Q&A: How Cliffwater Overcame the Hurdles to RIAs Investing in Private Credit

Wealth Management

JUNE 28, 2024

The alternative investment manager was among the first to launch an interval fund in 2019, with a focus on private credit.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 28, 2024

The alternative investment manager was among the first to launch an interval fund in 2019, with a focus on private credit.

Wealth Management

APRIL 10, 2024

The Investments & Wealth Institute has updated its CIMA certification curriculum and exam for the first time since 2019.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

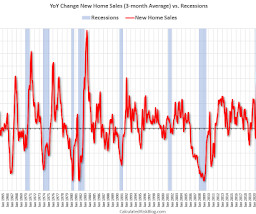

Calculated Risk

APRIL 7, 2025

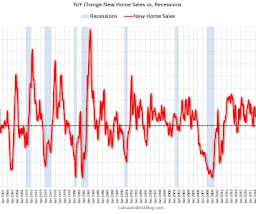

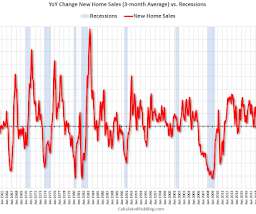

This graph uses new home sales, single family housing starts and residential investment. (I Note that Residential Investment is quarterly and single-family starts and new home sales are monthly. I dismissed it when the yield curve inverted in 2019 and again in 2022. I prefer single family starts to total starts).

The Chicago Financial Planner

FEBRUARY 5, 2022

New England won the 2019 game and it was also an up year for the markets. Is this a valid investment strategy? As far as your investments, I think you’ll agree that the outcome of the game should not dictate your strategy. Any investment strategy that does not incorporate your goals, time horizon, and risk tolerance is flawed.

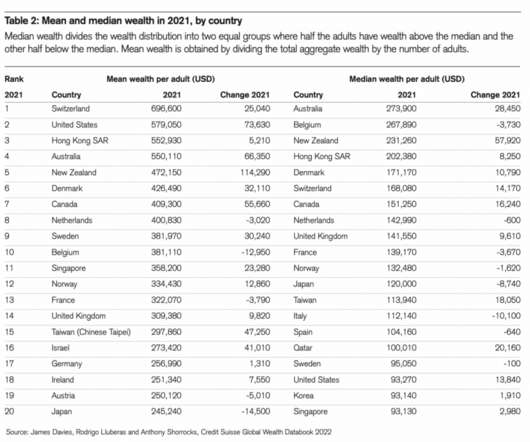

The Big Picture

SEPTEMBER 22, 2022

The data always has some interesting findings about how the very wealthy are investing, consuming, and otherwise spending their time and money. and +19.9%), but an the biggest surprise was the generational gains by Millennials and Gen X: They grew their wealth most between 2019 and 2022 dramatically: Most ultra-high-net-worth individuals.

The Big Picture

SEPTEMBER 16, 2023

This week, we speak with Elizabeth Burton , managing director and client investment strategist at Goldman Sachs Asset Management. She advises institutional clients on investment strategies and portfolio objectives, working alongside global client advisers and product strategists across public and private markets.

The Big Picture

JANUARY 23, 2023

UPDATE 4:45pm I see Chartr is on this as well: See Also : Mind the anecdata (Sam Ro, Jan 22, 2023) The American Rescue Plan was the best economic policy in forty years (Claudia Sahm, Dec 7, 2021) Previously : The Plural of Anecdote IS Data (February 4, 2019) Fearing the Dramatic, Complacent for the Mundane (April 29, 2019) Denominator Blindness, (..)

The Big Picture

SEPTEMBER 9, 2023

This week, we speak with Jon McAuliffe , who is co-founder and chief investment officer at the Voleon Group , heading the firm’s investment strategy, research, and development. Voleon, which manages $10 billion in client assets, has achieved great success applying these technologies to investing.

Wealth Management

FEBRUARY 7, 2024

The youngest generations, by far the poorest, received much of the Covid-era fiscal stimulus, giving them extra savings to invest in equities,

Calculated Risk

SEPTEMBER 16, 2022

One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). See my post in 2019: Don't Freak Out about the Yield Curve ) For the economy, what I focus on is single family starts and new home sales. (See Residential investment has also peaked.

The Big Picture

JUNE 21, 2023

Sinclair had a clear bead on the financial industry, especially the high-cost, active-investing side of it, even though he was writing about the meatpacking industry. Previously : Winner Takes All Applies to Stocks, Too (August 1, 2019) Wasn’t Passive Supposed to Blow Up During the Next Crash?

Random Roger's Retirement Planning

MARCH 22, 2025

For a ten year run ending Jan 1, 2019 though it compounded at over 6% annually plus that dividend yield on top and a very low beta. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. To me, that was a great mix of attributes.

The Big Picture

MAY 6, 2024

.” The guys who made that prediction: Rex Sinquefield, co-founder of Dimensional Funds (DFA) which now runs about 677 billion; and Roger Ibbotson, professor at Yale, and winner of too many awards to count for his contributions to investing theory. To say nothing of a contrarian but accurate extrapolation of future market returns).

Calculated Risk

DECEMBER 7, 2022

One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). See my post in 2019: Don't Freak Out about the Yield Curve ) For the economy, what I focus on is single family starts and new home sales. (See Residential investment has also peaked.

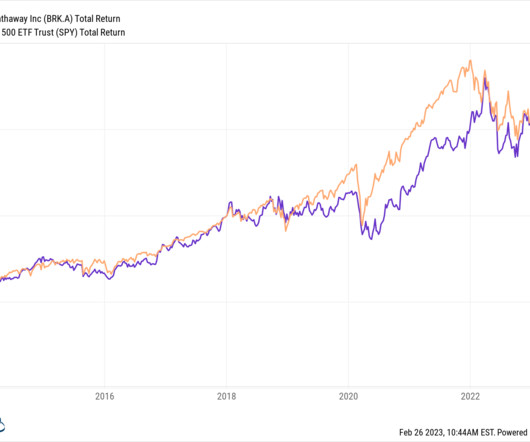

The Big Picture

FEBRUARY 27, 2023

equity market since 1945 has shifted dramatically to different investment vehicles. The key conclusion was this was despite the sexy idea and stock ticker and great performance, it was only a so-so investing vehicle, unlikely to attract much capital. As Ben pointed out via his favorite chart at top, ownership of U.S.

Nerd's Eye View

OCTOBER 25, 2023

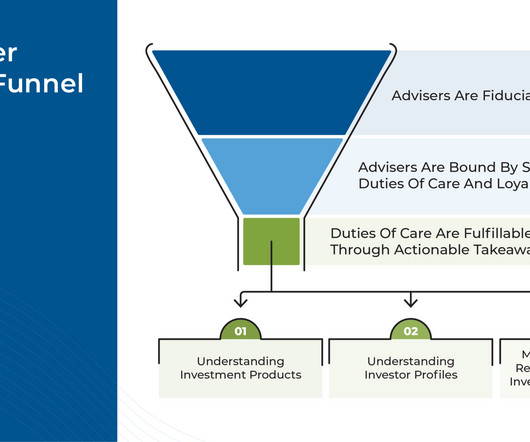

There is a general understanding that investment advisers have a fiduciary relationship with their clients – in other words, that they are required to act in the client's best interests. These 3 components in practice make up a core part of the adviser's fiduciary duty to their clients.

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Good Financial Cents

DECEMBER 22, 2022

You’ll be rewarded if you can invest it for the long haul. As this compound interest calculator demonstrates, investing $30,000 at a return of 8% for 20 years will leave you with $138,828. But where should you invest your $30,000? Table of Contents 16 Best Ways to Invest $30,000 in 2023. Invest in ETFs.

Nerd's Eye View

APRIL 21, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that in a settlement with the SEC, robo-advisor platform Betterment agreed to pay a $9 million penalty for allegedly misstating the frequency that its automated tax-loss harvesting system was scanning some client accounts between (..)

Nerd's Eye View

APRIL 10, 2024

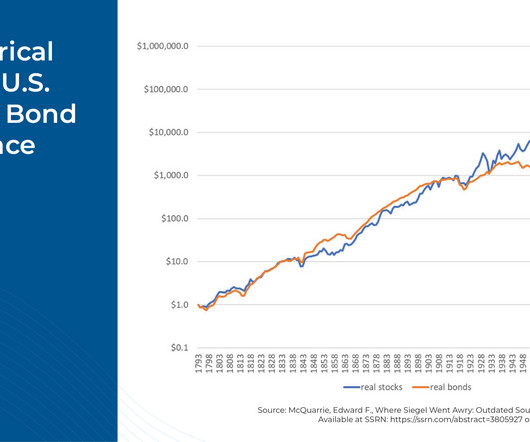

So, although the entire 227-year span of McQuarrie's analysis from 1793 to 2019 was weakly supportive of Siegel's conclusions, there were subperiods where bonds actually outperformed stocks, leading McQuarrie to conclude that there was no consistent relationship between asset outperformance and length of holding period to which values must revert.

Calculated Risk

JANUARY 10, 2024

Question #8 for 2024: How much will Residential investment change in 2024? Click on graph for larger image. Question #7 for 2024: How much will wages increase in 2024? How about housing starts and new home sales in 2024? Question #9 for 2024: What will happen with house prices in 2024?

The Big Picture

MARCH 9, 2023

She points to studies that show that male-dominated hedge funds represent a missed opportunity to generate more alpha — it’s simply a poor investment strategy. In this space, Hedge funds lag finance, which in turn lags the broader economy.

The Big Picture

DECEMBER 9, 2023

This week, we speak with investing legend Joel Tillinghast. He has been a mutual fund manager in the equity division at Fidelity Investments since the 1980s. He observes that when you make investing mistakes, “ You’ve got to be cruel to yourself so you don’t do it again.”

Clever Girl Finance

SEPTEMBER 11, 2023

When you’re new to investing, it can seem like there’s a lot of information to learn. But you have to start somewhere—so you might as well start with the best investing websites right off the bat! Table of contents What makes the best investment websites the best ? 6 Best investing websites for research (and taking action!)

The Big Picture

APRIL 26, 2024

This week, we speak with Dr. Ed Yardeni, President of Yardeni Research , a provider of global investment strategies and asset-allocation analyses and recommendations. He previously served as Chief Investment Strategist of Oak Associates, Prudential Equity Group, and Deutsche Bank’s US equities division in New York City.

The Big Picture

SEPTEMBER 29, 2022

2022 may not be 1981-82, but for the first time in several years, bonds are attractive investment options. Despite what you may have heard, the Fed isn’t the only factor driving equity markets. However, they are significant — and rising rates this year have been a headwind for both equities and the economy.

The Big Picture

MARCH 21, 2023

Fisher Investments ) • The 10 Top US Cities Where a $100,000 Salary Goes the Furthest : Here are the top 10 US cities where a six-figure salary goes the furthest. In the United States alone, individuals donated close to $300 billion to charity in 2019. It has always been a disaster but with a few great pieces. (

Calculated Risk

JANUARY 1, 2023

New construction delivery fell under 600,000 sqft and caused the inventory to grow just above 3 million sqft for the year, less than half of 2019’s record. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). for the fifth straight quarter.

The Big Picture

AUGUST 23, 2024

This week, we speak with Ricky Sandler , the chief investment officer and the founder of Eminence Capital. Today, Eminence is a $7B global investment management organization. Be sure to check out our Masters in Business next week with Heather Brilliant , CEO since 2019 of publicly traded Diamond Hill (DHIL).

The Big Picture

DECEMBER 30, 2022

Here is QAD from 2019: In business, change is inevitable , and those that fail to adapt and innovate are often doomed to failure. A perfect way to end the 2022 annus horriblis is to remind readers that not just individual stocks, but entire sectors fall in and out of favor. Almost nobody does this well consistently over time.

Carson Wealth

NOVEMBER 4, 2024

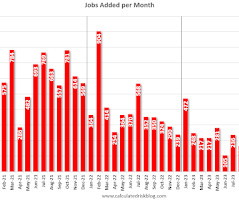

In 2019, monthly job growth averaged 166,000 but we saw four months with 100,000 or fewer jobs created. The 2017-2019 pace was 3.1%.) Business investment was also strong in Q3, though half of that was from aircraft spending, and that is unlikely to repeat in the next quarter or two.

Abnormal Returns

FEBRUARY 26, 2023

Sentencing Commission show judges rejected more than 80% of compassionate release requests filed from October 2019 through September 2022. abnormalreturns.com) The 2023 Credit Suisse Global Investment Returns Yearbook is here! (washingtonpost.com) Urban areas can't grow without new housing. bloomberg.com) Data from the U.S.

Calculated Risk

JANUARY 13, 2023

One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). Note that Residential Investment is quarterly and single-family starts and new home sales are monthly. Residential investment has also peaked. Real GDP Growth Year Annual GDP Q4 / Q4 2005 3.5%

The Big Picture

MARCH 8, 2023

1 Billion (Tie), John Overdeck, Two Sigma Investments 6. $1 1 Billion (Tie), David Siegel, Two Sigma Investments 8. February 27, 2023) Simple, But Hard (January 30, 2023) Wealth Distribution Analysis (July 18, 2019) Sources : Income and emotional well-being: A conflict resolved Matthew A. Shaw Group 10.

The Big Picture

JANUARY 31, 2023

But when the calendar changed from October to November in 2019, so too did the entire streaming industry. Consumer Is Starting to Freak Out : The flush savings accounts and cheap credit that helped keep Americans spending at high rates since 2020 are disappearing. Washington Post ) see also Politicians Want to Keep Money Out of E.S.G.

The Big Picture

NOVEMBER 10, 2023

June 21, 2021) Tversky and Kahneman Changed How We Think (December 5, 2016) How Shiller helped Fama win the Nobel (October 26, 2013) Plus, I have to include the discussion of Amos Tevarsky and Danny Kahnemann: Michael Lewis on The Undoing Project (December 10, 2016) The post MiB: The Nobel Laureates appeared first on The Big Picture.

Carson Wealth

JANUARY 13, 2025

But some of those companies will become an IBM, GM, or Kodak perhaps still worthy of investment in the future, but not the dominant player it is today. Thats running at a solid 170,000 per month, versus an average of 166,000 in 2019. million in 2023 but well in the ballpark of what we saw in 2017-2019 (2.1 in 2018-2019.

Validea

JANUARY 21, 2025

Don’t miss this conversation with one of the most influential figures in quantitative investing. Watch on YouTube Listen on Apple Podcasts Listen on Spotify The post Practical Lessons from Cliff Asness appeared first on Validea's Guru Investor Blog.

Carson Wealth

MARCH 3, 2025

You should never blindly invest in seasonality, but just as February was ripe for potential trouble, be open to a nice Spring bounce. Hopefully because youve been reading this then you know that even the best years have scary headlines and volatility and that volatility is the toll we pay to invest. Panic Is in the Air How do you feel?

Calculated Risk

JANUARY 11, 2023

2019 63.3% Question #8 for 2023: How much will Residential investment change in 2023? Unemployment and Participation Rate for December each Year December of Participation Rate Change in Participation Rate (percentage points) Unemployment Rate 2008 65.8% 2009 64.6% -1.2 2010 64.3% -0.3 2011 64.0% -0.3 2012 63.7% -0.3 2013 62.9% -0.8

Trade Brains

MAY 17, 2024

Fundamental Analysis Of Cholamandalam Investment & Finance Company: The Murugappa Group is one of India’s leading business conglomerates. Hailing from South India, the group holds leadership position across Auto Components, Abrasives, Ceramics, power Systems and other major industries. 7229 Cr, which increased by 24% from Rs.

Calculated Risk

DECEMBER 26, 2022

However, it seems unlikely that inventory will be back up to the 2017 - 2019 levels. As expected, inventory hit new record lows early in 2022, and is finishing the year up significantly year-over-year - but not close to the 2017 - 2019 levels. 7) Question #7 for 2022: How much will Residential investment change in 2022?

The Big Picture

JULY 20, 2023

It is the advisor’s job to prevent clients from engaging in the kind of bad investment behavior that drawdowns often cause; I cannot see how trading that for >30% of the upside makes any sense. Since inception (March 2019), they are up 27.8% respectively this year, versus 19.9% Chart after the jump ).

The Big Picture

DECEMBER 16, 2023

This week, we speak with Michael Rockefeller , Co-Chief Investment Officer and co-founder of Woodline Partners. The firm launched in 2019 with around $2 billion in initial assets, and became one of the fastest-growing emerging funds over the past few years. They now manage $7 billion in assets.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content