HNW Planning 2022 Review: The Patagonia Purpose Trust

Wealth Management

DECEMBER 22, 2022

The Patagonia Purpose Trust, and how high-net-worth individuals combine tax mitigation and charitable intent, was a thematic story in 2022 for advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 22, 2022

The Patagonia Purpose Trust, and how high-net-worth individuals combine tax mitigation and charitable intent, was a thematic story in 2022 for advisors.

The Big Picture

JUNE 15, 2023

The firm’s release of How America Saves is chock full of data and charts showing how 401k savings have reached all-time highs at Vanguard; I expect other large plan managers like Fidelity and Schwab to be at or near similar levels. The rally off of the June 2022 lows did not hurt either.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Calculated Risk

DECEMBER 26, 2022

At the end of each year, I post Ten Economic Questions for the following year (2022). 10) Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022? Here is a graph from Realtor.com showing active inventory through November 2022. This was correct. year-over-year.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k). The maximum for 2022 is $61,000, this has been increased to $66,000 for 2023. Eligibility.

Nerd's Eye View

OCTOBER 3, 2022

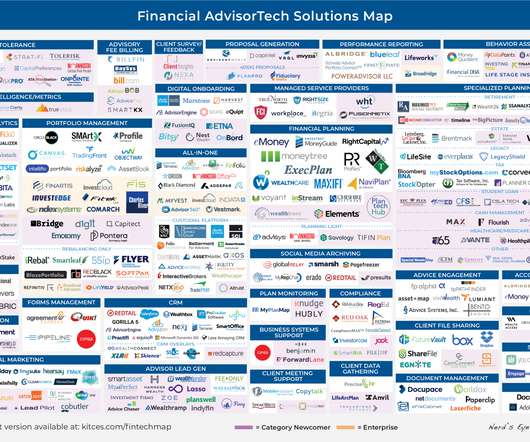

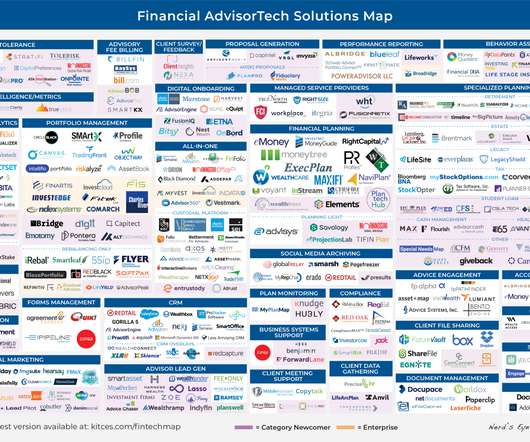

Welcome to the October 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

AUGUST 1, 2022

Welcome to the August 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

FEBRUARY 8, 2023

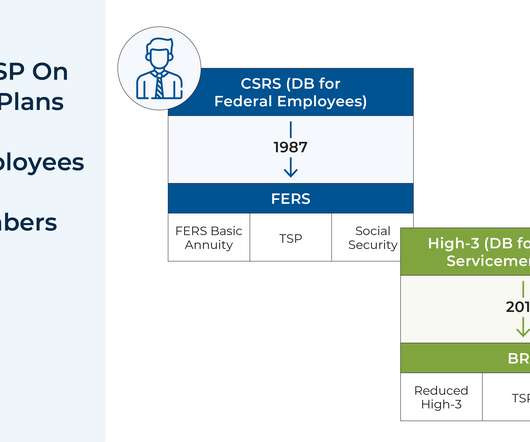

government is the largest employer in the country, it can be especially helpful for advisors to be familiar with the ins and outs of (and recent changes to) the Federal government’s own defined contribution plan: the Thrift Savings Plan (TSP). In 2022, the TSP underwent a series of changes impacting its many account holders.

Nerd's Eye View

OCTOBER 23, 2023

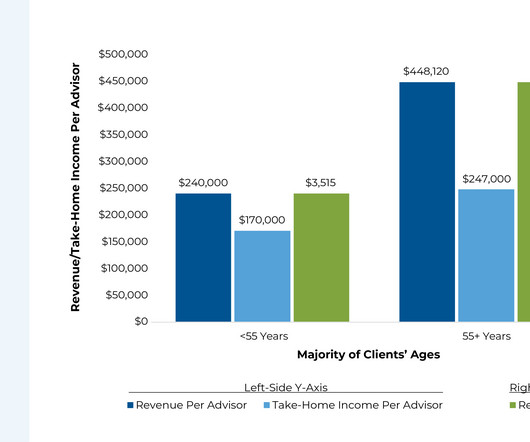

Though, at some point, covering a large number of financial planning topics can eat into an advisor's time, which is problematic if clients won't pay substantially more to receive that more comprehensive advice.

Nerd's Eye View

DECEMBER 26, 2022

As 2022 comes to a close, I am once again so thankful to all of you, the ever-growing number of readers who continue to regularly visit this Nerd’s Eye View Blog (and share the content with your friends and colleagues, which we greatly appreciate!). and inflation levels not seen in several decades. Read More.

Nerd's Eye View

SEPTEMBER 5, 2022

Welcome to the September 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

DECEMBER 28, 2022

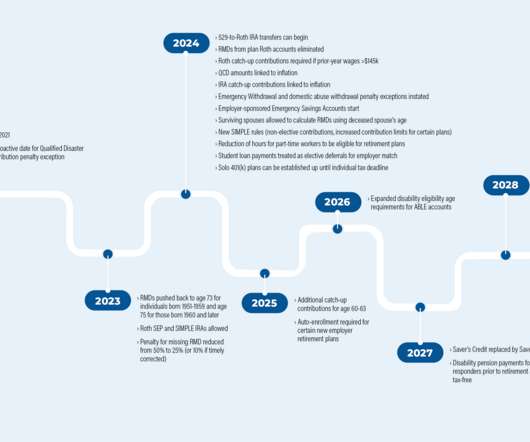

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

Nerd's Eye View

DECEMBER 5, 2022

Welcome to the December 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

Nerd's Eye View

SEPTEMBER 20, 2023

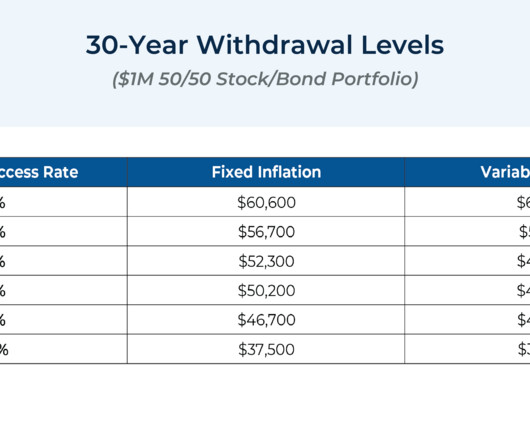

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns. Read More.

Wealth Management

DECEMBER 6, 2022

CBL plans to bring additional entertainment centers to its regional malls, reports Commercial Property Executive. A new survey found office workers care more about good WiFi connection and flexible workspaces rather than free coffee. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

DECEMBER 22, 2022

plan to expand in 2023, reports Chain Store Age. When the eviction protection program runs out, tens of thousands tenants and landlords will still be facing the same challenges, reports The Real Deal. Most restaurant chains in the U.S. These are among today’s must reads from around the commercial real estate industry.

The Chicago Financial Planner

OCTOBER 21, 2021

Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . These types of plans are becoming more common with employers and are available privately as well. How the HSA works . Click To Tweet.

Wealth Management

AUGUST 16, 2022

The Wipfli Financial Advisors acquisition comes with a retirement practice and a mass-affluent focused tech platform.

Wealth Management

JULY 9, 2024

The SEC’s latest rulemaking agenda indicates its staff is preparing to recommend reproposing the agency’s November 2022 bid to make it costlier for investors to redeem shares during times of extreme market tumult.

Wealth Management

OCTOBER 31, 2022

CBRE is laying off some of its workforce as part of a $400 million cost-reduction plan, reports Bisnow. Meta will spend $3 billion in lease terminations and other fees as part of a plan to shrink its office footprint, according to The Real Deal. These are among today’s must reads from around the commercial real estate industry.

Nerd's Eye View

NOVEMBER 7, 2022

Welcome to the November 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

NOVEMBER 23, 2022

Victoria J. Haneman, professor, Creighton University School of Law in Omaha, Neb.

Wealth Management

NOVEMBER 15, 2022

The proptech industry is not planning layoffs at this point, according to Commercial Observer. The Financial Brand looks at Chase’s new digital management platform for multifamily landlords. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

SEPTEMBER 27, 2022

Fannie Mae has a plan to help renters with low credit scores, reports USA Today. New York’s port has become the busiest in the U.S., according to the New York Post. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

AUGUST 8, 2022

The FDIC plans to increase its scrutiny of CRE loans, according to American Banker. The real estate industry breathed a sigh of relief as changes to carried interest were stripped out of the Inflation Reduction Act, reports The Real Deal. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

AUGUST 30, 2022

First Solar plans a new manufacturing plant in Southeastern U.S., The North American Securities Administrators Association might step up restrictions on small-time investors in real estate funds, reports The Wall Street Journal. according to CNBC.

Calculated Risk

MARCH 11, 2025

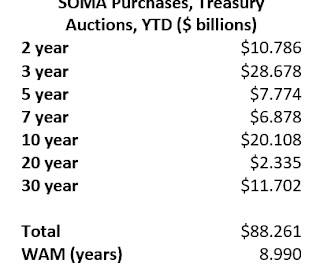

From housing economist Tom Lawler: From the beginning of 2020 to early June of 2022 the Federal Reserves balance sheet more than doubled to an almost inconceivable $8.9 Below is a comparable table for the end of 2022. trillion, with most of the decline reflecting decreases in Treasury and Agency MBS holdings.

Nerd's Eye View

AUGUST 29, 2022

For most advisory firms, 2022 has been a year of relative stability, market volatility notwithstanding.

Calculated Risk

DECEMBER 6, 2022

Today, in the Calculated Risk Real Estate Newsletter: Q3 Update: Delinquencies, Foreclosures and REO A brief excerpt: Last year, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023.

Wealth Management

JANUARY 31, 2023

Vestwell conducted the fourth-annual “Retirement Trends Report” in fall 2022 and received responses from almost 1,300 savers, 500 financial advisors and 250 small businesses.

Nerd's Eye View

MARCH 17, 2025

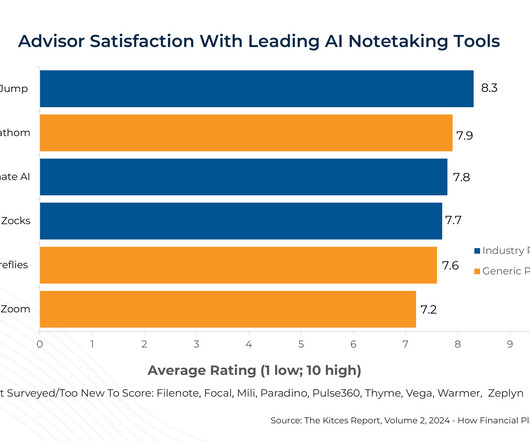

In addition, AI Notetakers are increasingly popular as advisors' financial plans get increasingly comprehensive; not surprisingly, the more detailed financial planning conversations happen in client meetings, the more there is to capture and share out. At the same time, AI Meeting Notes tools themselves continue to evolve rapidly.

Calculated Risk

JUNE 29, 2023

As mortgage rates surged in 2022, buyers saw costs soar, and a large number of shoppers reoriented their housing plans. year-over-year - this was the first YoY decrease in 59 weeks (since May 2022). The time it took to sell a home lengthened and the number of homes for sale piled up. Inventory is down 0.3%

The Big Picture

SEPTEMBER 16, 2022

Times, September 14, 2022). How financial advisors can create a more inclusive future for the industry (Financial Planning, September 13, 2022). Amid heat and motorcycles, Ritholtz and Robasciotti kick off new Future Proof ‘festival’ (Financial Planning, September 11, 2022).

Calculated Risk

DECEMBER 19, 2022

From the MBA: Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in November The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of November 30, 2022.

The Big Picture

NOVEMBER 3, 2022

I don’t care what your personal theories on monetary policy might be, your thoughts on Milton Friedman, or who you plan on voting for next week. It wasn’t until March 2022, 2 years after the pandemic panic, that the FOMC deemed it ok to start raising rates. Previously : When Your Only Tool is a Hammer (November 1, 2022).

Calculated Risk

NOVEMBER 8, 2022

Commercial planning was bolstered by a solid increase in office and hotel projects. The institutional component was varied, experiencing growth in recreational and education projects, countered by a decline in the number of healthcare and public planning projects. emphasis added Click on graph for larger image.

Calculated Risk

SEPTEMBER 11, 2023

“Overall activity remains above historical norms, but weaker market fundamentals continue to undermine planning growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. Also, planning in the sector continues to revert from the strong spike in activity back in May.

Calculated Risk

JANUARY 9, 2023

From Dodge Data Analytics: Dodge Momentum Index Wraps up 2022 with December Growth The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 6.6% (2000=100) in December to 222.2 Commercial planning in December was supported by broad-based increases across office, warehouse, retail and hotel planning.

Wealth Management

JANUARY 10, 2023

Dodge Momentum Index registered an increase in planning for commercial building in December 2022. Multifamily owners in Los Angeles would like to sell their properties, but the offers they are getting aren’t matching expectations, reports Bisnow.

Calculated Risk

JUNE 22, 2023

As mortgage rates surged in 2022, both buyers and sellers adjusted plans and expectations, and the number of for-sale homes on the market climbed sharply. This was the smallest YoY increase since May 2022. Here is a graph of the year-over-year change in inventory according to realtor.com.

Wealth Management

MARCH 6, 2024

The SEC voted Wednesday to impose climate-disclosure requirements that will be significantly softer than those it proposed in March 2022 after the agency received thousands of comment letters and numerous litigation threats over the plan.

Wealth Management

JUNE 22, 2023

Also, contrary to popular belief that investment management has become commoditized, there was more demand for those services in 2022, while interest in financial planning dropped, according to a new study by the IAA and COMPLY.

Wealth Management

AUGUST 16, 2022

Economic turmoil took a toll on savings in the first half of 2022 and that’s just the tip of the iceberg as many in the US lack employer-sponsored plans.

Wealth Management

AUGUST 16, 2022

Economic turmoil took a toll on savings in the first half of 2022 and that’s just the tip of the iceberg as many in the US lack employer-sponsored plans.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content