Investing Behavioral Hacks

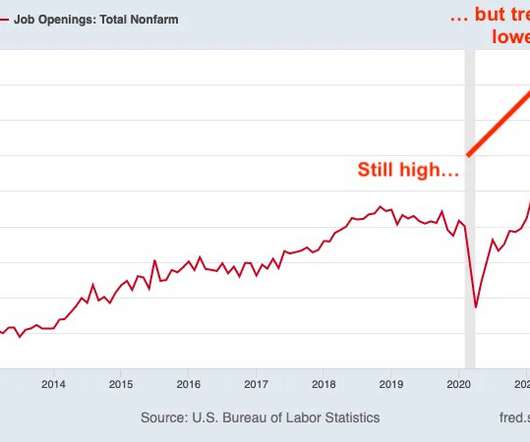

The Big Picture

NOVEMBER 15, 2023

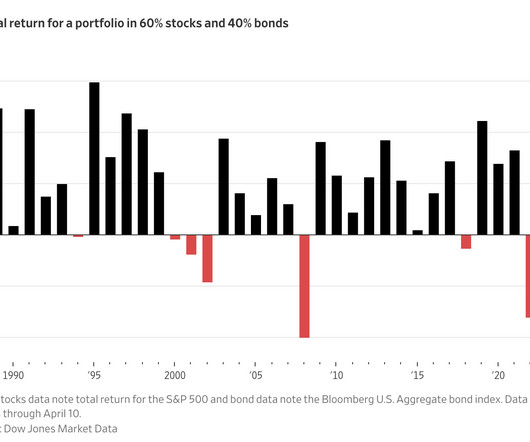

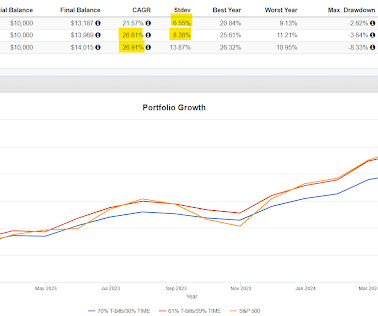

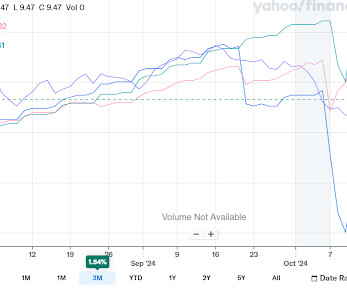

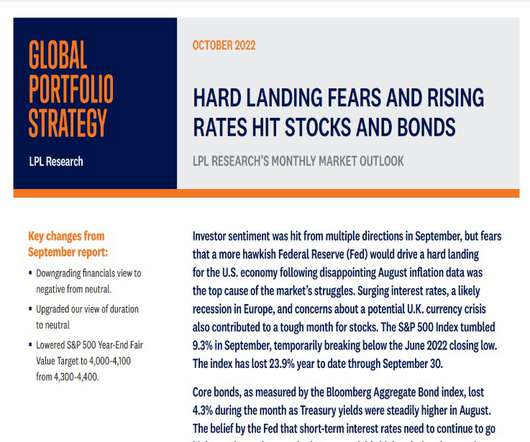

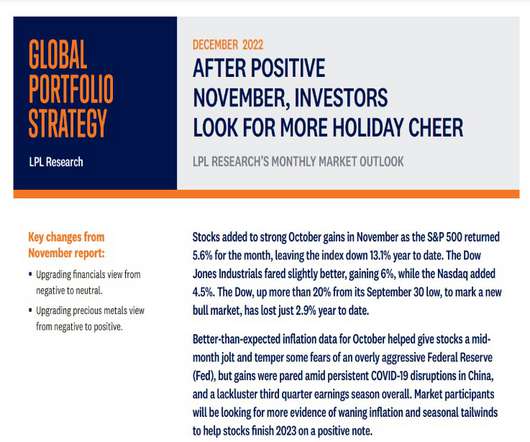

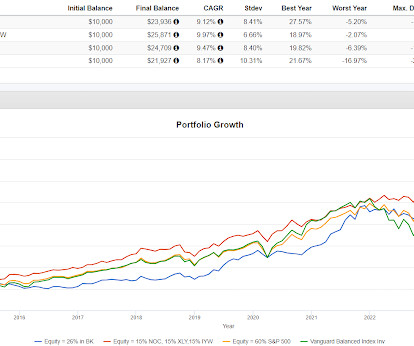

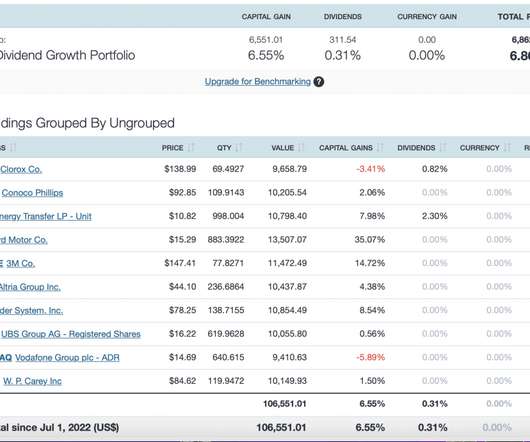

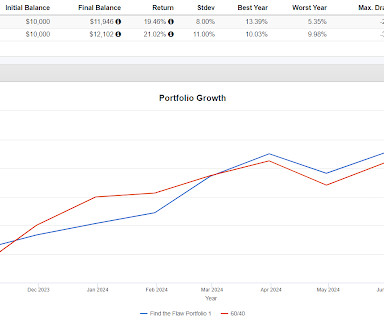

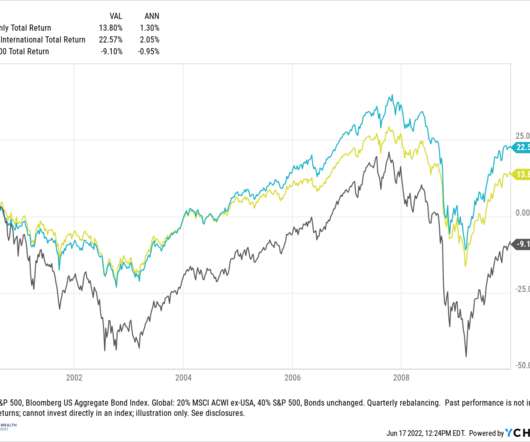

After a big gap opening, latecomers piled in; many had been sitting on the sidelines following a challenging 2022, while others got panicked out during the 10% October drawdown. The problem is those behaviors are so destructive to a portfolio. and it stops you from messing with your primary portfolio. ~~~ Good investing is boring.

Let's personalize your content