The Inside ETFs Podcast: Nancy Davis on Portfolio Management For 2023

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

The Big Picture

NOVEMBER 15, 2023

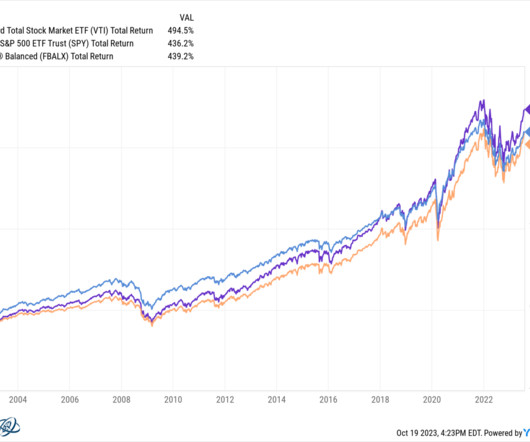

The problem is those behaviors are so destructive to a portfolio. 1 We ignore the reality of human behavior, including the need for some thrills and excitement, at the peril of our portfolios. Meaning, the core of your portfolio should be 70 to 80% of that simple ETF portfolio described above. We all are! – Don’t drink!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Big Picture

APRIL 19, 2023

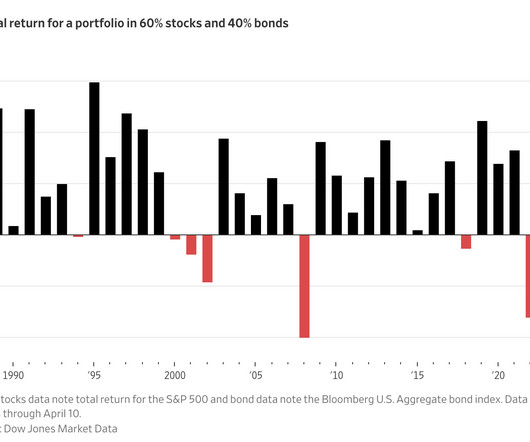

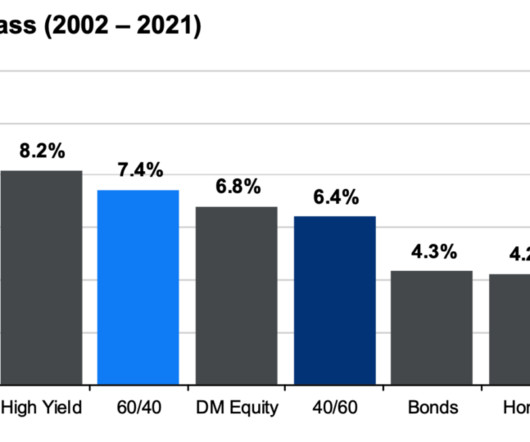

Check out these recent headlines about the classic 60/40 investment strategy 1 : The 60-40 Investment Strategy Is Back After Tanking Last Year BlackRock Ditches 60/40 Portfolio in New Regime of High Inflation Why a 60/40 Portfolio Is No Longer Good Enough The 60-40 portfolio is back Sorry, but all of these headlines utterly miss the point.

Wealth Management

DECEMBER 23, 2022

Zephyr Market Strategist Ryan Nauman highlights eight topics that he will be watching in 2023 that will drive markets and considerations to prepare investment portfolios for the new year.

The Big Picture

OCTOBER 20, 2023

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes. It does that splendidly.”

Wealth Management

JANUARY 16, 2024

After 2022, many declared the 60/40 portfolio dead, but the traditional portfolio mix rebounded in 2023, writes Morningstar. BlackRock’s move into the private infrastructure investment space is part of a broader strategy for the asset manager to diversify from its strength in ETFs, according to FundFire.

The Big Picture

JANUARY 3, 2023

Welcome to 2023! Let’s jump into the new year with some fresh observations, some of which are quite surprising: • Astronomical Measures of Time Are Unrelated to Investing : 2023 – a new year! Might 2023 be a fourth major March bottom? Have a great 2023 – embrace risk, but avoid unforced errors.

The Big Picture

FEBRUARY 25, 2025

The transcript from this weeks, MiB: Charley Ellis on Rethinking Investing , is below. Charlie Ellis is just a legend in the world of investing. He was chairman of the Yale’s Endowment Investment Committee and his, not only did he write 21 books, his new book, rethinking Investing, is just a delightful snack.

The Big Picture

JANUARY 25, 2023

But they also asked questions about how these managers invested their own monies. Robin buries the lede in his discussion, but allow me to correct that oversight: “ Active managers invest their own capital passively.” ” It’s is worth your time to delve into the entire discussion.

Wealth Management

MARCH 12, 2023

Watch as Shivani Vohra, Portfolio Manager and Senior Research Analyst, Parnassus Investments, discusses the outlook for growth stocks in 2023 and whether now is a good time to buy.

Wealth Management

JULY 10, 2023

Advisors Asset Management's CIO Cliff Corso provides his investment outlook for the remainder of 2023.

Abnormal Returns

DECEMBER 1, 2023

washingtonpost.com) Lists The best podcasts of 2023 including “The Big Dig.” newyorker.com) The top podcasts of 2023 via Apple Podcasts, including the Huberman Lab. apple.com) The top podcasts of 2023 via Spotify, including the Joe Rogan Experience. (sixcolors.com) Substack is adding video creation tools.

The Big Picture

FEBRUARY 7, 2024

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. Should value investing be part of that strategy? TRANSCRIPT: Jeremy Schwartz Value Investing Barry Ritholtz : How much you pay for your stocks has a giant impact on how well they perform. What Is value investing?

Wealth Management

AUGUST 31, 2023

non-life insurers are positioned to withstand any difficulties in their mortgage portfolios, according to Fitch Ratings. These are among the must reads from around the real estate investment world to end the week. Some companies that reduced their office space are now going back and signing new leases, reports Bisnow.

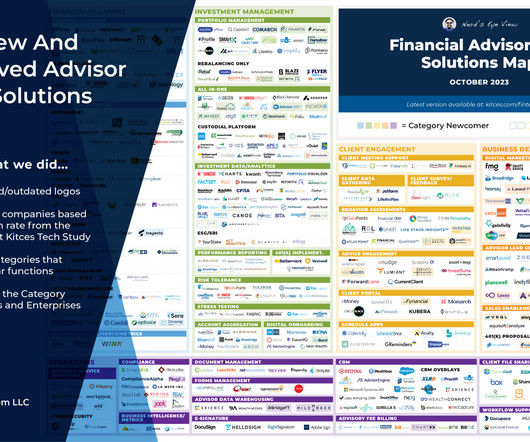

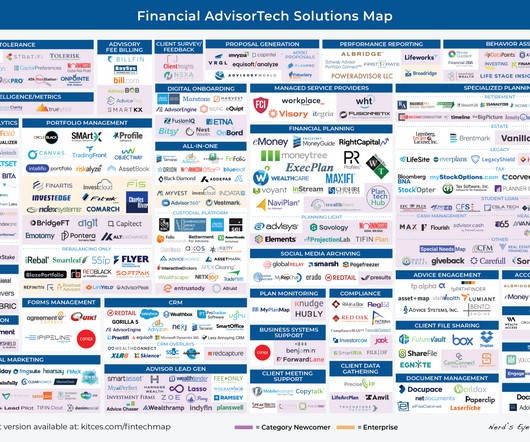

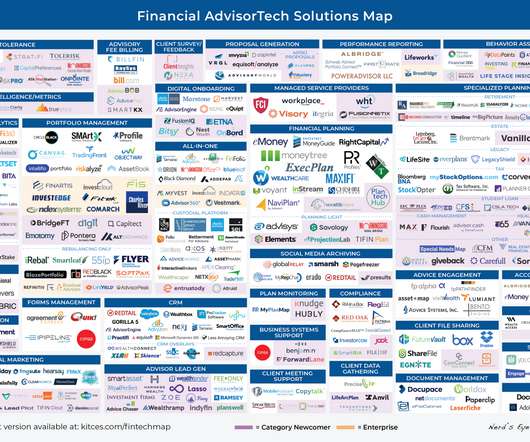

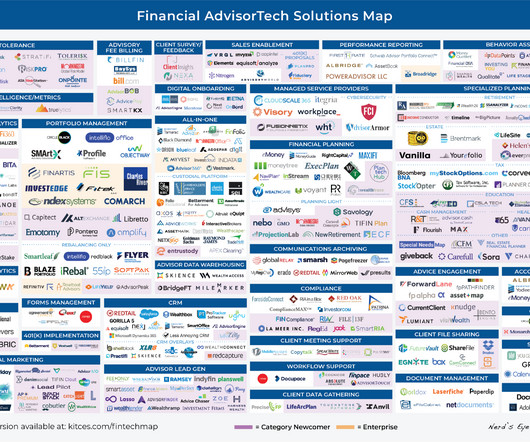

Nerd's Eye View

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

SEPTEMBER 20, 2023

Global credit manager Marathon said it is among the bidders for Signature Bank’s $33 billion commercial real estate loan portfolio, reports Bloomberg. These are among the must reads from the real estate investment world.

Nerd's Eye View

MAY 1, 2023

Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

FEBRUARY 6, 2023

Welcome to the February 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

JULY 3, 2023

Welcome to the July 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

JANUARY 1, 2023

abnormalreturns.com) Top clicks this week Here is Eddy's 2023 Buy List. rock-wealth.co.uk) 35 ideas from 2022 including 'Long term investing is hard.' humbledollar.com) Three ways to simplify your portfolio in 2023. Also on the site Why you should choose simplicity over complexity: the case against FSAs.

The Big Picture

MAY 11, 2023

SAVE THE DATE: Future Proof 2023, September 10-13 We hosted the first Future Proof conference last year, and it was quite delightful (see all of the reviews here ). I think for RIAs, it is the most important conference event of the year, as do others ( Best Conference Experience for 2023 ). Its only 4 months away! the curve.

Nerd's Eye View

DECEMBER 25, 2023

And as 2023 draws to a close, we wanted to highlight 25 of the most popular and insightful articles that were featured throughout the year (that you might have missed!).

The Big Picture

NOVEMBER 2, 2023

Before yesterday’s FOMC meeting, I reiterated my view from July 2023 that this hiking cycle was – or at least should be – over. But this after-the-fact story does not resonate as truth with me, as it looks more like the 10% market correction of October 2023 has ended. Depending on the specifics a 4.5-5% we are happy to help ).

Abnormal Returns

SEPTEMBER 24, 2023

Top clicks this week How Morgan Housel invests his portfolio. tonyisola.com) Leveraged loans have put corporate bonds to shame in 2023. etf.com) The hardest thing about being an investor is deciding what to focus on. behaviouralinvestment.com) Why selling a stock is harder than buying.

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.” Sonali Basak interviews AQR Capital Management’s Cliff Asness.

The Big Picture

OCTOBER 19, 2023

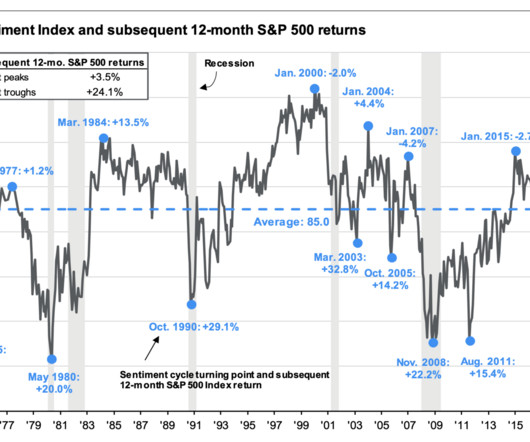

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for our clients. I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. 1980-82 Double Dip Recession 2.

The Big Picture

NOVEMBER 17, 2023

I think you will enjoy our conversation… Source : Episode 145: Politics and Your Portfolio DAVID L. BAHNSEN National Review, November 16, 2023 click for audio [link] The post Politics and Your Portfolio appeared first on The Big Picture.

Abnormal Returns

DECEMBER 29, 2023

Science Derek Thompson with Dr. Eric Topol about some big scientific breakthroughs in 2023. jordanharbinger.com) AI What happened in AI in 2023? ritholtz.com) Corey Hoffstein talks with Nick Baltas, Managing Director at Goldman Sachs about building multi-strategy portfolios.

Dear Mr. Market

APRIL 2, 2025

Market: This is perhaps one of our favorite articles and times of the year; not necessarily because of basketball but rather it allows us the opprtunity to articulate our main investment themes we see playing out for the remainder of the year. Who will be this years champion? Lets break it down ( click here to see the full bracket).

The Irrelevant Investor

JANUARY 2, 2023

Needless to say, but I have to say it anyway, nothing in this list is investment advice. I’m not doing anything with my portfolio based on t. The post 10 Predictions For 2023 appeared first on The Irrelevant Investor. That’s all I’m trying to do with this post. Entertain and educate.

The Big Picture

NOVEMBER 27, 2023

Let’s delve into these to see if they apply to your own investing and trading: Instinct : Malcolm Gladwell’s Blink: The Power of Thinking Without Thinking , discusses the strengths and capabilities of the “ adaptive unconscious.” And, it has the advantage of leaving your actual investments alone.

Nerd's Eye View

APRIL 10, 2024

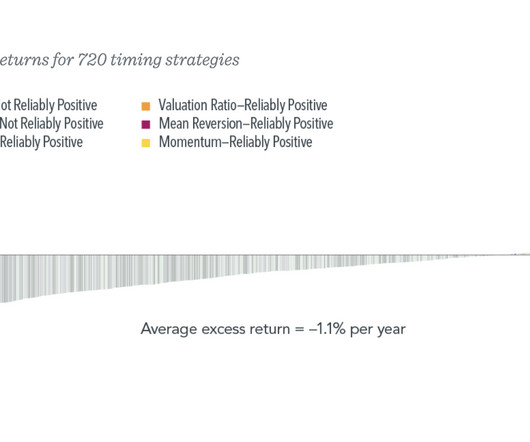

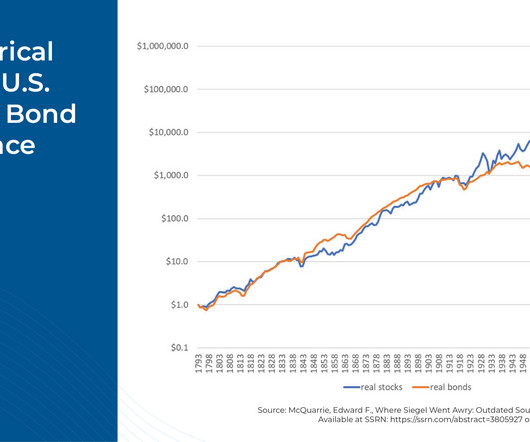

Every document that considers the facts around any particular asset class will invariably include that disclaimer, but constructing a portfolio consisting of a mix of equities, fixed income, and other assets requires investors and advicers to make some fundamental assumptions around long-term expected returns and correlations between assets.

The Big Picture

JANUARY 12, 2024

As co-CEO, Marcus develops and leads the company’s global strategy; as global COO, she is responsible for overseeing business and investment operations globally. Finance in 2023 She discusses how from an early age, she was primarily interested in all aspects of real estate, from architecture to investments.

The Big Picture

JANUARY 26, 2023

-Avoid costly errors -Remove classic pitfalls -Create a robust, bullet-proof portfolio It’s going to be the most valuable 45 minutes you will spend this year thinking about your investments.

Nerd's Eye View

MAY 17, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study indicates that while overall social media engagement for financial services companies was down in 2023 compared to the previous year, firms boosted their engagement through posts that were entirely original content (..)

Abnormal Returns

JANUARY 4, 2023

Retirement Why you need a diversified life portfolio in retirement. msn.com) New year Ten words for 2023 including 'Simplify.' kindnessfp.com) Personal finance Early in your life savings far outweighs investing. evidenceinvestor.com) Why you should think about 'investing' your time instead of 'spending' it.

Abnormal Returns

FEBRUARY 12, 2024

Podcasts Brendan Frazier talks with Sten Morgan, the founder of Legacy Investment Planning, about better communicating with clients. kitces.com) Daniel Crosby reads another chapter from his forthcoming book "The Soul of Money." (kindnessfp.com) DPL Financial Partners saw a big boost in annuity sales in 2023. thinkadvisor.com)

Abnormal Returns

MAY 1, 2023

Markets How major asset classes performed in April 2023. capitalspectator.com) The Nasdaq 100 has outpaced the Russell 2000 by over 20% in 2023. nytimes.com) ETFs Model portfolio shifts can have a big effect on ETF flows. abnormalreturns.com) A list of the best investing blogs of 2023.

Carson Wealth

JANUARY 22, 2025

But what does this mean for your portfolio, and how can you continue to protect and grow your assets during these times? Volatility in the market is the extent to which the price of stocks or other investments fluctuate in the short term. What Is Market Volatility? At the onset of the COVID pandemic, the VIX hit 83 points.

Nerd's Eye View

JANUARY 13, 2023

Also in industry news this week: A study suggests that simplification is the top reason consumers combine their investment accounts, signaling that the onboarding process for new advisory client assets is a value-add in itself. The long-term portfolio growth trajectory clients can expect when implementing a dollar-cost averaging strategy.

Abnormal Returns

JUNE 14, 2023

Strategy When it comes to investing, more activity doesn't guarantee better results. awealthofcommonsense.com) Focus on the role bonds play in your portfolio. sellwoodconsulting.com) Future Proof 2023 The 2023 Future Proof agenda is live and you can sign up now for a $200 discount. In fact, just the opposite is true.

Abnormal Returns

DECEMBER 20, 2023

financialsamurai.com) Investing Five ways you lost money in 2023 including overtrading. downtownjoshbrown.com) A lot of stuff matters beside your portfolio. obliviousinvestor.com) Splitting your portfolio in two. (morningstar.com) Why it's so hard to stay retired when you retire early.

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

The Big Picture

AUGUST 30, 2023

1 The Executive Summary gives you the flavor of the timing issue: “The persistent gap between the returns investors actually experience and reported total returns makes cash flow timing one of the most significant factors—along with investment costs and tax efficiency—that can influence an investor’s end results.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content