Conquest Planning Secures $17.8M In Series A Funding

Wealth Management

FEBRUARY 7, 2023

Having brought its version of financial planning to Canada in late 2020, the firm is preparing to enter the U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

FEBRUARY 7, 2023

Having brought its version of financial planning to Canada in late 2020, the firm is preparing to enter the U.S.

Nerd's Eye View

MAY 15, 2024

In practice, the DoL's Final Rule means that financial advisers who advise clients about rolling over assets from an employee retirement account like a 401(k) plan into an IRA are now subject to ERISA fiduciary obligations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JULY 26, 2023

Financial plans play an important role for both clients and advisors, as they not only help clients gain a clear perspective of their current financial position, but also provide advisors with a systematic way to organize their analyses and communicate their recommendations to the client.

Wealth Management

SEPTEMBER 30, 2024

TPG will join General Atlantic, which made its own minority investment in the firm in 2020. CEO Peter Mallouk will keep his majority stake and continue to lead the firm.

Nerd's Eye View

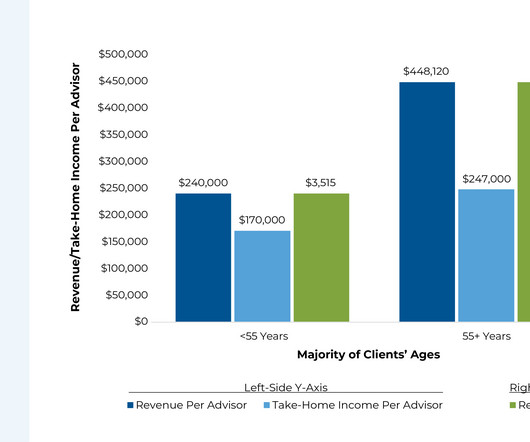

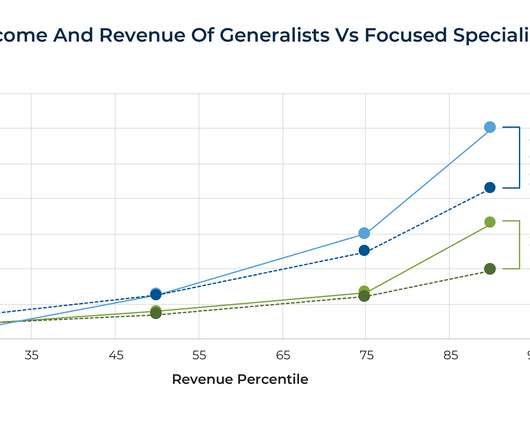

OCTOBER 23, 2023

Though, at some point, covering a large number of financial planning topics can eat into an advisor's time, which is problematic if clients won't pay substantially more to receive that more comprehensive advice.

Nerd's Eye View

MAY 22, 2023

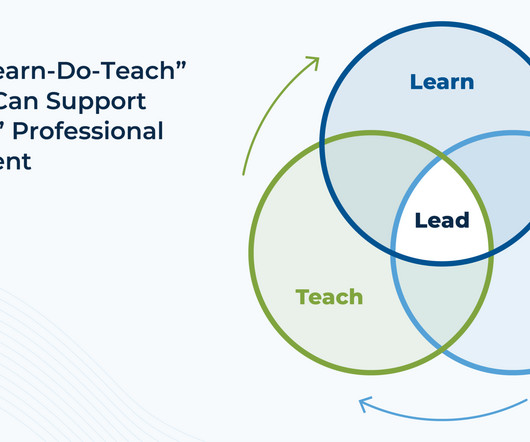

Traditionally, financial planning internship programs have offered students who are aspiring financial planners a way to prepare for entering the workforce by gaining real-world experience in advisory firm settings (as well as a way to get their foot in the door with prospective employers).

Calculated Risk

NOVEMBER 18, 2024

According to MBA’s estimate, 235,000 homeowners are in forbearance plans. million borrowers since March 2020. While forbearances are still low compared to the height of the pandemic, the monthly increase in forbearances is the largest since May 2020 and likely driven by the effects of Hurricanes Helene and Milton.”

Calculated Risk

DECEMBER 23, 2024

According to MBAs estimate, 250,000 homeowners are in forbearance plans. million borrowers since March 2020. emphasis added At the end of November, there were about 250,000 homeowners in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.5

Calculated Risk

SEPTEMBER 18, 2023

According to MBA’s estimate, 165,000 homeowners are in forbearance plans. million borrowers since March 2020. The share of forbearance plans has been decreasing and declined to 0.33% in August from 0.39% in July. At the end of July, there were about 165,000 homeowners in forbearance plans.

Nerd's Eye View

SEPTEMBER 25, 2023

In the mid-20th century, the first phone call for a person who needed guidance on saving or planning for retirement was likely to be to a stockbroker or a mutual fund or insurance salesperson. So, in the late 1960s, a movement began to organize and promote best practices that would establish financial planning as a true profession.

Calculated Risk

MARCH 17, 2025

According to MBAs estimate, 190,000 homeowners are in forbearance plans. million forbearances since March 2020. emphasis added At the end of February, there were about 190,000 homeowners in forbearance plans. Mortgage servicers have provided approximately 8.6 Another 24.2% are in forbearance because of a natural disaster.

Calculated Risk

MAY 2, 2024

As mortgage rates have climbed to new 2024 highs, we could see sellers adjust their plans, since nearly three-quarters of potential sellers also plan to buy a home. • For the 25th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. from one year ago.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. A lot has changed since 2020, though.

Nerd's Eye View

MAY 31, 2023

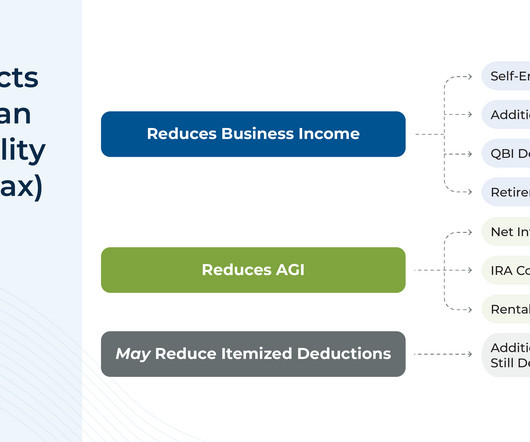

With IRS giving its blessing to this approach through Notice 2020-75, 33 states now have some sort of PTET available and, as a result, owners of pass-through businesses who live (or do business) in those states may be considering whether to make a PTET election.

Calculated Risk

JANUARY 21, 2025

According to MBAs estimate, 235,000 homeowners are in forbearance plans. million borrowers since March 2020. At the end of December, there were about 235,000 homeowners in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.5 Another 42.8% are in forbearance because of a natural disaster.

Calculated Risk

JUNE 20, 2023

According to MBA’s estimate, 245,000 homeowners are in forbearance plans. million borrowers since March 2020. The number of loans in forbearance is reaching levels not seen since the beginning of March 2020, prior to the passage of the CARES Act,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

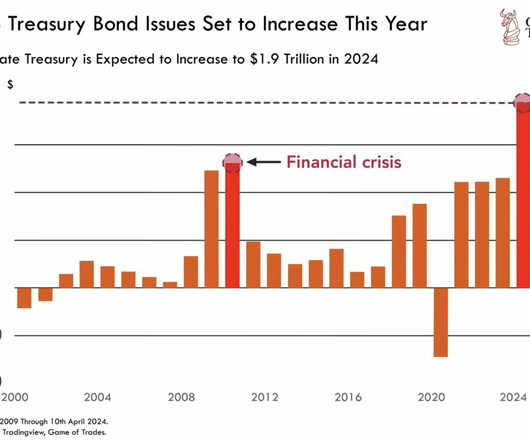

The Big Picture

AUGUST 12, 2024

Sorry, but “fake it till you make it” seems like a poor plan for thinking about the future… Previously : Time to Stop Believing Deficit B t (September 3, 2021) Stimulus, More Stimulus and Taxes (January 25, 2021) Cost of Financing US Deficits Falls (December 18, 2020) Can We Please Have an Honest Debate About Tax Policy?

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” aka The Hidden World of Failure ) (October 23, 2020) Stock Ownership : Distribution of Household Wealth in the U.S.

The Big Picture

JANUARY 23, 2023

million employees, more than half of whom were hired in 2020-2022. Second, what looks like giant layoffs are in fact a tiny percentage of just the recent hiring (to say nothing of the total workforce) of these same firms. Amazon , now has 1.5 Google just fired 12,000 people; they hired 57,000 over the past two years. At least, not yet.

Calculated Risk

APRIL 17, 2023

According to MBA’s estimate, 275,000 homeowners are in forbearance plans. million borrowers since March 2020. The share of forbearance plans has been decreasing, declined to 0.55% in March from 0.60% in February. At the end of March, there were about 275,000 homeowners in forbearance plans.

NAIFA Advisor Today

FEBRUARY 6, 2025

McGlothlin served on the Society of FSP National Executive Committee from 2018 to 2021 and was National President in 2020-2021. The team has achieved a remarkable 300% growth over six years. Previously, he served terms on the FSP National Board of Directors from 2011 through 2016.

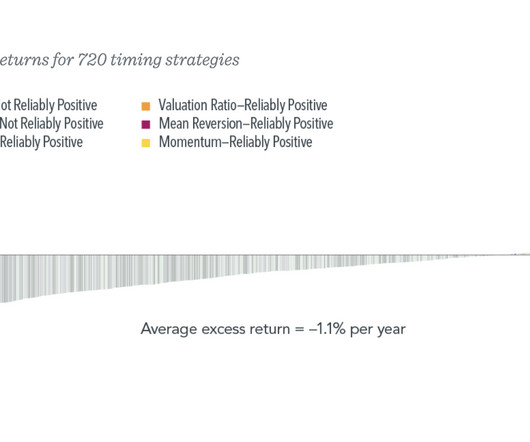

The Big Picture

NOVEMBER 27, 2023

When you get it wrong, it crushes your retirement plans. Staying long through the 60-day 34% drop during the 2020 pandemic; getting out of the market ahead of the 2022 rate hiking cycle; and getting back in October 2022 for the next bull leg. The less it matters, the easier it is to be bold and outside of the mainstream.4

Carson Wealth

FEBRUARY 27, 2025

Like gardening or working out, tax planning is one of those activities where you get out what you put in. Tax planning is similar in the sense that you can put work in on the front end that youll reap benefits from later. This initial question may help you put together the rest of your tax planning strategies.

Indigo Marketing Agency

JANUARY 28, 2025

Every financial advisor knows the importance of a growth plan. If a financial planner doesnt build a solid plan of ROI, their clients wont have a solid financial future. Financial advisors need a solid growth marketing plan to ensure they are built to last for years and decades to come. Read Jims full story here.

The Big Picture

OCTOBER 7, 2023

Previously : Cancelling Michael Lewis (October 5, 2023) Revisiting Liar’s Poker, 30 Years Later (April 22, 2022) MiB: Michael Lewis on Pandemic Planning (May 8, 2021) MiB: Michael Lewis on Coaches and Risk (May 25, 2020) MIB: Michael Lewis, Podcaster (April 6, 2019) MIB: Michael Lewis on a Writer’s Life (December 13, 2016) Michael Lewis’ Portrait (..)

Calculated Risk

SEPTEMBER 11, 2023

Today, in the Calculated Risk Real Estate Newsletter: Q2 Update: Delinquencies, Foreclosures and REO A brief excerpt: In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. Currently 23.3%

MainStreet Financial Planning

MAY 10, 2024

According to the 2020 US Census, over a quarter (27.6%) of all US households were one-person households. Looking ahead and planning is the best way to preserve your sense of autonomy, choice, and life satisfaction before the unexpected happens and your health declines. Are your Advance Care Plans in place and written down and current?

Calculated Risk

SEPTEMBER 15, 2022

Probably declined in 2020 and 2021 due to foreclosure moratoriums, forbearance programs and house price increases). Here is some data on REOs through Q2 2022 …. We will probably see an increase in REOs in late 2022 and into 2023 following the end of the moratoriums.

Mish Talk

DECEMBER 1, 2022

Order backlogs, prices and now lead times are declining rapidly, which should bring buyers and sellers back to the table to refill order books based on 2023 business plans.” Regarding the overall economy, this figure indicates expansion for the 30th month in a row after contraction in April and May 2020. percent recorded in October.

Calculated Risk

MAY 15, 2023

According to MBA’s estimate, 255,000 homeowners are in forbearance plans. million borrowers since April 2020. The share of forbearance plans has been decreasing, declined to 0.51% in April from 0.55% in March. At the end of April, there were about 255,000 homeowners in forbearance plans.

Trade Brains

NOVEMBER 22, 2023

In 2020, the Murugappa Group via its subsidiary Tube Investments of India (TII) acquired a controlling stake in CG Power and Industrial Solutions Ltd. The MNRE collaborated with the Danish Energy Agency, to publish a conceptual plan for 15 offshore wind projects, paving the way for offshore wind development. 177 Cr loss in FY22.

Trade Brains

JUNE 30, 2023

2020 29,766.98 77 2020 460.87 2020 17 227.59 This gives it a 4-year CAGR growth of 25.50% The table below showcases the revenue growth of Adani Wilmar Vs Patanjali Foods for the last five financial years. Fiscal Year Adani Wilmar Patanjali Foods 2019 28,919.68 2021 37,195.65 2022 54,385.89 2023 58,446.16 7,672 2021 727.64

Trade Brains

SEPTEMBER 1, 2023

The article concludes with a highlight of future plans and a summary. 2020 ₹ 385.29 Future Plans of Talbros Automotive So far we looked at previous fiscals’ data for our fundamental analysis of Talbros Automotive Components. Let us now see what plans the company has in store for the future. 2021 ₹ 444.2 2022 ₹ 577.24

Nerd's Eye View

DECEMBER 26, 2022

Accordingly, just as I did last year, and in 2020, 2019, 2018, 2017, 2016, 2015, and 2014, I've compiled for you this Highlights List of our top 20 articles in 2022 that you might have missed , along with a few of our most popular episodes of ‘Kitces & Carl’ and the ‘Financial Advisor Success’ podcasts.

Trade Brains

SEPTEMBER 29, 2023

In this fundamental Analysis of Exide Industries, we read about its history, operating segments, industry, financials and future plans. 2020 14471.01 It has been serving India for as long as we received our Independence. Fundamental Analysis of Exide Industries We will read in brief about its history and its current capabilities.

The Big Picture

MAY 5, 2023

From the perspective of an asset management and financial planning firm, the challenge is getting people to ignore the day-to-day noise in favor of thinking about where prices will be a decade hence. Rather than accept the volatility of month-to-month economic datapoints — NFP, Consumer Spending, Manufacturing, Inflation, etc.

Trade Brains

OCTOBER 25, 2023

In this article on Force Motors Vs Olectra Greentech, we compare the company, financials, ratios & see which one has better future plans. The government has launched various initiatives to help the industry grow, including the Automotive Mission Plan 2016-26 and the FAME Scheme. Industry Overview With a 7.1% of market volume.

Trade Brains

JANUARY 29, 2024

The country plans to reach 450 GW of installed renewable energy capacity by 2030, with 280 GW (over 60%) expected from solar power. 2021-22 ₹ 6,581.78 ₹ 2,417 2020-21 ₹ 3,345.72 ₹ 2,485.39 2020-21 ₹ 103.59 ₹ 1,645.72 2020-21 -2.02 Most of the demand will come from the real estate and transport sectors. 2021-22 -1.79

Carson Wealth

NOVEMBER 29, 2023

How to Plan for Long-Term Care Coverage You should start with your financial advisor. Together, you can map out a plan for what kind of care you want to receive and how you’ll pay for that care when you need it. 3 Putting together a solid long-term care plan can be a gift to your family members so they don’t have to make that choice.

Carson Wealth

JANUARY 8, 2025

Knowledge and Personalized Planning Financial advisors can bring a wealth of knowledge from extensive education and experience, helping enable them to craft tailored strategies that align with your unique financial goals. 1 Envestnet, How a Financial Advisor Can Help You Achieve Financial Wellness, 2020.

Trade Brains

FEBRUARY 14, 2024

Industry Analysis The Indian rail freight industry is experiencing growth and improvements, with ambitious plans and increased investment by the government and schemes such as Gati Shakti, which aim at enhancing capacity, efficiency, and sustainability. 2020-21 ₹ 1,520.63 ₹ 995.75 2020-21 ₹ -18.78 ₹ 53.39 crore and Rs.

The Big Picture

SEPTEMBER 10, 2022

The super-rich ‘preppers’ planning to save themselves from the apocalypse : Tech billionaires are buying up luxurious bunkers and hiring military security to survive a societal collapse they helped create, but like everything they do, it has unintended consequences. ( One Brain Molecule Decides.

Wealth Management

FEBRUARY 8, 2023

In 2020, the company said it would seek to increase the number of under-represented employees by 50% in five years. Visa’s new Atlanta offices will help the firm achieve goals it set almost three years ago for improving the diversity of its ranks, Rector said.

Trade Brains

MARCH 3, 2024

Fiscal Year Revenue from operations (In Crores) Net Profit (In Crores) 2023 968 24 2022 1178 65 2021 930 76 2020 383 -14 2019 546 45 4-year CAGR 15.39% -14.54% Profit Margins The financials reported an operating margin of 7% and a net profit margin of 2.5% 2020 -0.19 -5.31% 2019 16.72 2020 0.73 -0.04 2020 0.73 -0.04

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content