Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations

Brown Advisory

SEPTEMBER 6, 2022

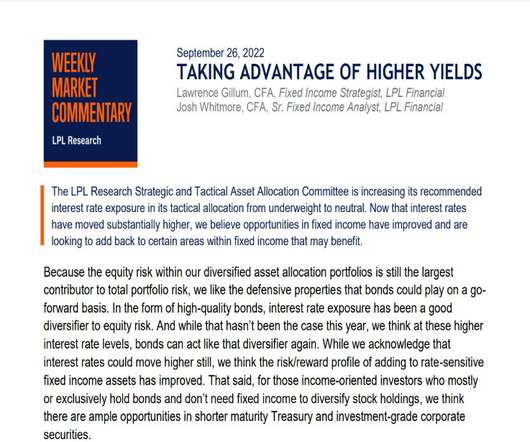

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. Tue, 09/06/2022 - 10:30. When putting a plan in place, we believe it is critical for any mission-driven organization to develop an effective, long-term asset allocation strategy to manage its endowment assets.

Let's personalize your content