Key Tax Court Cases on Valuation of Pass-Through Entities: The Later Years

Wealth Management

JANUARY 30, 2024

Developments from 2020 to 2023.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 30, 2024

Developments from 2020 to 2023.

A Wealth of Common Sense

AUGUST 29, 2024

A reader asks: My asset allocation has been pretty conservative since the market run-up in 2020. One thing I like about having the 60/40 split is that it gives me the option of changing to a more aggressive allocation if stock valuations fall. I have nagging doubts that my alloc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

The Big Picture

OCTOBER 17, 2022

I have a few ideas, none of which are conclusive, but perhaps together they explain some of the price action: the distraction to Elon Musk from the Twitter acquisition (and litigation); company valuation, and last, competition from legacy car makers. Let’s spend a few moments on each: 1.

The Big Picture

APRIL 7, 2023

million that cast ballots in the 2020 race when there was also a presidential primary. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. More than 1.7 Knowing When You Have Enough.

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” (June 21, 2021) What If Everything is Survivorship Bias? Let’s consider another question, this one on U.S.

The Big Picture

FEBRUARY 27, 2023

MSCI ex-USA: 8.4% ( Wealth of Common Sense ) • I’m not Sure Speculation Is Gone : Jim Chanos, president and founder of Chanos & Company, believes the level of silliness and speculation seen in 2020 and 2021 marked an important moment for valuations. These were the annual returns1 from 1970 through January 2023: S&P 500: 10.5%

Advisor Perspectives

MAY 2, 2024

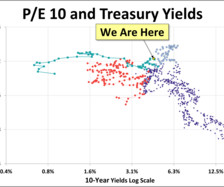

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of April 30, it was 4.69%.

The Big Picture

JUNE 20, 2024

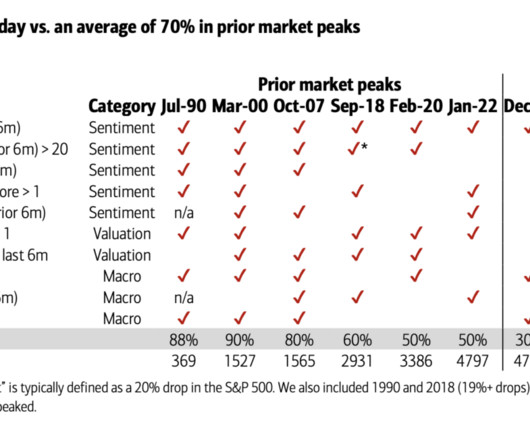

She observes it is less about the things investors tend to focus on — “technical analysis, geopolitics, behavioral finance and even skirt hemline trends” — and more about specific measures she tracks in sentiment, valuation, macro-economic areas. The table above shows the major market peaks going back to 1990.

Trade Brains

OCTOBER 3, 2024

’s expansion, its potential future growth, and its sustainability, and whether the valuations are justified. Financial Overview Of Trent Financial Year Mar 2020 Mar 2021 Mar 2022 Mar 2023 Mar 2024 Revenue (Crores) 3,485.00 Should you buy Trent despite having a high valuation? This article will examine Trent Ltd.’s

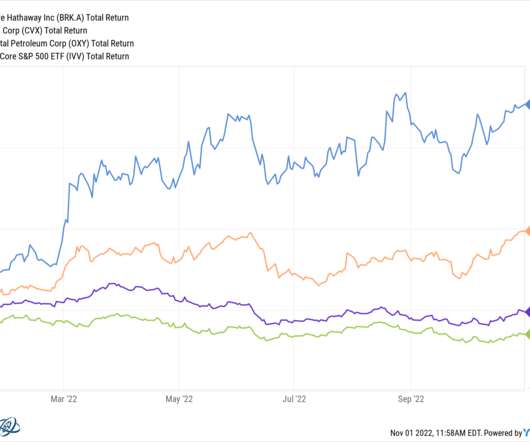

Validea

SEPTEMBER 21, 2022

A study of history would have told us in advance that the 2020 bear market was an anomaly based on how fast things turned around, but you still can’t blame us for hoping for a repeat. With the S&P 500 now close to 20% off its highs, I thought now might be a good time to look to our market valuation tool to see where things stand.

Advisor Perspectives

JUNE 4, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of May 31, it was 4.51%.

Advisor Perspectives

APRIL 3, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of March 28, it was 4.20%.

Advisor Perspectives

MARCH 5, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of February 29, it was 4.25%.

The Irrelevant Investor

OCTOBER 1, 2022

Nose bleed valuations are getting knee clubbed by a combination of high inflation and rising interest rates. These darlings of 2020 are down 80% or more from their all-time high. The world has turned upside down, or right side up, depending on your perspective.

The Big Picture

DECEMBER 1, 2022

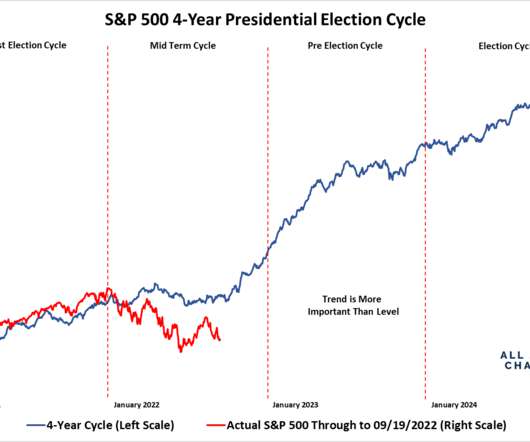

Investors need to recognize: The economy has thus far remained resilient; Corporate Profits have remained robust; Consumers are still spending; Households and corporate balance sheets are healthy; Valuations have become more attractive; Seasonal patterns are positive (see chart above via JC ). Not So Fast (April 3, 2020).

Advisor Perspectives

FEBRUARY 2, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of January 31, it was 3.99%.

Advisor Perspectives

JANUARY 3, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of December 31, it was 3.88%.

Advisor Perspectives

DECEMBER 5, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of November 30, it was 4.37%.

Advisor Perspectives

NOVEMBER 2, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of October 31, it was 4.88%.

Advisor Perspectives

OCTOBER 3, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of September 30, it was 4.59%.

Advisor Perspectives

SEPTEMBER 6, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of August 31st, it was 4.09%.

Advisor Perspectives

MARCH 3, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of February 28, 2023 it was at 3.92%.

The Big Picture

AUGUST 1, 2023

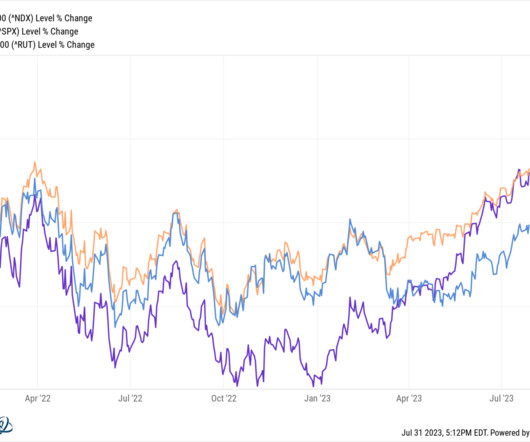

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. But we won’t know how big a losing trade it might be until early 2024, when we see the updated valuations. Blame whatever you want – Too far, too fast? End of ZIRP?

Advisor Perspectives

FEBRUARY 6, 2025

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4th, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of January 31st, it was 4.54%.

Advisor Perspectives

JANUARY 6, 2025

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4th, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of December 31st, it was 4.58%.

Advisor Perspectives

NOVEMBER 8, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of November 8, it was 4.30%.

Advisor Perspectives

OCTOBER 4, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of October 4, it was 3.98%.

Advisor Perspectives

SEPTEMBER 3, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of August 31, it was 3.91%.

Advisor Perspectives

AUGUST 5, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of July 31, it was 4.09%.

Advisor Perspectives

JULY 2, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of June 28, it was 4.36%.

Advisor Perspectives

AUGUST 10, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of July 31, it was 3.97%.

Advisor Perspectives

JULY 5, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of June 30, it was 3.81%.

Advisor Perspectives

JUNE 5, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of May 31, 2023, it was 3.64%.

Brown Advisory

FEBRUARY 1, 2021

Global Leaders Investment Letter - Q4 2020 jharrison Mon, 02/01/2021 - 08:25 Just want the PDF? One of the most important investing reminders of 2020 was around one of the few sources of investment edge: time. When does crowd psychology take hope for economic return beyond what valuation can support? What is Space?

Brown Advisory

FEBRUARY 1, 2021

Global Leaders Investment Letter - Q4 2020. One of the most important investing reminders of 2020 was around one of the few sources of investment edge: time. The power of our clear and disciplined process was evident throughout 2020 as it enabled us to focus on our long investment horizon during a stressful and uncertain period.

Advisor Perspectives

MAY 3, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of April 28, 2023, it was 3.44%.

Advisor Perspectives

APRIL 5, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of March 31, 2023, it was 3.55%.

Advisor Perspectives

FEBRUARY 2, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations on investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of January 31, 2023, it was at 3.52%

Advisor Perspectives

JANUARY 6, 2023

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations on investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of December 30, 2022, it was at 3.88%.

Abnormal Returns

SEPTEMBER 22, 2022

Markets Market valuations are a lot more attractive than they were a year ago. interest rates since 2020. blog.validea.com) Visualizing U.S. visualcapitalist.com) Strategy The hardest part of investing is holding through tough times. evidenceinvestor.com) A lot of investor problems are self-inflicted.

Abnormal Returns

NOVEMBER 1, 2022

Markets How major asset classes performed in October 2020. every.to) Q3 saw big drops in startup valuations. capitalspectator.com) Don't be surprised to see the stock market rally before the economy bottoms out. behaviouralinvestment.com) Nick Maggiulli, " The present is redefining your past.

The Big Picture

SEPTEMBER 19, 2022

So along those lines, there are some venture firms that don’t really seem to care a lot about valuations and others seem to focus on a little bit. Is valuation significant, or is it, hey, we’re going to make 100 investments and if two or three workout, the valuations are irrelevant? How do you fall in that spectrum?

Trade Brains

OCTOBER 7, 2024

The Chinese market has struggled since 2020 due to COVID-19, real estate issues, and tech company crackdowns. Additionally, foreign investors are shifting funds from India to China, attracted by lower valuations. These valuations reflect different economic conditions and investor sentiments in each country.

Validea

MARCH 7, 2025

A companys price-to-earnings (P/E) ratio must be in line with or lower than its earnings growth rate to ensure valuation remains attractive. While it has led the market over time, much of the recent outperformance has come from explosive gains post-COVID in 2020, along with strong returns in 2023 and 2024 as growth stocks rebounded.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content