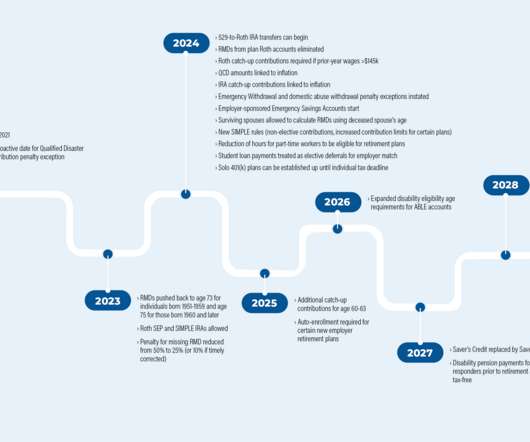

SECURE Act 2.0: Later RMDs, 529-to-Roth Rollovers, And Other Tax Planning Opportunities

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Let's personalize your content