Preparing for the Sunset of the 2017 Tax Reform Act

Wealth Management

JUNE 21, 2024

Some strategic actions and best practices in the wake of the sunsetting of the 2017 Tax Reform and Jobs Act in 2025.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 21, 2024

Some strategic actions and best practices in the wake of the sunsetting of the 2017 Tax Reform and Jobs Act in 2025.

Calculated Risk

NOVEMBER 27, 2024

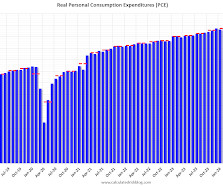

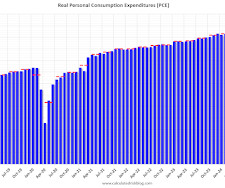

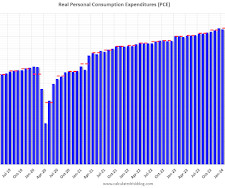

Disposable personal income (DPI), personal income less personal current taxes, increased $144.1 The following graph shows real Personal Consumption Expenditures (PCE) through October 2024 (2017 dollars). The BEA released the Personal Income and Outlays, October 2024 report for October: Personal income increased $147.4 billion (0.6

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

OCTOBER 28, 2024

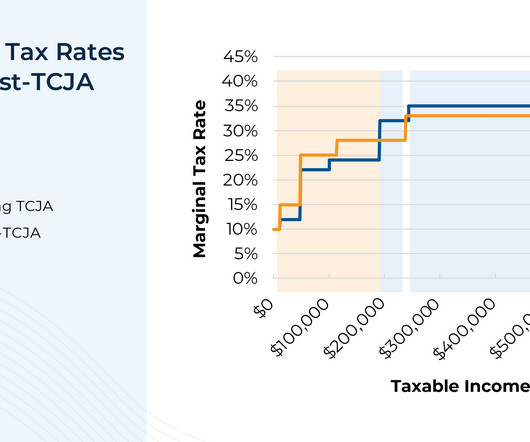

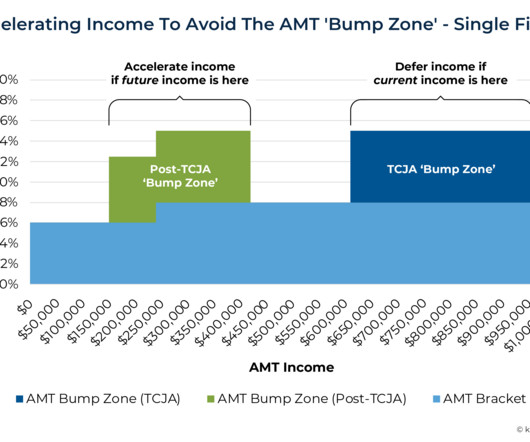

The Tax Cuts and Jobs Act of 2017 is on the cusp of expiration. What that could could mean for you.

Calculated Risk

DECEMBER 22, 2024

There were many promises made during the campaign that obviously will not happen (deport 20 million people, no taxes on tips, overtime or Social Security benefits, 200% tariffs, and on and on). We can assume the 2017 Tax Cuts and Jobs Act (TCJA) will be extended.

MainStreet Financial Planning

NOVEMBER 25, 2024

The maximum amount of earnings subject to Social Security tax (taxable maximum) will increase to $176,100 from $168,600. The individual tax brackets for ordinary income have been adjusted by inflation. On average, tax parameters that are adjusted for inflation will increase about 2.80%.

Nerd's Eye View

JULY 10, 2024

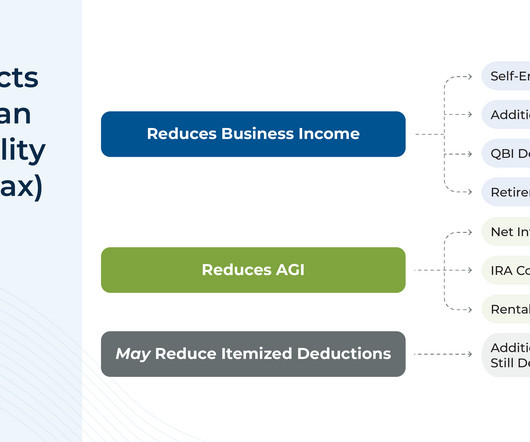

The Tax Cuts and Jobs Act (TCJA), passed in 2017, was one of the most extensive pieces of tax legislation to be passed in the last 30 years, touching many aspects of individual, corporate, and estate tax.

Carson Wealth

FEBRUARY 27, 2025

Like gardening or working out, tax planning is one of those activities where you get out what you put in. Tax planning is similar in the sense that you can put work in on the front end that youll reap benefits from later. Tax planning is similar in the sense that you can put work in on the front end that youll reap benefits from later.

Nerd's Eye View

OCTOBER 16, 2024

Since the Tax Cuts & Jobs Act (TJCA) was passed in 2017, few households have been subject to the Alternative Minimum Tax (AMT), which TCJA restructured so that it applied mainly to a select number of upper-income households.

Nerd's Eye View

MAY 31, 2023

The 2017 Tax Cuts & Jobs Act introduced a $10,000 limit on the State And Local Tax (SALT) deduction that was previously available for taxpayers who itemized their deductions. Another set of considerations involves owners of businesses that operate in multiple states, which can compound the complexity of electing a PTET.

Wealth Management

FEBRUARY 29, 2024

The agency this week is sending letters to target 125,000 cases of taxpayers with incomes of more than $400,000 who didn’t file returns between the years 2017 and 2021.

Abnormal Returns

JUNE 16, 2024

fortunesandfrictions.com) What happens if the 2017 tax cuts lapse. (apolloacademy.com) What really is the goal of portfolio diversification? rogersplanning.blogspot.com) Small advantages, consistently applied, compound over time. wsj.com) Nothing compares to the Nasdaq Internet bubble. mrzepczynski.blogspot.com)

Calculated Risk

APRIL 26, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $104.0 The following graph shows real Personal Consumption Expenditures (PCE) through March 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for March: Personal income increased $122.0 billion (0.5 billion (0.5

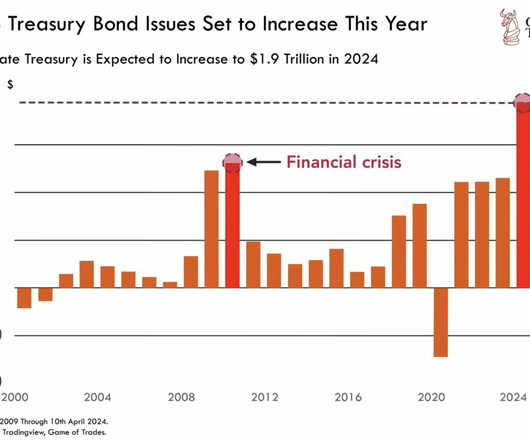

The Big Picture

OCTOBER 23, 2023

Your grandchildren will blame the toxic combination of incompetency and ideology for the massively increased carrying costs of unfunded spending and tax cuts. Note that we undertook much of the work anyway (airports, electrical grid, roads, etc.), just decades later at a much greater cost. All simply unnecessary.

The Big Picture

AUGUST 12, 2024

Sorry, but “fake it till you make it” seems like a poor plan for thinking about the future… Previously : Time to Stop Believing Deficit B t (September 3, 2021) Stimulus, More Stimulus and Taxes (January 25, 2021) Cost of Financing US Deficits Falls (December 18, 2020) Can We Please Have an Honest Debate About Tax Policy?

Harness Wealth

JANUARY 10, 2025

Tax advice is a common topic on social media platforms like TikTok. Influencers promise easy ways to secure tax deductions, simplifying complex ideas into bite-sized claims that gloss over important details in the process. Can Hiring Your Children Help You Save on Taxes? Can You Claim Your Pet as a Tax Write-Off?

The Big Picture

AUGUST 17, 2022

What’s obvious is that cheaper is better than more expensive; that there are inherent costs in managing an active portfolio that include more than just trading and taxes but research, analysis, PMs, etc. Previously : Don’t Blame Morningstar for Our Own Shortcomings (October 26, 2017). Russel Kinnel. Morningstar, August 9, 2010.

Calculated Risk

JULY 26, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $37.7 The following graph shows real Personal Consumption Expenditures (PCE) through June 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for June: Personal income increased $50.4 billion (0.2 billion (0.2 billion (0.3

Calculated Risk

FEBRUARY 29, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $67.6 The following graph shows real Personal Consumption Expenditures (PCE) through January 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for January: Personal income increased $233.7 billion (1.0 billion (0.3

Calculated Risk

JANUARY 26, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $51.8 The following graph shows real Personal Consumption Expenditures (PCE) through December 2023 (2017 dollars). The BEA released the Personal Income and Outlays report for December: Personal income increased $60.0 billion (0.3 billion (0.3

Calculated Risk

MARCH 29, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $50.3 The following graph shows real Personal Consumption Expenditures (PCE) through January 2024 (2017 dollars). From the BEA: Personal Income and Outlays for February: Personal income increased $66.5 billion (0.3 billion (0.2 billion (0.8

Abnormal Returns

JUNE 9, 2024

wsj.com) Policy What happens if the 2017 tax cuts lapse. (humbledollar.com) Russia An increasing portion of Russia's budget is dedicated to fighting Ukraine. msn.com) How Russian propaganda spreads despite bans in place. nytimes.com) Russia's population has been shrinking for decades.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. At that point, many provisions will revert to 2017 levels, adjusted for inflation. For example, in 2017, the marginal tax brackets were 10%, 15%, 25%, 28%, 33%, 25%, and 39.6%.

The Big Picture

APRIL 11, 2024

And even still, fund fees and taxes remained a major cost element. In 1978, Congress enacted Internal Revenue Code Section 401(k), which allowed tax-deferred savings through a company-administered plan. Lower trading costs, a rampaging bull market, and tax-deferred investing led to millions of new entrants into markets.

Cordant Wealth Partners

NOVEMBER 18, 2024

We also get you up to speed on the tax benefits of using a DAF. If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you. Key Takeaways: Contributions to a donor-advised fund reduce your tax bill in the year your contribution is made.

Nerd's Eye View

OCTOBER 1, 2022

A new bill would make many parts of the Tax Cuts and Jobs Act of 2017 permanent, including its changes to tax brackets, the higher standard deduction, and the cap on state and local tax deductions.

Nerd's Eye View

APRIL 5, 2023

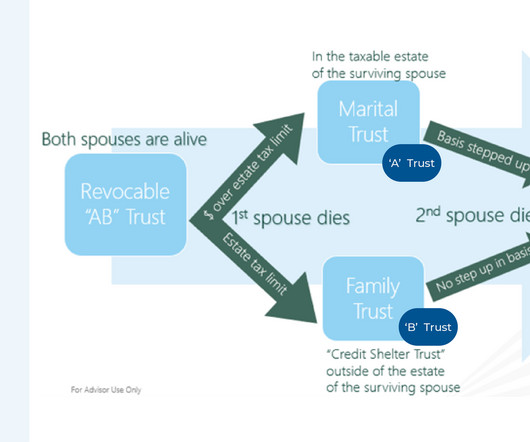

Given how frequently the tax code changes, advisors can add value for clients by ensuring their estate plans are aligned with current law to meet the clients’ objectives, and not with past rules that may no longer apply to them. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

Calculated Risk

MAY 31, 2024

Disposable personal income (DPI) —personal income less personal current taxes—increased $40.2 The following graph shows real Personal Consumption Expenditures (PCE) through April 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for April: Personal income increased $65.3 billion (0.3 percent in February 2022.

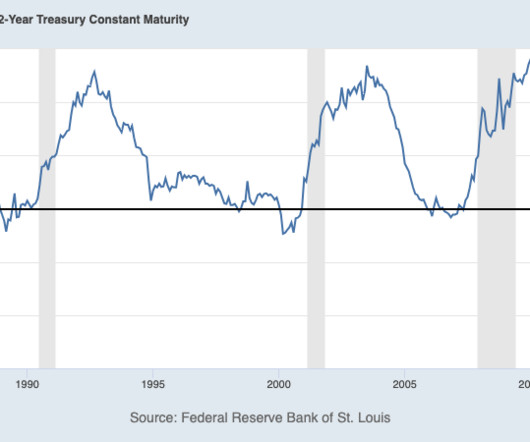

The Big Picture

NOVEMBER 2, 2023

If you are in a top tax bracket and have residency in a high-tax state with strong credit quality – think Ohio, New York, Massachusetts, California, Connecticut, etc. – Cash in No Longer Trash : TINA is officially over. you should be looking at Munis here. Depending on the specifics a 4.5-5%

Advisor Perspectives

JANUARY 31, 2025

For the new Congress, deciding the fate of the 2017 Tax Cuts and Jobs Act will present an immediate dilemma. Allowing the law’s provisions to expire as scheduled at the end of the year would effectively raise taxes on tens of millions of Americans.

Calculated Risk

JUNE 28, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $94.0 The following graph shows real Personal Consumption Expenditures (PCE) through May 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for May: Personal income income increased $114.1 billion (0.5 billion (0.5

Carson Wealth

DECEMBER 8, 2023

That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA). AGI impacts multiple other tax considerations.

The Big Picture

JULY 27, 2022

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising ( 2016 , 2017 , 2018 , 2018 , 2019 ). Then came the pandemic, and a huge federal worker subsidy. Workers upskilled and launched new businesses.

Zoe Financial

JANUARY 28, 2025

Looking at the same 1950-2017 period, but looking through the lens of five-year investment horizons, returns for the S&P 500 ranged from down 3% to up 28%. Zoe Financial is not an accounting firm – clients and prospective clients should consult with their tax professional regarding their specific tax situation.

Calculated Risk

OCTOBER 27, 2023

Disposable personal income (DPI), personal income less personal current taxes, increased $56.1 The following graph shows real Personal Consumption Expenditures (PCE) through September 2023 (2017 dollars). The BEA released the Personal Income and Outlays report for September: Personal income increased $77.8 billion (0.3 billion (0.3

Calculated Risk

SEPTEMBER 27, 2024

Disposable personal income (DPI), personal income less personal current taxes, increased $34.2 The following graph shows real Personal Consumption Expenditures (PCE) through August 2024 (2017 dollars). The BEA released the Personal Income and Outlays report for August: Personal income increased $50.5 billion (0.2 billion (0.2

MainStreet Financial Planning

JANUARY 3, 2024

The maximum amount of earnings subject to Social Security tax (taxable maximum) will increase to $168,600 from $160,200. More Information If you would like to read more about the 2024 changes from the IRS here is the IRS Publication and summary at the Tax Foundation website.

The Big Picture

FEBRUARY 27, 2023

This demographic cohort is simply not a seller due to retirement – the tax expenses would be too great. Estate taxes are why appreciated equity is transferred this way. I suspect most of us have a distorted viewpoint of the average investor versus the total capital in the market. appeared first on The Big Picture.

Harness Wealth

MARCH 27, 2025

Pass-Through Entity Tax (PTET) is a state-level tax mechanism designed to sidestep the federal State and Local Tax (SALT) deduction limit. Allowing a pass-through entity to pay state income taxes directly, PTET effectively shifts the tax burden from individual owners to the business itself.

The Big Picture

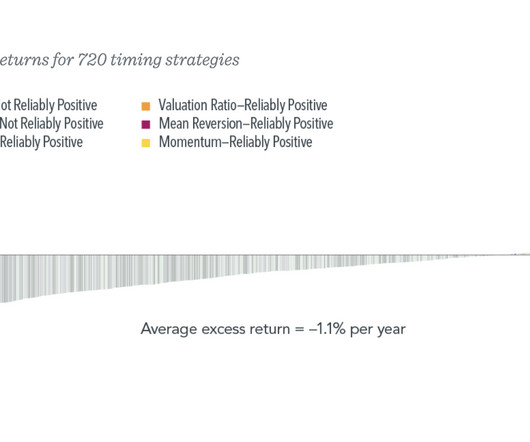

NOVEMBER 27, 2023

This is before we get to the issue of capital gains taxes, which create a hurdle of (minimum) 20% on those pesky profits just to get to breakeven. Not only are the odds stacked against you, but very often systems that have successfully timed the market have been simply lucky, and do not succeed in out-of-sample tests.

Carson Wealth

FEBRUARY 29, 2024

But when does gifting become a tax issue? Let’s take a closer look at estate and gift taxes and how you can approach them with a financial planning mindset. Taxes on Giving??? Why do you have to pay taxes on money you’re giving away? This continued until the federal government wised up and imposed a federal gift tax.

Brown Advisory

DECEMBER 4, 2017

2017 Year-End Planning Letter. Mon, 12/04/2017 - 13:10. presidential election, we have grappled with the lack of clarity regarding the details of new tax legislation. The outcome of the tax reform debate is likely to impact how we advise clients on tax planning, estate planning and a host of other topics.

The Chicago Financial Planner

OCTOBER 21, 2021

This is up from $285,000 in 2019, from $275,000 in 2017 and from $220,000 in 2014. The money goes into the account on a pre-tax basis much like a traditional 401(k) or IRA. This is a great opportunity for those who earn too much to make pre-tax contributions to a traditional IRA. The rising cost of healthcare in retirement .

Harness Wealth

DECEMBER 30, 2024

However, as appealing as these forms of compensation may be, they can result in sizable and unexpected tax bills. Along with the 83(b) election, there is a less well-known provisionthe 83(i) election that offers other tax advantages to certain types of employees. Table of Contents What is an 83(i) election?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content