What’s Ailing Tesla’s Stock?

The Big Picture

OCTOBER 17, 2022

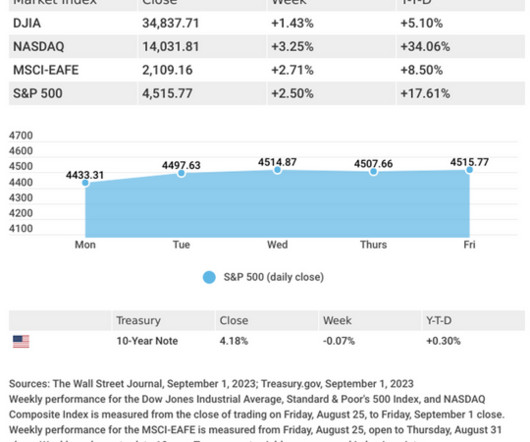

off of its 2021 highs. “Tesla’s strategic use of semiconductors has lowered the number of chips required to produce vehicles” has cut lead times , and allowed the firm to make more cars with fewer chips. 2021’s Surprising Laggard: Amazon (January 5, 2022). See also : 7 Trends in Car Markets (December 23, 2021).

Let's personalize your content