : S&P 500s 2024 Rally Shocked Forecasters Expecting It to Fizzle By Alexandra Semenova and Sagarika Jaisinghani Bloomberg, December 29, 2024 See also : My Year-End Stock Market Forecast (December 10, 2024) All those 2025 mortgage rates forecasts are now wrong By Mike Simonsen Housing Wire, December 19, 2024 Previously : Coming March 18: (..)

Calculated Risk

DECEMBER 4, 2023

Today, in the Calculated Risk Real Estate Newsletter: IICE (Black Knight) Mortgage Monitor: "Home prices continued sending mixed signals in October" A brief excerpt: And on Florida inventory: Florida has experienced some of the largest inventory gains in recent months • In fact, six of the nine markets seeing the strongest inventory growth over the (..)

Calculated Risk

MARCH 7, 2025

percent, the highest reading in the history of that monthly data series, which goes back to the start of 2017. On the supply side of the rental market, our national vacancy index now sits at 6.9

Calculated Risk

SEPTEMBER 23, 2024

The following graph shows months-of-supply since 2017. in August 2017 and 4.3 Even though inventory has declined significantly compared to 2019, sales have fallen even more - pushing up months-of-supply. Note that months-of-supply is higher than the last 3 years (2021 - 2023), and above August 2019. Months-of-supply was at 4.2

Wealth Management

JANUARY 16, 2025

Graham, who joined Cambridge in 2017, stepped down from his role on Dec. The IBD is currently searching for a replacement.

Wealth Management

OCTOBER 28, 2024

The Tax Cuts and Jobs Act of 2017 is on the cusp of expiration. What that could could mean for you.

Abnormal Returns

JUNE 16, 2024

fortunesandfrictions.com) What happens if the 2017 tax cuts lapse. (apolloacademy.com) What really is the goal of portfolio diversification? rogersplanning.blogspot.com) Small advantages, consistently applied, compound over time. wsj.com) Nothing compares to the Nasdaq Internet bubble. mrzepczynski.blogspot.com)

Calculated Risk

MARCH 26, 2025

million SAAR for the month of February in the 2017-2020 period. Sales at 4.26 million on a Seasonally Adjusted Annual Rate (SAAR) basis were above the consensus estimate; however, this was primarily because of the seasonal adjustment for February. Housing economist Tom Lawlers estimate was very close (as usual). Sales averaged over 5.5

Calculated Risk

JUNE 20, 2024

YoY, but still down almost 34% compared to April 2017 to 2019 levels. Meanwhile, newly listed homes remained approximately 22% below pre-pandemic (2017 to 2019) levels. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory.

Calculated Risk

JANUARY 23, 2025

compared to the 2017 to 2019 same month levels. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For December, Realtor.com reported inventory was up 22.0% YoY, but still down 15.7% above year-ago levels.

Calculated Risk

APRIL 13, 2023

And below is a table showing the ten most common ages in 2010, 2021, and 2030 (projections are from the Census Bureau, 2017 ). Note that the largest age group is in the early-to-mid 30s. There is also a large cohort in their early 20s. Note the younger baby boom generation dominated in 2010.

Calculated Risk

OCTOBER 18, 2022

percent of its 2017 average, total industrial production in September was 5.3 In September, manufacturing output rose 0.4 percent after advancing a similar amount in the previous month. The index for mining moved up 0.6 percent, and the index for utilities fell 0.3 percent above its year-earlier level. Capacity utilization moved up 0.2

Calculated Risk

DECEMBER 30, 2024

million SAAR in November 2017, 2018, and 2019. The big story for November was that existing home sales increased year-over-year (YoY) for the second time since July 2021 (October was the first). However, sales in November, at 4.15 million on a seasonally adjusted annual rate basis (SAAR) were still historically low. Sales averaged about 4.5

The Big Picture

OCTOBER 23, 2023

Treasury Bond (May 19, 2016) Last Call for 50-Year Treasury Bonds (March 16, 2017) Deficit Spending Should Be Counter-Cyclical Not Pro-Cyclical (August 28, 2017) Can We Please Have an Honest Debate About Tax Policy? This is what happens to nations governed by 535 innumerate asshats… Previously : Time for a 50-Year U.S.

The Big Picture

MARCH 13, 2025

I have known Scott Galloway since way before his first book, The Four , came out in 2017. He had been on MiB prior, and it was my pleasure to intro it at NYU Stern when it first was published.

Wealth Management

APRIL 17, 2024

In 2017, Cheryl Canzanella lost her husband to an accidental overdose. Now, she’s working to educate advisors on how they can help families ripped apart by the opioid crisis.

Wealth Management

FEBRUARY 29, 2024

The agency this week is sending letters to target 125,000 cases of taxpayers with incomes of more than $400,000 who didn’t file returns between the years 2017 and 2021.

Calculated Risk

APRIL 14, 2023

percent of its 2017 average, total industrial production in March was 0.5 In March, manufacturing and mining output each fell 0.5 The index for utilities jumped 8.4 percent, as the return to more seasonal weather after a mild February boosted the demand for heating. percent above its year-earlier level. Capacity utilization moved up to 79.8

The Big Picture

FEBRUARY 6, 2023

Previously : Vanguard’s Tim Buckley: The Complete Interview (August 1, 2017) Meet the Man Who Is Going to Run Vanguard. Bloomberg, July 25, 2017) Vanguard Group (all columns & pods) The post Masters in Business Live With Vanguard’s Tim Buckley appeared first on The Big Picture. It should be very informative.

Calculated Risk

APRIL 26, 2024

The following graph shows real Personal Consumption Expenditures (PCE) through March 2024 (2017 dollars). The PCE price index, excluding food and energy, increased 2.8 percent YoY , unchanged from 2.8 percent in February, and down from the recent peak of 5.4 percent in February 2022. Click on graph for larger image.

Calculated Risk

JANUARY 17, 2025

percent of its 2017 average, total IP in December was 0.5 Manufacturing output rose 0.6 percent after gaining 0.4 percent in November. The indexes for mining and utilities climbed 1.8 percent and 2.1 percent, respectively, in December. percent above its year-earlier level. Capacity utilization stepped up to 77.6 percent , a rate that is 2.1

Calculated Risk

APRIL 4, 2024

YoY, but still down almost 38% compared to March 2017 to 2019 levels. compared to what was typical in 2017 to 2019. • What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. Now - on a weekly basis - inventory is up 25.0%

The Big Picture

JANUARY 25, 2023

Sources : “Study sheds light on cognitive dissonance in active management Robin Powell TEBI, January 25, 2023 Active fund managers and the rise of Passive investing: epistemic opportunism in financial markets Crawford Spence, Yuval Millo, James Valentine Kings College, 06 Jan 2023 Understanding Communities of Practice: Taking Stock and Moving Forward (..)

Calculated Risk

JUNE 18, 2024

percent of its 2017 average, total industrial production in May was 0.4 Manufacturing output posted a similar gain of 0.9 percent after declining in the previous two months. The index for mining increased 0.3 percent in May, and the index for utilities advanced 1.6 percent higher than its year-earlier level. percent in May, a rate that is 0.9

Calculated Risk

JULY 18, 2024

compared to April 2017 to 2019 levels. Broadly speaking, the number of new homes for sale remains historically low and is still below the 2017-2022 levels, even with recent improvements. What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. YoY, but still down 32.4%

Calculated Risk

JANUARY 25, 2024

below similar weeks in 2017 to 2020. • compared to similar weeks in 2017 to 2020. Should the uptick in new listings persist, the added inventory would greatly improve availability and affordability heading into the spring homebuying season but overall inventory is still 37.5% from one year ago.

Calculated Risk

MAY 16, 2024

percent of its 2017 average, total industrial production in April was 0.4 Manufacturing output decreased 0.3 percent; excluding motor vehicles and parts, manufacturing output edged down 0.1 The index for mining fell 0.6 percent, and the index for utilities rose 2.8 percentage point lower than its year-earlier level.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content