iCapital Reaches $200B in Global Assets

Wealth Management

OCTOBER 8, 2024

Alternative investment platform iCapital doubled the volume of assets on its platform since December 2023.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 8, 2024

Alternative investment platform iCapital doubled the volume of assets on its platform since December 2023.

Wealth Management

JANUARY 5, 2023

While cryptocurrencies have experienced recent collapses, the underlying blockchain technology still has immense potential to propel the modern innovation of finance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

JANUARY 26, 2024

It was a slow week for deals in the RIA space but MAI didn’t miss a beat and Wealth Enhancement Group reinforced its position as 2023’s most active buyer.

Wealth Management

FEBRUARY 14, 2024

Public equities dipped to 29% of the average total assets in family offices surveyed, down from 31% in 2020, according to KKR's Family Capital report.

Wealth Management

OCTOBER 23, 2024

Digital assets and social media fraud were frequently cited in the states’ investigations and enforcement actions in 2023, according to a new NASAA report.

Wealth Management

JANUARY 10, 2024

billion in assets and launched an acquisition-focused OSJ model. Ending last year on a high note, the self-styled ‘home for hybrids’ reached $9.5

The Big Picture

JULY 25, 2023

I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets? That underperformance between asset class returns and investor returns is the behavior gap. The post Underperforming Your Own Assets appeared first on The Big Picture.

Wealth Management

NOVEMBER 13, 2023

The 7th breakaway advisor to join Snowden Lane this year, William “Trey” Jones III managed $230 million as a VP at Merrill Lynch.

Abnormal Returns

DECEMBER 13, 2023

bloomberg.com) Some ETF statistics for 2023. (platformer.news) Tesla ($TSLA) is recalling more than 2 million vehicles to fix Autopilot systems. nbcnews.com) ETFs If current trends continue Vanguard will overtake Blackrock ($BLK) in ETF AUM. etf.com) Economy Real wages are now above pre-pandemic levels.

Wealth Management

APRIL 5, 2023

Revenue Ruling 2023-2 confirms that taxpayers can’t have their cake and eat it too.

Abnormal Returns

NOVEMBER 5, 2023

currentaffairs.org) Economy The Sahm rule did not trigger in October 2023. (nextbigideaclub.com) 24 charts showing the world is getting better. fullstackeconomics.com) Corporations have always been against social change. stayathomemacro.substack.com) How the current post-Covid economy resembles the post-WWII economy.

Abnormal Returns

OCTOBER 31, 2023

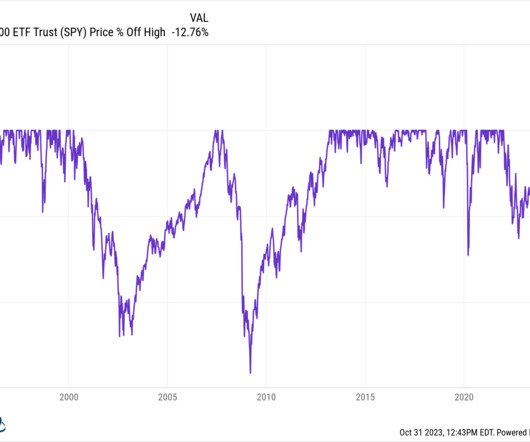

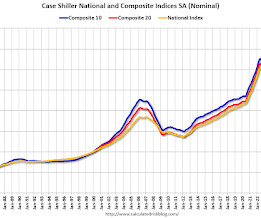

rise in house prices through August 2023. (om.co) Apple TV+ just doesn't have a big enough library. variety.com) Why Apple ($AAPL) should make its batteries removable. hypercritical.co) Economy Case-Shiller showed a 2.6% calculatedriskblog.com) New home prices are still under pressure.

Calculated Risk

FEBRUARY 25, 2025

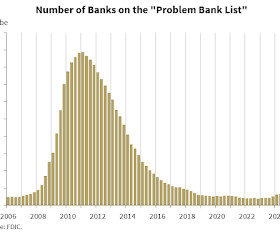

percent) from 2023. The aggregate return-on-assets ratio (ROA) increased 3 basis points to 1.12 The increase primarily occurred due to one-time events in 2023 and 2024 that led to lower noninterest expense (down $8.5 percent, down 8 basis points from 2023. billion, up $14.1 billion (5.6 billion, or 1.4 billion, or 2.0

Wealth Management

JULY 10, 2023

Advisors Asset Management's CIO Cliff Corso provides his investment outlook for the remainder of 2023.

Wealth Management

JANUARY 13, 2023

In the second week of 2023, RIA M&A announcements abound with deals from Cerity Partners, Captrust and Mercer, among others.

Wealth Management

DECEMBER 14, 2023

Silicon Valley Wealth Advisors and Hall Private Wealth Advisors represent Allworth's sixth and seventh deals of 2023 and mark its entry into Southern California.

Wealth Management

DECEMBER 18, 2023

The limited liquidity vehicle is becoming increasingly popular as a tool for individual investors looking for some exposure to private assets.

The Big Picture

AUGUST 11, 2023

You will network with the best practitioners in the RIA/Asset management space while learning about how the latest cutting-edge fintech can help you manage your practice. We took over all 5 hotels for the 3000 attendees, including 1,000 registered advisors and over 500 sponsors. Sure, you can earn CE credits, but this is a lot more than that.

Calculated Risk

MARCH 4, 2025

The reason, of course, is that the Federal Reserve funded the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. release, and is available in the FRED database.

Wealth Management

JANUARY 5, 2023

Many lenders have stopped financing office assets, and those that do are offering less favorable terms and scrutinize deals closely.

The Big Picture

MARCH 4, 2023

This week, we speak with Dr. Maria Vassalou , co-chief investment officer of multi-asset solutions at Goldman Sachs Asset Management. In 2023, some of the worst-quality stocks have done very well — namely Goldman’s non-profitable tech basket as well as their “soft-landing” basket.

Wealth Management

OCTOBER 20, 2022

At its annual Fearless Investing Summit in Salt Lake City, CEO Aaron Klein also announced that the company would not become a turnkey asset management platform.

Wealth Management

JANUARY 17, 2023

The rising cost of interest rate caps could precipitate some real estate investors who can no longer afford the hedges to sell their assets, reports The Wall Street Journal. Multi-Housing News has a special report on the state of affordable housing policy. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

JUNE 22, 2023

The amount of distressed commercial real estate assets rose 10% in the first quarter and now amounts to $64 billion, according to MSCI Real Assets. Some owners are coughing up cash to buy time on their mortgages, reports The Real Deal.

The Big Picture

MARCH 22, 2023

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data , puts recent events into perspective: At $209 billion in assets, the Silicon Valley Bank failure since Washington Mutual crashed in 2008 (JPM Chase took them over from the FDIC). The post U.S.

Calculated Risk

SEPTEMBER 7, 2023

The FDIC released the Quarterly Banking Profile for Q2 2023: Reports from 4,645 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $70.8 billion in second quarter 2023. Total assets of problem banks decreased from $58.0 billion (11.3 billion (11.3

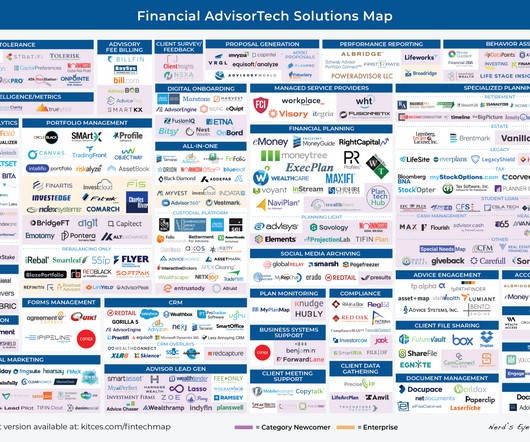

Nerd's Eye View

MARCH 6, 2023

Welcome to the March 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

MAY 23, 2023

The Wall Street Journal explained why even perfectly creditworthy property owners may opt to let some of their assets default. Private equity funds have stepped up their loan offerings, including for mortgage and construction loans, reported Reuters. These are among today’s must reads from around the real estate universe.

Abnormal Returns

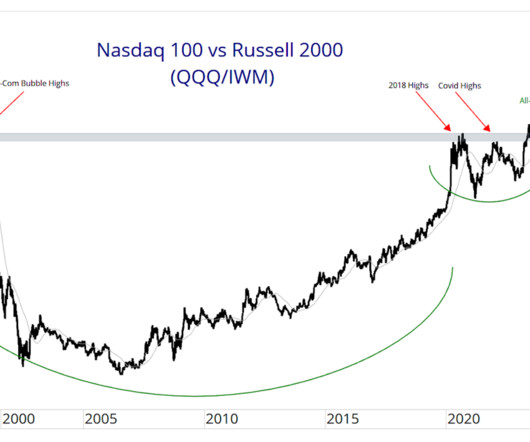

JANUARY 7, 2024

Top clicks this week Some of the best charts of 2023. allstarcharts.com) How major asset classes performed in December 2023. wsj.com) Asset class returns were pretty green in 2023 except for commodities. entrylevel.topdowncharts.com) 10 predictions for 2024 including 'The economy overheats.'

Wealth Management

JULY 31, 2023

The bid-ask gap in the commercial real estate market has created a massive falloff in transaction volume in 2023.

Wealth Management

MAY 26, 2023

billion joint venture focused on retail assets. Office REITs are trading at their lowest levels since 2009, reports Bloomberg. Crow Holdings formed a $2.6 These are some must reads from around the real estate investment world heading into the weekend.

Wealth Management

OCTOBER 5, 2023

Nightingale struck a deal to sell assets in order to pay back CrowdStreet Investors, reported Bisnow. Forbes listed 25 real estate tycoons among its latest list of billionaires. These are among the must reads from the real estate investment world to end the week.

Wealth Management

JULY 6, 2023

industrial assets, reported Bisnow. Boston Business Journal looked at which metros might have the most exposure to upcoming real estate debt maturities. EQT Exeter closed a $4.9 billion fund earmarked for U.S. These are among today’s must reads from around the commercial real estate industry.

The Big Picture

APRIL 3, 2023

The asset value peak was $33.6 Given the rough year markets had in 2022, including all of the held asset classes, it is an impressive, albeit curious showing. The group also names 2022’s Best of, including Fund, Asset Class, Region, and Industry of the Year (all found here ). Its an amazing collection of charts and data.

Wealth Management

DECEMBER 12, 2022

According to recent CAIS survey, private wealth allocation to new asset classes set to take off over next two years.

Calculated Risk

OCTOBER 29, 2024

Home price growth is beginning to show signs of strain , recording the slowest annual gain since mortgage rates peaked in 2023,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “As With stronger gains in the Northeast and West than the South, blue states have outperformed red states dating back to July 2023.”

Wealth Management

OCTOBER 10, 2023

Real estate managers’ assets under management fell by 2.9% during the year ended June 30, reported Pensions & Investments. S&P might downgrade Brookfield Real Estate to junk status because of its high maturing debt loan, according to Bisnow. These are among today’s must reads from around the commercial real estate industry.

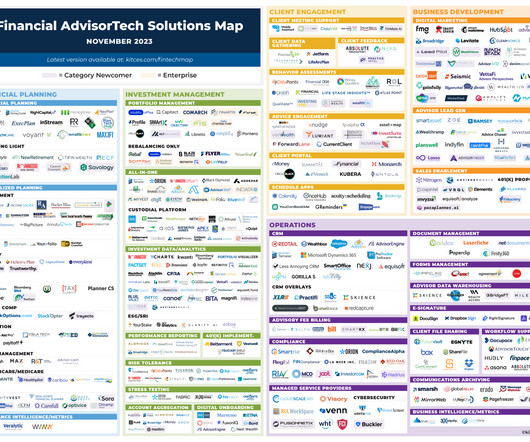

Nerd's Eye View

MAY 1, 2023

Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

OCTOBER 20, 2022

At its annual Fearless Investing Summit in Salt Lake City, CEO Aaron Klein also announced that the company would not become a turnkey asset management platform.

Nerd's Eye View

NOVEMBER 6, 2023

Welcome to the November 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

DECEMBER 4, 2023

Welcome to the December 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

JUNE 12, 2023

Lenders on office assets are doing everything they can to avoid taking the keys on properties and working on extension and modification agreements, reports Bisnow. Don Peebles sat down with Commercial Observer to discuss how far Black real estate development has come.

Wealth Management

MAY 8, 2023

Bain Capital is raising a $4 billion special situations fund that aims to invest in a range of assets, including real estate. The largest commercial real estate brokerage firms reported quarterly losses and forecast more struggles ahead, reports Bisnow.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content