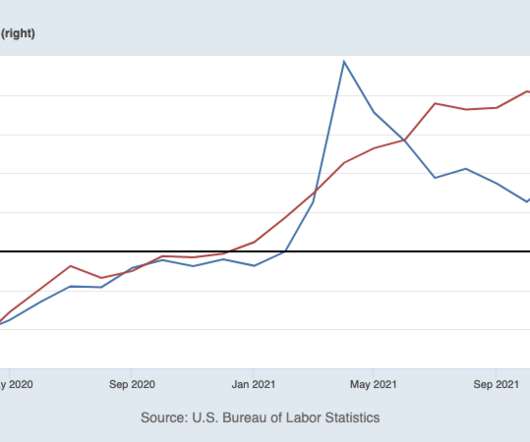

The Great Resignation Is Long Over

The Big Picture

JULY 27, 2022

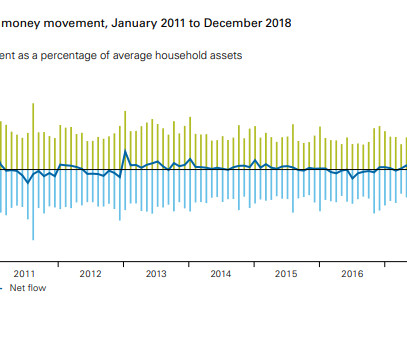

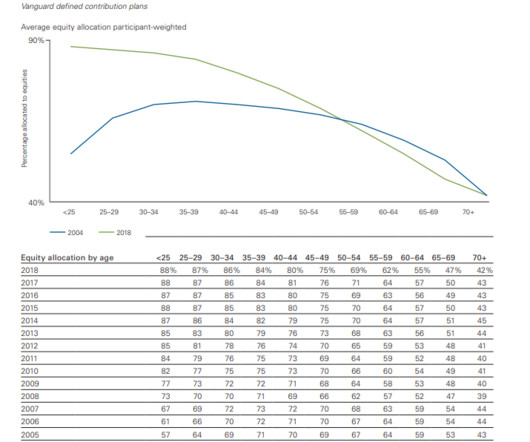

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising ( 2016 , 2017 , 2018 , 2018 , 2019 ). The 2010s monetary rescue plan benefitted anybody who owned capital assets: Stocks, Bonds, and Real Estate. Now we have inflation.

Let's personalize your content