Prime Capital Hires OneDigital’s Jania Stout to Lead Retirement Plan Business

Wealth Management

NOVEMBER 1, 2024

Jania Stout, who sold her firm to OneDigital in 2021, will lead Prime Capital Retirement and Prime Capital Wellness.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 1, 2024

Jania Stout, who sold her firm to OneDigital in 2021, will lead Prime Capital Retirement and Prime Capital Wellness.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

The Chicago Financial Planner

OCTOBER 21, 2021

Saving for retirement is a major undertaking for most of us. Health savings accounts (HSA) provide another vehicle to save for retirement. An HSA can serve as an additional retirement savings vehicle on top of your IRA or 401(k) to help cover healthcare and other retirement expenses. How the HSA works .

The Big Picture

APRIL 13, 2023

Some encouraging news about people saving for retirement: A study by Vanguard Group found that “Automatic enrollment and the rise of target-date funds” are having a substantial and positive impact on retirement savers, in particular, on Millennials and Generation Z investors.

The Big Picture

MAY 4, 2023

Owners tend to be fairly well off, and each incremental dollar they earn is more likely to be spent elsewhere – retirement savings, durable goods, etc. It stays local and is likely to benefit the regional economy. It has aa much smaller impact on the local economy. Note: I have not seen conclusive research as to whether this is so or not).

NAIFA Advisor Today

FEBRUARY 6, 2025

Mike McGlothlin , CFP, CLU, ChFC, LUTCF, NSSA, Executive Vice President, Retirement, at Ash Brokerage , is the 2024 recipient of the Kenneth Black Jr. McGlothlin served on the Society of FSP National Executive Committee from 2018 to 2021 and was National President in 2020-2021. Leadership Award.

A Wealth of Common Sense

MARCH 5, 2023

According to the Bureau of Labor Statistics, nearly 70% of private industry workers had access to a workplace retirement plan in 2021. It’s estimated more than 100 million Americans are covered by a defined contribution retirement plan. That’s a lot of money but is it enough to retire comfortably?

Abnormal Returns

DECEMBER 20, 2023

(podcasts.apple.com) Retirement How to find a new you in retirement. ofdollarsanddata.com) What's changing for retirement accounts in 2024. morningstar.com) Why it's so hard to stay retired when you retire early. savantwealth.com) The IRS is extending an olive branch to taxpayers who owe money from 2020-2021.

The Chicago Financial Planner

NOVEMBER 8, 2021

So far in 2021, the index is in record territory and has closed at record levels numerous times during the year. As someone saving for retirement , what should you do now? Has the market rally accelerated the amount you’ve accumulated for retirement relative to where you had thought you’d be at this point? Learn from the past

The Big Picture

DECEMBER 11, 2023

billion in retail inventory losses in 2021 was not “attributable to organized retail crime.” retailers retracted its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021 after finding that incorrect data was used for its analysis.” In 2021, he told a U.S.

Nerd's Eye View

AUGUST 12, 2022

From there, we have several articles on Mergers & Acquisition (M&A) trends: M&A activity so far in 2022 is set to exceed 2021’s record pace despite economic headwinds, meaning there could simply be a ‘new normal’ of higher activity regardless of the economic environment. Enjoy the ‘light’ reading!

Calculated Risk

DECEMBER 27, 2024

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid). The Atlanta Fed Wage tracker showed nominal wage growth increased sharply in 2021 and for most of 2022.

Calculated Risk

OCTOBER 12, 2023

On average, Social Security retirement benefits will increase by more than $50 per month starting in January. in 2021 (used to calculate contribution base). From Social Security: Social Security Announces 3.2 percent in 2024 , the Social Security Administration announced today. The National Average Wage Index increased to $63,795.13

The Chicago Financial Planner

OCTOBER 20, 2021

In today’s world of early or semi-retirement, many people wonder when they should begin taking their Social Security benefits. Full retirement age. Your full retirement age or FRA is the age at which you become eligible for a full, unreduced retirement benefit. This increases to $19,560 for 2022. 25,000 earned income.

Nerd's Eye View

OCTOBER 21, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass a series of changes affecting retirement planning, dubbed “SECURE ACT 2.0”, ”, by the end of the year. Social Security COLA for 2023.

The Big Picture

FEBRUARY 27, 2023

Recall last week , we were discussing thinking about the impact of retiring Baby Boomers on the equity markets and of rising rates on housing. The demographic question touches on a big issue: $6 trillion dollars in 650,000 (401k) retirement plans held by 10s of millions of Americans. Previously : What If EVERYTHING Is Narrative?

The Chicago Financial Planner

FEBRUARY 6, 2022

In spite of what was said on PBS Frontline The Retirement Gamble and elsewhere in the press, in my opinion 401(k) plans are one of the best retirement savings vehicles available. Here are 4 steps to make sure that your 401(k) plan is working hard for your retirement. There are a number of retirement plan options to consider.

The Chicago Financial Planner

DECEMBER 5, 2021

For those of you who are self-employed it is important that you save for your own retirement. For 2021 the maximum contribution limits are $58,000 and $64,500 for those who will be 50 or over in 2021. For 2021 the maximum contribution limits are $58,000 and $64,500 for those who will be 50 or over in 2021.

Integrity Financial Planning

JANUARY 9, 2023

Between 1991 and 2021, annual inflation averaged 2.5%, close to the Federal Reserve’s desired 2% target, which many believe to indicate a healthy economy. [1] 2] With higher prices in consumer goods, retirees may have had to reevaluate their withdrawals and spending on retirement accounts as their income became strained. 1] [link]. [2]

Nerd's Eye View

AUGUST 12, 2022

From there, we have several articles on Mergers & Acquisition (M&A) trends: M&A activity so far in 2022 is set to exceed 2021’s record pace despite economic headwinds, meaning there could simply be a ‘new normal’ of higher activity regardless of the economic environment. Enjoy the ‘light’ reading!

Calculated Risk

JULY 3, 2023

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory and Demographics: The Next Big Shift A brief excerpt: In 2021 I wrote Housing and Demographics: The Next Big Shift. In that article I reviewed how demographics had helped me call the apartment boom in the early 2010s, and the home buying boom in 2020.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. Given the complexity and magnitude of things necessary for a comfortable retirement, starting planning from a young age is also essential. At the age of 30, your daily expenses can significantly differ from what you would need in retirement. Ten retirement expenses to keep in mind: 1.

The Big Picture

OCTOBER 28, 2022

My end-of-week morning train WFH reads: • For Diving FAANG Stocks, It’s the End of an Era : The five FAANG stocks are on track for their worst simultaneous losses ever, a far cry from their late-2021 highs. “We work among the lowest hours, we retire early and our productivity is poor. Wall Street Journal ).

The Chicago Financial Planner

FEBRUARY 5, 2022

In 2021 the indicator held true to form, sort of, with the market having an up year after Tampa Bay’s win. Approaching retirement and want another opinion on where you stand? Financial coaching focuses on providing education and mentoring on the financial transition to retirement. How has the Super Bowl Indicator done?

The Chicago Financial Planner

JUNE 13, 2022

After a strong finish in 2020 and very solid returns in 2021, we’ve seen a lot of market volatility so far in 2022. Approaching retirement and want another opinion on where you stand? Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Be a smart investor.

Getting Your Financial Ducks In A Row

OCTOBER 17, 2022

In 1974, Congress passed the Employee Retirement Income Security Act (ERISA) that, among many other provisions, provided for the implementation of the Individual Retirement Arrangement. Amounts rolled over from employer retirement plans are entirely exempt. This IRA history is updated occasionally as new provisions are added.

The Big Picture

SEPTEMBER 6, 2023

Watch Danny Boyd of CinemaStix’s video (above) about the challenges of making a flick about a retired hitman. But it almost wasn’t made at all. John Wick is yet another reminder about just how little any of us know about what might happen in the future… Previously : Nobody Knows Nuthin’ (May 5, 2016) Can Anyone Catch Nokia?

The Chicago Financial Planner

FEBRUARY 3, 2022

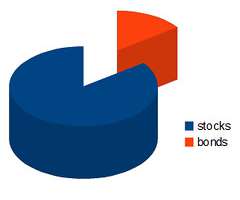

At the end of 2021, Meta shares comprised 1.96% of the Vanguard S&P 500 Index ETF (ticker VOO). With the tremendous year for stocks in in 2021, many investors are likely still in a good long-term position. Approaching retirement and want another opinion on where you stand? Meta Platforms, Inc. Review your asset allocation

The Chicago Financial Planner

AUGUST 24, 2021

While Bernie Madoff passed away in April of 2021, financial fraud is still very much an issue. Approaching retirement and want another opinion on where you stand? Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Financial fraud is all over the news. FINANCIAL WRITING.

The Big Picture

MARCH 6, 2023

Barron’s ) • Why It’s So Hard for China to Shake the ‘Uninvestable’ Tag : In 2021, Goldman Sachs said the word was starting to feature in a number of client conversations about the country’s stocks. Venture-capital investments are plunging, along with valuations of prepublic companies. A Wealth of Common Sense ) • On Wall St.,

Abnormal Returns

FEBRUARY 10, 2024

msn.com) A controversial 2021 study on mifepristone has been retracted. modernfarmer.com) Europe's farmers are set to retire. (msn.com) Why you should switch arms for vaccinations. newatlas.com) Health Why do women get more autoimmune diseases? smithsonianmag.com) Should older Americans really be taking GLP-1s? ft.com) Purple tomatoes?

The Big Picture

MARCH 3, 2023

2 The current move from 2021 highs is shown in red. By then, we began to have meaningful assets in our savings/retirement accounts and the bear markets had a bigger economic impact on those finances. As Batnick points out, all of these horrendous periods of market pain are already factored into long-term returns of equities.

Calculated Risk

SEPTEMBER 6, 2022

in August 2021. 3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years). Click on graph for larger image. The teen employment-population ratio was 36.5%

The Big Picture

APRIL 24, 2023

December 1, 2022) Secular vs. Cyclical Markets, 2022 (May 16, 2022) Bull Market Bull (March 31, 2021) Redefining Bull and Bear Markets (August 14, 2017) Are We in A Secular Bull Market? Nobody should be swinging around billions of dollars based on gut instinct, and certainly not retirement accounts or other very important capital.

Calculated Risk

JANUARY 8, 2023

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid). The Atlanta Fed Wage tracker showed nominal wage growth increased sharply in 2021 and for most of 2022.

Random Roger's Retirement Planning

JULY 20, 2023

Marketwatch posted an advice type of column where a reader asked about his retirement readiness as he just got laid off and now would like to be done with working. They have a combined $350,000 in qualified retirement accounts and $200,000 in taxable accounts. He is 61, no mention of his wife's age or whether she is still working.

Calculated Risk

AUGUST 14, 2022

in July 2021. 3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20+ years). Click on graph for larger image. The teen employment-population ratio was 38.4%

Carson Wealth

OCTOBER 31, 2024

According to a 2021 AARP report, 78% of family caregivers incur routine out-of-pocket expenses, spending $7,242 annually, and nearly half have experienced at least one financial setback as a result of their caregiving. 4 The caregiver might not be able to work outside the home for enough hours per week to qualify for retirement benefits.

Validea

JANUARY 9, 2023

Veteran portfolio manager Bill Miller, founder of Miller Value Partners and manager of the firm’s Miller Opportunity Trust and the Miller Income funds, retired at the end of 2022, reports an article in CityWire. However, the fund has been down since 2021, losing 3.95% that year and then 36.6%

Nationwide Financial

OCTOBER 6, 2022

Key Takeaways: According to a new Nationwide Retirement Institute® survey, the overall outlook on retirement for Americans has changed significantly since 2021, as roughly one in four employees feel they are on the wrong track for retirement and fewer than six in 10 have a positive outlook on their retirement plan and financial investments.

Cordant Wealth Partners

SEPTEMBER 27, 2021

Microsoft matches 50% of your contributions up to the annual IRS limit of $19,500 for 2021 (or $26,000 for those over 50, thanks to the additional $6,500 catch-up contribution). This means that for those contributing the maximum of $19,500, Microsoft would contribute another $9,750 towards your retirement savings.

Calculated Risk

JANUARY 5, 2024

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid). The Atlanta Fed Wage tracker showed nominal wage growth increased sharply in 2021 and for most of 2022.

Nationwide Financial

JANUARY 10, 2023

Key Takeaways: Female participants are delaying their retirement at a greater rate than male counterparts due to concerns about inflation and market volatility. 2022 was a difficult year for many American retirement savers who watched markets drop and inflation dent their monthly budgets. That represents a 22% uptick from 2021.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content