LPL’s Recruited Assets Down in 2022

Wealth Management

FEBRUARY 3, 2023

The IBD reported a slowdown in recruited assets in 2022, although its traditional independent advisor channel had a strong quarter.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

FEBRUARY 3, 2023

The IBD reported a slowdown in recruited assets in 2022, although its traditional independent advisor channel had a strong quarter.

Calculated Risk

FEBRUARY 28, 2023

The FDIC released the Quarterly Banking Profile for Q4 2022: Reports from 4,706 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $68.4 billion in fourth quarter 2022, a decrease of $3.3 Total assets of problem banks declined $116.3 billion (4.6

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Calculated Risk

SEPTEMBER 9, 2022

The FDIC released the Quarterly Banking Profile for Q2 2022 this morning: Quarterly net income totaled $64.4 billion in second quarter 2022 , a reduction of $6.0 The number of FDIC-insured institutions declined from 4,796 in first quarter 2022 to 4,771. Total assets of problem banks declined $2.7 billion (8.5

Wealth Management

DECEMBER 1, 2022

Invenio Wealth Partners in Florida, with $250 million in assets, expands tru Independence's presence in the Southeast.

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

Wealth Management

FEBRUARY 22, 2023

During the fourth quarter of 2022, 66 independent financial professionals affiliated with the tax-centric broker/dealer.

The Big Picture

JANUARY 16, 2023

But for others, including some of the largest companies in the world, a strong brand is one of their most valuable assets. The post Most Valuable Brands, 2000–2022 appeared first on The Big Picture. For some companies, a brand is something that helps slightly boost customer engagement and sales.

Calculated Risk

DECEMBER 26, 2022

At the end of each year, I post Ten Economic Questions for the following year (2022). 10) Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022? Here is a graph from Realtor.com showing active inventory through November 2022. This was correct. year-over-year.

The Big Picture

JULY 25, 2023

I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets? That underperformance between asset class returns and investor returns is the behavior gap. The post Underperforming Your Own Assets appeared first on The Big Picture.

Wealth Management

DECEMBER 22, 2022

After a bullish 2021 for NFTs and cryptocurrencies, the value of these digital assets fell significantly in 2022.

Calculated Risk

DECEMBER 6, 2022

The FDIC released the Quarterly Banking Profile for Q3 2022 last week: Net Income Increased Quarter Over Quarter and Year Over Year: Quarterly net income totaled $71.7 billion in third quarter 2022 , an increase of $7.3 percent from second quarter 2022. percent from second quarter 2022. billion (11.3 billion to $163.8

Wealth Management

JUNE 5, 2023

Charts detailing returns by asset class from 1992 to 2022.

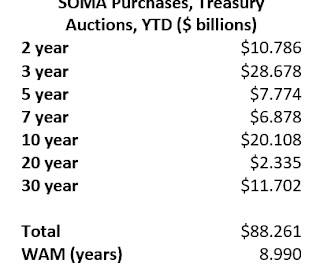

Calculated Risk

MARCH 4, 2025

The reason, of course, is that the Federal Reserve funded the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. release, and is available in the FRED database.

Calculated Risk

MARCH 11, 2025

From housing economist Tom Lawler: From the beginning of 2020 to early June of 2022 the Federal Reserves balance sheet more than doubled to an almost inconceivable $8.9 Inquiring minds might want to know why the Federal Reserve did not achieve its balance sheet targets by selling longer maturity/duration assets it had previously purchased.

Abnormal Returns

AUGUST 5, 2022

newsletter.abnormalreturns.com) Mixed media The best books of 2022, so far, including "True Story: What Reality TV Says About Us" by Danielle J. (abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. esquire.com) Have we reached 'peak Substack newsletter'?

Calculated Risk

JANUARY 1, 2023

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk.

The Big Picture

MARCH 4, 2023

This week, we speak with Dr. Maria Vassalou , co-chief investment officer of multi-asset solutions at Goldman Sachs Asset Management. The inflation and rising rate environment we experienced in 2022 were just the kinds of macro events she had studied. All of our earlier podcasts on your favorite pod hosts can be found here.

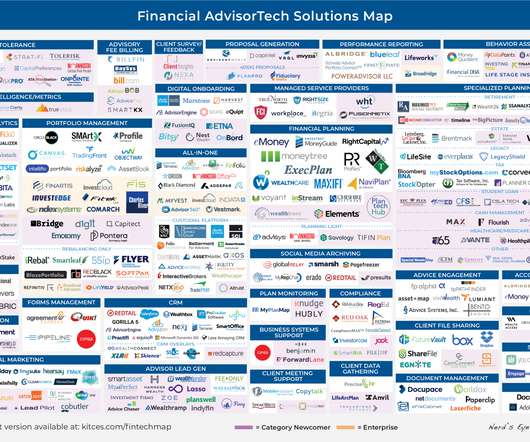

Nerd's Eye View

OCTOBER 3, 2022

Welcome to the October 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

OCTOBER 4, 2022

Asset managers continue to own large office portfolios, according to Pensions & Investments. As more homebuyers step away from the market due to rising mortgage rates, home builders are selling new homes to SFR investors in bulk, reports The Wall Street Journal.

Calculated Risk

SEPTEMBER 9, 2022

The Federal Reserve released the Q2 2022 Flow of Funds report today: Financial Accounts of the United States. trillion during the second quarter of 2022. percent at an annual rate in the second quarter of 2022. percent at an annual rate in the second quarter of 2022. in Q1, 2022. in Q1, 2022.

Calculated Risk

DECEMBER 9, 2022

The Federal Reserve released the Q3 2022 Flow of Funds report today: Financial Accounts of the United States. trillion during the third quarter of 2022. percent at an annual rate in the third quarter of 2022. percent at an annual rate in the third quarter of 2022. in Q2, 2022. in Q2, 2022.

The Big Picture

APRIL 1, 2023

This week, we speak with Ken Kencel, who is president and chief executive officer of Churchill Asset Management, a private credit firm with $46 billion in assets under management that was the top US private equity lender in the 2022 PitchBook league tables and was named 2022 Lender Firm of the Year by The M&A Advisor.

Nerd's Eye View

NOVEMBER 7, 2022

Welcome to the November 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Calculated Risk

MARCH 13, 2025

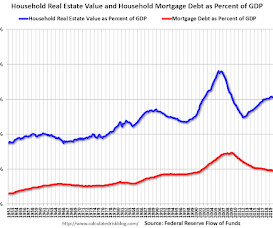

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Net worth increased $0.2 trillion in Q4 to an all-time high. As a percent of GDP, net worth decreased in Q4 and is below the peak in 2021.

Wealth Management

JUNE 22, 2023

Also, contrary to popular belief that investment management has become commoditized, there was more demand for those services in 2022, while interest in financial planning dropped, according to a new study by the IAA and COMPLY.

Wealth Management

NOVEMBER 7, 2023

Net new assets reported by RIAs dropped by 40% YOY, according to a Fidelity survey suggesting it may be time to consider adjusting fees and outsourcing functions.

The Big Picture

APRIL 3, 2023

The asset value peak was $33.6 trillion as of the end of 2022. Given the rough year markets had in 2022, including all of the held asset classes, it is an impressive, albeit curious showing. The group also names 2022’s Best of, including Fund, Asset Class, Region, and Industry of the Year (all found here ).

Wealth Management

DECEMBER 8, 2023

This is the held-away asset management platform's second capital raise since pivoting and changing its name from FeeX in February 2022.

Wealth Management

DECEMBER 13, 2022

Sales of multifamily assets and development sites have been the most active of any property types in New York City recently, reports The Real Deal. The Street forecasts that equity REITs might see a better year in 2023. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

FEBRUARY 29, 2024

The dips in M&A and total assets in 2022 should have been a wakeup call for the industry to return its focus to organic growth.

The Big Picture

MARCH 10, 2023

Price stability and full employment seems to have taken a back seat to asset prices, discouraging speculation, and increasing Fed Chair “credibility.” Where the 2000s-era Fed ignored obvious recklessness among banks and leveraged asset managers, the current Fed seems to be overly concerned with asset prices and appearances.

Random Roger's Retirement Planning

FEBRUARY 8, 2025

Barron's had a very quick look at the recent popularity of private assets to try to figure out whether investors should wade into the space. Consumer discretionary is another one that pretty reliably outperforms for ten year periods, not the last couple though after getting whacked pretty hard in 2022 though.

Calculated Risk

SEPTEMBER 12, 2024

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Net worth increased $2.8 trillion in Q2 to an all-time high. As a percent of GDP, net worth increased in Q2, but is below the peak in 2021.

A Wealth of Common Sense

JANUARY 8, 2023

And we update my asset allocation quilt once a year when the calendar turns (OK that’s just me). Here’s the updated quilt with 2022 data: I have A LOT of tho. We wear Hawaiian shirts at holiday dinners (try it…it’s fun). We get Chinese takeout for lunch every year on Christmas day. Let’s do this.

Wealth Management

OCTOBER 18, 2023

But can it be sustained, given the negative asset growth in 2022?

The Big Picture

OCTOBER 7, 2022

If only the Fed didn’t do X, our portfolio would have been much better” seems to be a terrible approach to managing assets for clients. Following those March 2020 rate cuts, the Fed stayed at Zero until March 2022. Previously : Farewell, TINA (September 28, 2022). June 9, 2022). Blame the Fed For Everything!

The Big Picture

JUNE 15, 2023

Record highs in participation, deferral rates, and the use of professionally managed allocations in 2022 ” added to the totals. The rally off of the June 2022 lows did not hurt either. VG credits the impact of automatic enrollment/contribution escalation as leading savers to this milestone.

Calculated Risk

MARCH 9, 2023

The Federal Reserve released the Q4 2022 Flow of Funds report today: Financial Accounts of the United States. trillion during the fourth quarter of 2022. percent at an annual rate in the fourth quarter of 2022. percent at an annual rate in the fourth quarter of 2022. trillion from the all-time high in Q1 2022.

Wealth Management

OCTOBER 5, 2022

Eleventh acquisition of 2022 brings WEG’s total client assets to more than $57.7

Wealth Management

AUGUST 13, 2023

New data from MSCI Real Assets looks at what changed in the world of professionally-managed real estate around the globe in 2022.

Wealth Management

JANUARY 16, 2024

After 2022, many declared the 60/40 portfolio dead, but the traditional portfolio mix rebounded in 2023, writes Morningstar. BlackRock’s move into the private infrastructure investment space is part of a broader strategy for the asset manager to diversify from its strength in ETFs, according to FundFire.

The Big Picture

JUNE 22, 2023

It shows “Share of Total Assets Held by the Bottom 50% ( red line ) versus the Share of Total Assets Held by the Top 0.1% ( green line ). Consider the chart at top, created by Invictus via FRED. That spread is currently just about as wide as its ever been. Let’s Talk About the 0.01 Percent By Howard R.

Calculated Risk

OCTOBER 3, 2022

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk.

Wealth Management

FEBRUARY 14, 2024

BlackRock’s ESG-related assets under management swelled 53% from the beginning of 2022 through the end of last year, even as the wider ESG fund market only grew by about 8%.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content