Edelman Financial Engines Acquires $1.5B Retirement Plan Consultant

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

Calculated Risk

AUGUST 9, 2022

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning. Commercial planning in July was led by an increase in data center, office and warehouse projects, while fewer education and healthcare projects drove the institutional component lower.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k). I generally consider this a plan for the self-employed. You need to start a retirement plan today.

Wealth Management

NOVEMBER 1, 2024

Jania Stout, who sold her firm to OneDigital in 2021, will lead Prime Capital Retirement and Prime Capital Wellness.

The Chicago Financial Planner

OCTOBER 21, 2021

Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . These types of plans are becoming more common with employers and are available privately as well. How the HSA works . Click To Tweet.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Calculated Risk

DECEMBER 9, 2022

Commercial planning experienced a healthy increase in hotel and data center projects and modest growth in stores and office projects. On a year-over-year basis, the DMI was 25% higher than in November 2021, the commercial component was up 28%, and institutional planning was 21% higher.

The Big Picture

APRIL 13, 2023

They have seen a significant uptick in overall participation rate, which has increased from 62% in 2006 to 82% in 2021. More employer plans are adopting automatic enrollment, a small nudge often credited to Nobel prize-winning economist Richard Thaler. Eligible employees deferred nearly 40% more in 2021 than in 2006.

Nerd's Eye View

MARCH 25, 2025

What's unique about AJ, though, is how she and her business partner have navigated the hiring and training, and system and process challenges, that come from very rapidly scaling an advisory firm business from scratch to $5 million of revenue in just 7 years.

Calculated Risk

NOVEMBER 8, 2022

Commercial planning was bolstered by a solid increase in office and hotel projects. The institutional component was varied, experiencing growth in recreational and education projects, countered by a decline in the number of healthcare and public planning projects. emphasis added Click on graph for larger image.

Calculated Risk

OCTOBER 5, 2022

From Moody’s Analytics Senior Economist Lu Chen: Office continues its bumpy ride, and Retail remains flat Office vacancy has been persistently stuck at over 18% since early 2021 , a consequence of excess inventories and strains on companies’ expansion plans. in Q3 2021. Q2 2021 at 18.5% in Q1 2021, and down from 11.3%

Wealth Management

JUNE 22, 2023

Dooley launched the SPAC in 2021, with the goal of acquiring wealth management firms. It now plans to take Unifund, a consumer debt servicer, public in a $238 million deal.

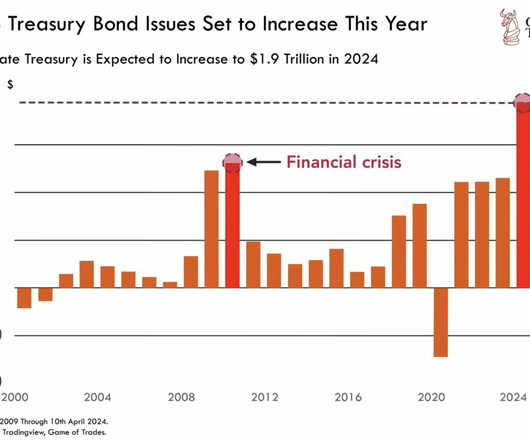

The Big Picture

AUGUST 12, 2024

Sorry, but “fake it till you make it” seems like a poor plan for thinking about the future… Previously : Time to Stop Believing Deficit B t (September 3, 2021) Stimulus, More Stimulus and Taxes (January 25, 2021) Cost of Financing US Deficits Falls (December 18, 2020) Can We Please Have an Honest Debate About Tax Policy?

The Big Picture

NOVEMBER 3, 2022

I don’t care what your personal theories on monetary policy might be, your thoughts on Milton Friedman, or who you plan on voting for next week. A few months later, CPI was over 4%; by June, it was over 5%, October, higher than 6%, and they finished 2021 with CPI over 7%. They remained on the emergency footing of zero.

The Big Picture

JANUARY 23, 2023

Microsoft laid off 10% of its 221,000 workforce bringing headcount back to mid-2021 levels. Amazon , now has 1.5 million employees, more than half of whom were hired in 2020-2022. Google just fired 12,000 people; they hired 57,000 over the past two years. Last, the Labor market remains very robust. At least, not yet.

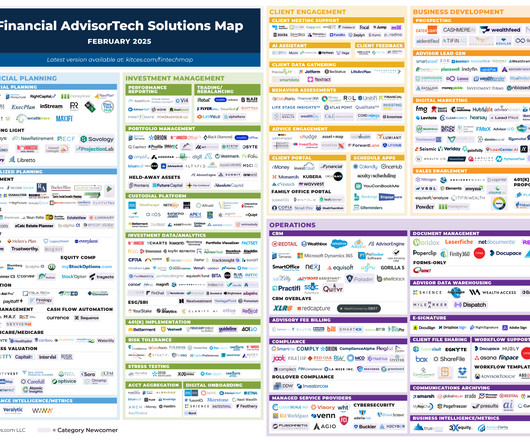

Nerd's Eye View

FEBRUARY 3, 2025

This month's edition kicks off with the news that FP Alpha has released its tax return extraction and analysis module as a standalone product, while RightCapital has separately launched its own tax return extraction tool bundled within its platform – with both announcements coming on the heels of Holistiplan implementing a significant price increase, (..)

Calculated Risk

JUNE 29, 2023

As mortgage rates surged in 2022, buyers saw costs soar, and a large number of shoppers reoriented their housing plans. Inventory is still up from the record lows in the 2nd half of 2021 and early 2022, and it is unlikely we will see new record lows this year. Inventory is down 0.3%

NAIFA Advisor Today

FEBRUARY 6, 2025

McGlothlin served on the Society of FSP National Executive Committee from 2018 to 2021 and was National President in 2020-2021. Under his leadership, more than 25 employees have bolstered their professional skills and received in-house promotions. The team has achieved a remarkable 300% growth over six years.

Calculated Risk

OCTOBER 10, 2022

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. On the commercial side, the figure was primarily bolstered by an influx of data centers entering the planning queue. The index was at 183.2

Calculated Risk

JANUARY 9, 2023

Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning. Meanwhile, institutional growth focused on recreation and public building, with education and healthcare planning activity remaining flat. emphasis added Click on graph for larger image.

Wealth Management

MARCH 6, 2023

Grayscale filed plans with the SEC in October 2021 to convert GBTC, the world’s biggest Bitcoin investment vehicle, into an exchange-traded fund.

Calculated Risk

SEPTEMBER 9, 2022

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. Compared to August 2021, the Momentum Index was up 14%. emphasis added Click on graph for larger image.

Carson Wealth

OCTOBER 31, 2024

According to a 2021 AARP report, 78% of family caregivers incur routine out-of-pocket expenses, spending $7,242 annually, and nearly half have experienced at least one financial setback as a result of their caregiving. Without a long-term care plan in place, you rely on luck or charity.

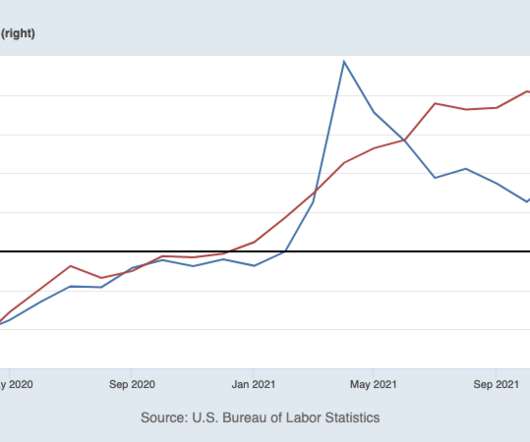

The Big Picture

JULY 27, 2022

But also look at the year-over-year change in the Quits Rate: It spiked in percentage terms to all-time highs in early 2021, before slowly easing back towards (more or less) flat to 2019 over the ensuing 12 months. The 2010s monetary rescue plan benefitted anybody who owned capital assets: Stocks, Bonds, and Real Estate.

Calculated Risk

SEPTEMBER 7, 2023

With inventory continuing to remain constrained, the pending and existing home sales pace has consistently hovered around a low level in recent months as high mortgage rates and home prices drive sellers and buyers to put plans to move on-hold. • New listings–a measure of sellers putting homes up for sale–were down again this week, by 8.5%

The Big Picture

FEBRUARY 16, 2023

Canadian Jason Slaughter lives in Amsterdam and focuses on urban planning, suburbia, and city design (more on Jason here ). March 21, 2022) How Everybody Miscalculated Housing Demand (July 29, 2021) What Makes a Community Attractive? He created the channel Not Just Bikes on YouTube and produces all of the videos there.

Calculated Risk

MARCH 14, 2023

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO A brief excerpt: In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023.

Nerd's Eye View

OCTOBER 21, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass a series of changes affecting retirement planning, dubbed “SECURE ACT 2.0”, ”, by the end of the year. Social Security COLA for 2023.

Indigo Marketing Agency

JANUARY 28, 2025

Every financial advisor knows the importance of a growth plan. If a financial planner doesnt build a solid plan of ROI, their clients wont have a solid financial future. Financial advisors need a solid growth marketing plan to ensure they are built to last for years and decades to come. Read Jims full story here.

Calculated Risk

SEPTEMBER 11, 2023

Today, in the Calculated Risk Real Estate Newsletter: Q2 Update: Delinquencies, Foreclosures and REO A brief excerpt: In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023.

Nerd's Eye View

DECEMBER 19, 2022

At the same time, questions abound as to how the FPA realistically plans to pursue Title Protection, and its noticeable abstention from mentioning the CFP marks anywhere in its discussion of its new advocacy agency, despite the fact that the FPA is the membership association for CFP professionals.

Calculated Risk

SEPTEMBER 15, 2022

Probably declined in 2020 and 2021 due to foreclosure moratoriums, forbearance programs and house price increases). Here is some data on REOs through Q2 2022 …. We will probably see an increase in REOs in late 2022 and into 2023 following the end of the moratoriums.

Calculated Risk

DECEMBER 26, 2022

year-over-year in November compared to November 2021. Price appreciation will decrease from the unsustainable 2021 pace but seems likely to still be in the mid-to-high single digit range in 2022." compared to the same period in 2021. compared to the same period in 2021. Note: The NAR reported inventory was up 2.7%

Trade Brains

SEPTEMBER 1, 2023

The article concludes with a highlight of future plans and a summary. When compared to the first half of 2021, the automotive component industry’s revenue increased 34.8% in H123 to ₹79,033 crore, up from ₹68,746 crore in H1 2021-22. 2021 ₹ 444.2 Following that, we’ll go into the stock’s financials.

Trade Brains

JUNE 30, 2023

From 2021-2027, the total revenue of the FMCG market is estimated to grow at a CAGR of 27.9%, which will nearly be US$ 615.87 2021 37,195.65 7,672 2021 727.64 2021 3.14% 5.42 2021 25 16.75 As of December 2022, the FMCG market has reached a total of US$ 56.8 Fiscal Year Adani Wilmar Patanjali Foods 2019 28,919.68

Trade Brains

SEPTEMBER 29, 2023

In this fundamental Analysis of Exide Industries, we read about its history, operating segments, industry, financials and future plans. 2021 10359.43 It has been serving India for as long as we received our Independence. Fundamental Analysis of Exide Industries We will read in brief about its history and its current capabilities.

Trade Brains

JANUARY 29, 2024

India has already met its target of 40% installed electric capacity from non-fossil fuels by November 2021, making it the world’s fourth-largest installed capacity of solar and wind power. The country plans to reach 450 GW of installed renewable energy capacity by 2030, with 280 GW (over 60%) expected from solar power.

Nerd's Eye View

JANUARY 16, 2023

Indeed, financial advisors often describe one of the benefits of financial planning as helping people take control of their time by giving them the financial freedom to do what they enjoy.

Trade Brains

OCTOBER 25, 2023

In this article on Force Motors Vs Olectra Greentech, we compare the company, financials, ratios & see which one has better future plans. The government has launched various initiatives to help the industry grow, including the Automotive Mission Plan 2016-26 and the FAME Scheme. 2.51% 2021 0.65% 7.17 % 2022 2% 14.26% 2023 6.5%

Nerd's Eye View

AUGUST 12, 2022

From there, we have several articles on Mergers & Acquisition (M&A) trends: M&A activity so far in 2022 is set to exceed 2021’s record pace despite economic headwinds, meaning there could simply be a ‘new normal’ of higher activity regardless of the economic environment.

Trade Brains

MAY 23, 2023

Fundamental Analysis of Laxmi Organic Industries: After listing at a premium of 20% in March 2021, the stock of Laxmi Organic Industries rallied further by 200% in another 7 months. A highlight of the future plans and a summary conclude the article at the end. However, the stock has corrected 50% since then.

Trade Brains

FEBRUARY 14, 2024

Industry Analysis The Indian rail freight industry is experiencing growth and improvements, with ambitious plans and increased investment by the government and schemes such as Gati Shakti, which aim at enhancing capacity, efficiency, and sustainability. 2021-22 ₹ 1,467.50 ₹ 1,178.35 2021-22 ₹ -0.68 ₹ 49.65 crore and Rs.

The Chicago Financial Planner

JUNE 13, 2022

After a strong finish in 2020 and very solid returns in 2021, we’ve seen a lot of market volatility so far in 2022. Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. If not perhaps you are taking more risk than you had planned. Do nothing.

Trade Brains

MARCH 3, 2024

Fiscal Year Revenue from operations (In Crores) Net Profit (In Crores) 2023 968 24 2022 1178 65 2021 930 76 2020 383 -14 2019 546 45 4-year CAGR 15.39% -14.54% Profit Margins The financials reported an operating margin of 7% and a net profit margin of 2.5% The table below exhibits the revenue and profits of Shakti Pumps over the last 5 years.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content