HNW Planning 2022 Review: The Patagonia Purpose Trust

Wealth Management

DECEMBER 22, 2022

The Patagonia Purpose Trust, and how high-net-worth individuals combine tax mitigation and charitable intent, was a thematic story in 2022 for advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 22, 2022

The Patagonia Purpose Trust, and how high-net-worth individuals combine tax mitigation and charitable intent, was a thematic story in 2022 for advisors.

Nerd's Eye View

DECEMBER 28, 2022

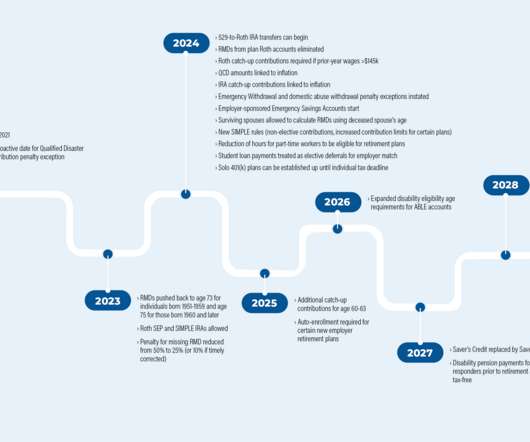

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k). Employer contributions only.

Nerd's Eye View

NOVEMBER 9, 2022

One of these changes was the ability for children to remain on their parents’ health insurance plan until they reach age 26. And as HSAs offer significant tax advantages, advisors can help clients ensure that opting for family HDHP makes sense financially for the family as a whole! Read More.

Nerd's Eye View

FEBRUARY 8, 2023

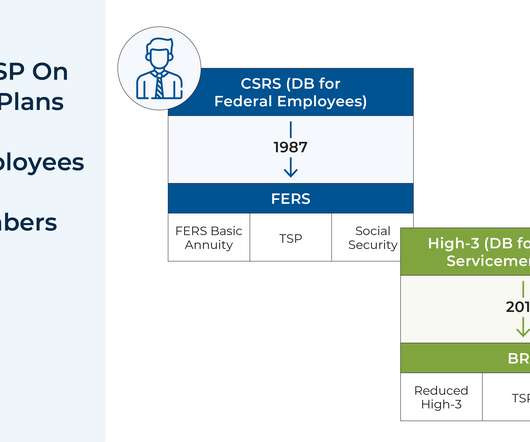

government is the largest employer in the country, it can be especially helpful for advisors to be familiar with the ins and outs of (and recent changes to) the Federal government’s own defined contribution plan: the Thrift Savings Plan (TSP). In 2022, the TSP underwent a series of changes impacting its many account holders.

Nerd's Eye View

SEPTEMBER 5, 2022

Welcome to the September 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

AUGUST 23, 2023

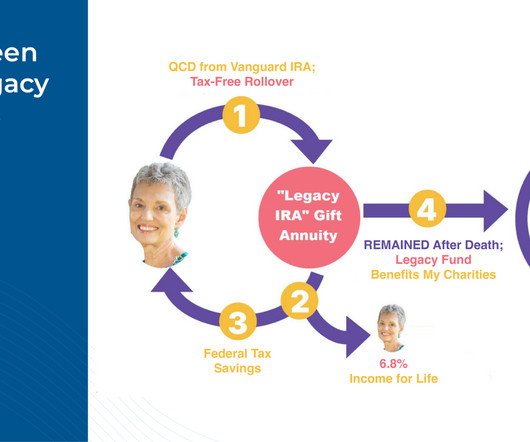

Charitable Gift Annuities (CGAs) have long been a popular way for individuals with charitable intentions to plan their legacies. However, the caveat with current CGAs has been that they could only be funded with after-tax dollars before the donor’s death, meaning that if an individual only had tax-deferred funds (e.g.,

The Chicago Financial Planner

OCTOBER 21, 2021

Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . These types of plans are becoming more common with employers and are available privately as well. How the HSA works . Vision care.

Carson Wealth

DECEMBER 5, 2024

High net worth households gave nearly $35,000, on average, in 2022. In 2022, Americans contributed $85.53 The Tax Impact of Charitable Giving The personal financial and income tax impact from charitable giving can affect the size of the gift and the timing of giving. There are more than 1.8

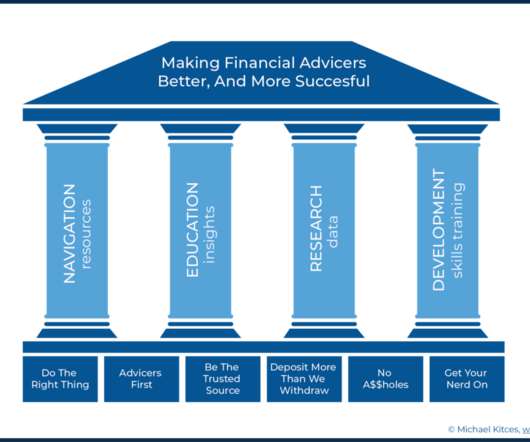

Nerd's Eye View

AUGUST 29, 2022

For most advisory firms, 2022 has been a year of relative stability, market volatility notwithstanding. Which means now it’s time once again to take at least a brief pause to get some feedback about how we’re doing.

The Big Picture

AUGUST 12, 2024

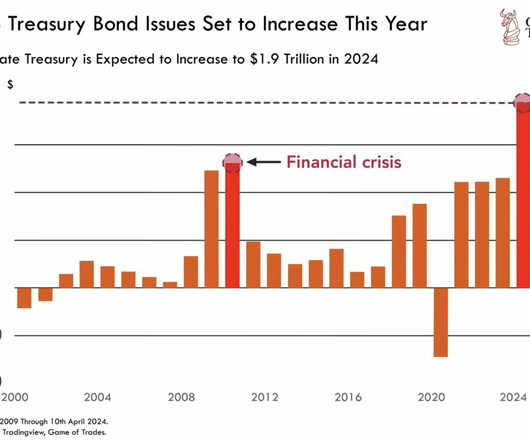

Economy in 2022 was $25,439.70B; in 2009, it was $14,478.06B; ignore that also? Do we simply ignore the growth in the size of the economy and the U.S. population? The US population today is 341,814,420; in 2009 it was 308,512,035. Do we just ignore that? Do we pretend that there has been no inflation? By the way, inflation-adjust that $1.3T

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Nerd's Eye View

JULY 25, 2022

2022 was a year that began with high hopes as households were slowly re-emerging from pandemic shutdowns, markets were reaching new highs, and most advisory firms had growing momentum. This year’s Summit will be held on Thursday, December 8 th – Save the date!

Nerd's Eye View

JUNE 26, 2024

Traditionally, the challenge in using a 529 plan to save for higher education expenses has been figuring out how much to save to cover the beneficiary's college costs without overshooting and saving more in the 529 plan than is actually needed. The Secure 2.0 The Secure 2.0

Nerd's Eye View

JANUARY 20, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that several states are considering a series of tax hikes targeting higher-income and ultra-high-net-worth residents after similar proposals failed to pass at the Federal level. Read More.

Abnormal Returns

FEBRUARY 13, 2023

citywire.com) Taxes Five tax mistakes to avoid when it comes to stock options, RSUs, etc. wsj.com) Direct indexing Vanguard is planning a bigger push into direct indexing. riabiz.com) The number of CFPs grew some 5% in 2022. (fa-mag.com) fa-mag.com) How to advise clients in the government Thrift Savings Plan.

Abnormal Returns

DECEMBER 14, 2022

Podcasts Christine Benz and Jeff Ptak talks with Jamie Hopkins of Carson Wealth about some common retirement planning questions. ft.com) Who really benefits from 529 plans? nytimes.com) Planning Doug Boneparth, "Cash flow lives at the heart of financial organization." morningstar.com) 20 thing to do before year-end.

Your Richest Life

FEBRUARY 27, 2023

Whether you’re preparing to file , waiting on a refund , or have already paid your tax bill, you might notice some differences this year. First of all, many taxpayers are noticing smaller refunds or higher tax bills this year than in the previous two years. In 2022, if your AGI was over $43,000, you could take 20% of the credit.

The Big Picture

JULY 27, 2022

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising ( 2016 , 2017 , 2018 , 2018 , 2019 ). The 2010s monetary rescue plan benefitted anybody who owned capital assets: Stocks, Bonds, and Real Estate. I wrote a book about this).

Abnormal Returns

NOVEMBER 23, 2022

ft.com) The 2022 fundraising scene is completely different than the prior 11 years. awealthofcommonsense.com) What falling tax withholding numbers say about the state of the economy. thinkadvisor.com) Books Tyler Cowen's favorite non-fiction books of 2022 including "Of Boys and Men" by Richard R. artofmanliness.com).

Zoe Financial

APRIL 7, 2025

Tariffs impact: Proposed increases could raise the effective tax rate on U.S. I ntra-year drop: Markets are down ~1819% this year high, but still within historical norms: 2022: 25% 2020 (COVID): 34% 2008 (financial crisis): 49% Volatility spike: VIX rose above 45 one of the highest on record. imports from 2.3%

MainStreet Financial Planning

MARCH 7, 2023

It is March…that means you have just about 5 weeks left to get organized and submit your tax return. The tax deadline is April 18, 2023 (some taxpayers in disaster areas in California, Georgia and Alabama have an extended deadline). Gathering all your documents is crucial to complete a tax return free of mistakes.

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. As proposed, the new legislation would increase these tax rates to 9% and perhaps even 16% , respectively, starting in 2023.

Integrity Financial Planning

JUNE 12, 2023

As you plan for retirement, it’s important to consider tax optimization strategies to minimize your tax liabilities. Here are three key ways to optimize taxes in retirement, based on information from sources published between 2022 and 2023.

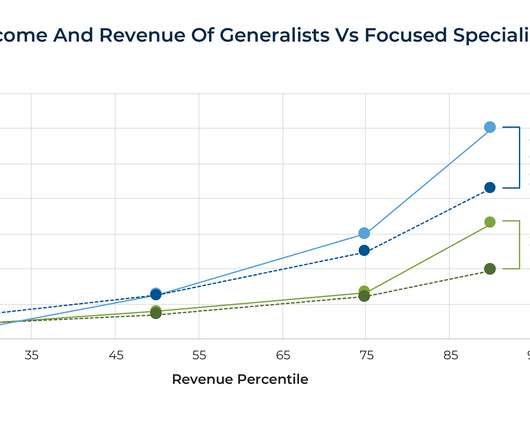

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. What’s notable, however, is that the most ‘productive’ (i.e.,

Good Financial Cents

JANUARY 19, 2023

A major decision in retirement planning is whether to make pre-tax or Roth (after-tax) 401k contributions. Pre-tax contributions go into your retirement account with money that has not been taxed, and then taxes will be paid when the funds are withdrawn in retirement.

Calculated Risk

MAY 15, 2023

According to MBA’s estimate, 255,000 homeowners are in forbearance plans. About three out of four borrowers are remaining current on their post-forbearance workouts, but this is down from the average of four out of five borrowers that was relatively consistent in 2022 and into 2023.” million borrowers since April 2020.

Carson Wealth

FEBRUARY 16, 2024

By Mike Valenti, CPA, CFP ® , Director of Tax Planning It’s that time of year again! W-2s, 1099s and mortgage statements have been to hit your mailbox: a daily reminder that it is, once again, Tax Season. Overall, it was a relatively quiet year on the tax front. Although Congress isn’t done yet! More on that later.)

Nerd's Eye View

APRIL 19, 2024

Also in industry news this week: The Office of Management and Budget (OMB) has completed its review of the Department of Labor's new "fiduciary rule ", indicating that it could be released in the coming days or weeks (though, like its predecessors, its ultimate disposition is likely to be determined in the courts) The IRS announced this week that it (..)

Nerd's Eye View

JULY 24, 2024

When the original SECURE Act was passed in December 2019, it brought sweeping changes to the post-death tax treatment of qualified retirement accounts. Act passed in late 2022. Along with the new Finalized Regulations, the IRS also released a new set of Proposed Regulations dealing with some unanswered questions around the SECURE 2.0

Good Financial Cents

SEPTEMBER 29, 2022

In this guide, we’re going to present the 10 best long-term investment strategies for 2022. The table below provides a quick summary of each of the 10 best long-term investment strategies for 2022, along with the main features and benefits of each. Below is our list of the 10 best long-term investment strategies for 2022.

Carson Wealth

JULY 19, 2022

At their most basic level, executive compensation plans are designed to attract, retain and motivate top talent and leadership. But truly successful plans are designed to be much more than providing a high salary to a key employee – they support the business’s philosophies, values, and mission. . Direct Compensation & Benefits.

Good Financial Cents

APRIL 1, 2023

Financial bloggers often portray the traditional IRA vs. the 401(k) plan as a debate, as if one plan is better than the other. In truth, they’re very different plans, and they fill very different needs. If you can, you should plan to have both. This is especially true if your 401(k) plan is fairly restrictive.

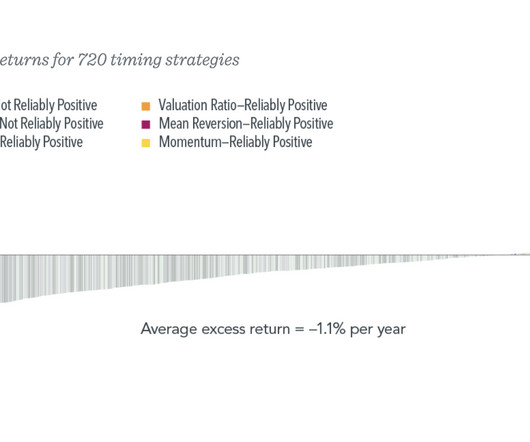

The Big Picture

NOVEMBER 27, 2023

This is before we get to the issue of capital gains taxes, which create a hurdle of (minimum) 20% on those pesky profits just to get to breakeven. When you get it wrong, it crushes your retirement plans. Let’s add some color to the discussion on timing itself and add a little nuance.1

Carson Wealth

JANUARY 5, 2023

Qualified retirement plans – such as 401(k)s, 403(b)s and IRAs – offer clear tax advantages. Traditional 401(k)s, 403(b)s, and IRAs offer a tax deferral on contributions and growth until distribution. To prevent individuals from taking advantage of the tax-deferred growth in perpetuity, there are certain rules in place.

Nerd's Eye View

AUGUST 12, 2022

From there, we have several articles on Mergers & Acquisition (M&A) trends: M&A activity so far in 2022 is set to exceed 2021’s record pace despite economic headwinds, meaning there could simply be a ‘new normal’ of higher activity regardless of the economic environment.

Abnormal Returns

NOVEMBER 21, 2022

Podcasts Jeff Ptak and Christine Benz talk with Feraud Calixte who is the founder and lead financial planner of Vantage Pointe Planning. riabiz.com) CI Financial ($CIXX) is planning to spin-off its U.S. morningstar.com) Delaying taxes in retirement isn't always the best strategy. unit debt-free in 2023. thinkadvisor.com).

eMoney Advisor

JANUARY 12, 2023

We’ve gathered seven unique volunteer opportunities for financial professionals, including pro bono financial planning. A 2021 study measured the impact pro bono financial planning can have on cancer patients. Their study found that those who received pro bono financial planning support had a 53 percent higher survival rate.

Carson Wealth

NOVEMBER 29, 2023

The downside is that premiums might not be tax-deductible. How to Plan for Long-Term Care Coverage You should start with your financial advisor. Together, you can map out a plan for what kind of care you want to receive and how you’ll pay for that care when you need it. 2 Genworth, “Cost of Care Survey,” 6/2/2022.

Trade Brains

SEPTEMBER 29, 2023

In this fundamental Analysis of Exide Industries, we read about its history, operating segments, industry, financials and future plans. According to the Society of Indian Automobile Manufacturers (SIAM), passenger vehicles registered the highest-ever domestic sales in 2022- 23, surpassing the previous peak of 2018-19. 2022 12789.22

The Better Letter

APRIL 6, 2023

Realistic Retirement Planning My children have consistently (and kindly) remarked about how grateful they are to have been able to graduate (with honors) from fine universities without any debt. Our retirement planning took a hit to do so. Much retirement planning advice focuses on saving more and saving earlier.

Trade Brains

JANUARY 22, 2024

as of 2022. The industry is expected to grow at a CAGR of approximately 16% from 2022 to 2026. Particulars / Fiscal Year 2021 2022 2023 2 Year CAGR KPIT Technologies - Revenue ₹2,051.50 ₹2,477.19 ₹3,405.23 36% YoY Growth (%) 48% 25% KPIT reported a Profit after tax of Rs. 150 Lakh Cr.) Out of the total ER&D market Rs.

Trade Brains

DECEMBER 4, 2023

The article concludes with a highlight of future plans and a summary. The table below shows the total income and net profit of Gujarat Pipavav Port for 5 financial years: Year Total income (₹ In crores) Profit after tax (₹ In crores) 2023 967.95 Following that, we’ll go into the stock’s financials. million MT.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content