The Inside ETFs Podcast: Nancy Davis on Portfolio Management For 2023

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

The Big Picture

APRIL 19, 2023

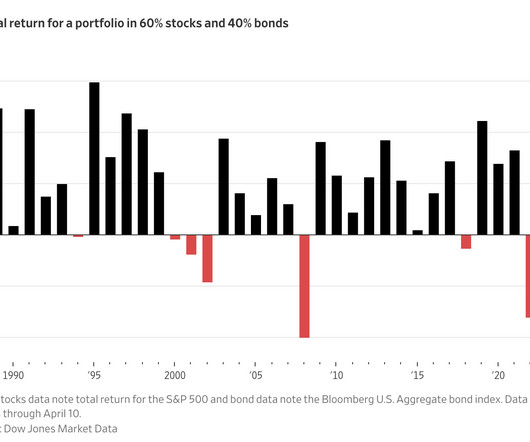

Check out these recent headlines about the classic 60/40 investment strategy 1 : The 60-40 Investment Strategy Is Back After Tanking Last Year BlackRock Ditches 60/40 Portfolio in New Regime of High Inflation Why a 60/40 Portfolio Is No Longer Good Enough The 60-40 portfolio is back Sorry, but all of these headlines utterly miss the point.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

The Big Picture

JANUARY 3, 2023

Welcome to 2023! Let’s jump into the new year with some fresh observations, some of which are quite surprising: • Astronomical Measures of Time Are Unrelated to Investing : 2023 – a new year! Might 2023 be a fourth major March bottom? Have a great 2023 – embrace risk, but avoid unforced errors.

Wealth Management

MARCH 7, 2023

Real Insights forecasts some challenges for commercial real estate investors in 2023. Realty Income agreed to buy a portfolio of more than 400 convenience stores across the U.S. in a sale-leaseback transaction, reports Commercial Property Executive. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

DECEMBER 23, 2022

Zephyr Market Strategist Ryan Nauman highlights eight topics that he will be watching in 2023 that will drive markets and considerations to prepare investment portfolios for the new year.

Wealth Management

NOVEMBER 16, 2023

Thursday, November 30, 2023 | 2:00 PM ET

Wealth Management

MARCH 12, 2023

Watch as Shivani Vohra, Portfolio Manager and Senior Research Analyst, Parnassus Investments, discusses the outlook for growth stocks in 2023 and whether now is a good time to buy.

Wealth Management

JULY 10, 2023

Advisors Asset Management's CIO Cliff Corso provides his investment outlook for the remainder of 2023.

Wealth Management

AUGUST 24, 2023

Thursday, September 21, 2023 | 2:00 PM ET

Calculated Risk

FEBRUARY 25, 2025

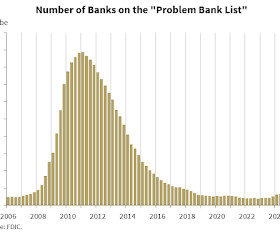

percent) from 2023. The increase primarily occurred due to one-time events in 2023 and 2024 that led to lower noninterest expense (down $8.5 The increase primarily occurred due to one-time events in 2023 and 2024 that led to lower noninterest expense (down $8.5 percent, down 8 basis points from 2023. billion, up $14.1

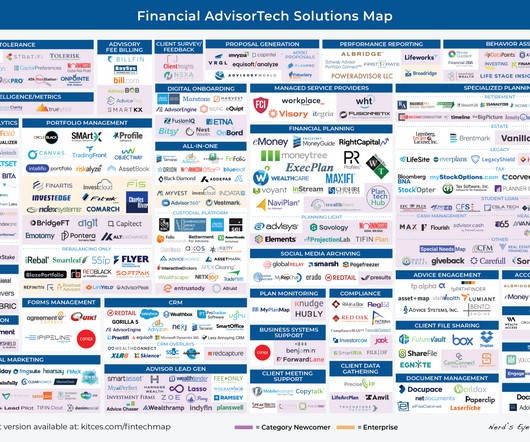

Nerd's Eye View

OCTOBER 2, 2023

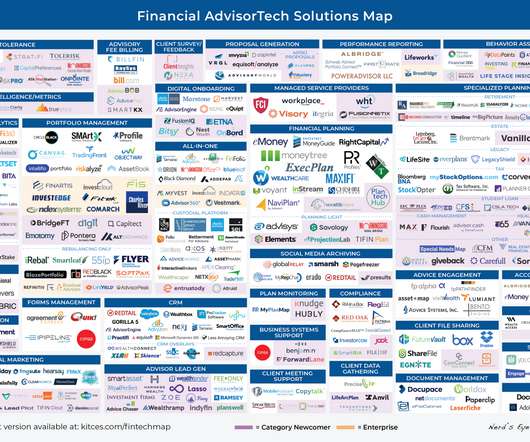

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

MAY 22, 2023

PacWest Bancorp struck a deal to sell a portfolio of $2.6 billion in construction loans to Kennedy-Wilson Holdings, reported Reuters. Equity Commonwealth named a successor to Sam Zell. These are among today’s must reads for real estate investors.

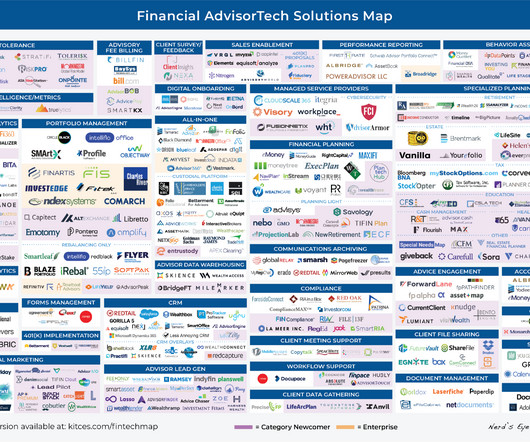

Nerd's Eye View

FEBRUARY 6, 2023

Welcome to the February 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

SEPTEMBER 5, 2023

FDIC Started Marketing Signature Bank’s $33-Billion Commercial Loan Portfolio, Reported Bloomberg. Blackstone Published an Interview with its Global Co-Head of Real Estate Kathleen McCarthy. These Are Among Today’s Must Reads from Around the Commercial Real Estate Industry.

The Big Picture

NOVEMBER 15, 2023

The problem is those behaviors are so destructive to a portfolio. 1 We ignore the reality of human behavior, including the need for some thrills and excitement, at the peril of our portfolios. Meaning, the core of your portfolio should be 70 to 80% of that simple ETF portfolio described above. We all are! – Don’t drink!

Nerd's Eye View

MAY 1, 2023

Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

AUGUST 31, 2023

non-life insurers are positioned to withstand any difficulties in their mortgage portfolios, according to Fitch Ratings. Some companies that reduced their office space are now going back and signing new leases, reports Bisnow. These are among the must reads from around the real estate investment world to end the week.

Wealth Management

FEBRUARY 2, 2023

One of New York City’s largest commercial real estate owners had to write down the value of its portfolio by $600 million, reports Bisnow. market saw the delivery of a record amount of new industrial space last year, according to Commercial Edge. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

SEPTEMBER 20, 2023

Global credit manager Marathon said it is among the bidders for Signature Bank’s $33 billion commercial real estate loan portfolio, reports Bloomberg. The SEC fined CBRE $375,000 over language in its separation agreements that prevented potential whistleblowers from reporting, according to The Wall Street Journal.

Nerd's Eye View

JULY 3, 2023

Welcome to the July 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Calculated Risk

DECEMBER 19, 2022

Ginnie Mae loans in forbearance increased 5 basis points to 1.46%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 6 basis points to 0.97%. This graph shows the percent of portfolio in forbearance by investor type over time. emphasis added Click on graph for larger image.

The Big Picture

NOVEMBER 17, 2023

I think you will enjoy our conversation… Source : Episode 145: Politics and Your Portfolio DAVID L. BAHNSEN National Review, November 16, 2023 click for audio [link] The post Politics and Your Portfolio appeared first on The Big Picture.

Wealth Management

FEBRUARY 11, 2025

The firm estimates that assets in custom models increased by nearly 50% between mid-2023 and late 2024.

Wealth Management

JUNE 13, 2023

Kennedy Wilson bought the first tranche of a multi-billion-dollar real estate loan portfolio from Pacific Western Bank, reported Multi-Housing News. Commercial Property Executive looks at what a pause in interest rate increases would mean for the commercial real estate industry.

Calculated Risk

SEPTEMBER 18, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.33% in August The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023.

Calculated Risk

JUNE 20, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.49% in May The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.51% of servicers’ portfolio volume in the prior month to 0.49% as of May 31, 2023.

Calculated Risk

MARCH 20, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.60% in February The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 0.64% of servicers’ portfolio volume in the prior month to 0.60% as of February 28, 2023.

Wealth Management

JANUARY 16, 2024

After 2022, many declared the 60/40 portfolio dead, but the traditional portfolio mix rebounded in 2023, writes Morningstar. BlackRock’s move into the private infrastructure investment space is part of a broader strategy for the asset manager to diversify from its strength in ETFs, according to FundFire.

Nerd's Eye View

DECEMBER 25, 2023

And as 2023 draws to a close, we wanted to highlight 25 of the most popular and insightful articles that were featured throughout the year (that you might have missed!).

The Big Picture

NOVEMBER 2, 2023

Before yesterday’s FOMC meeting, I reiterated my view from July 2023 that this hiking cycle was – or at least should be – over. But this after-the-fact story does not resonate as truth with me, as it looks more like the 10% market correction of October 2023 has ended. Depending on the specifics a 4.5-5% we are happy to help ).

The Big Picture

DECEMBER 1, 2023

The problem is those sets of forecasts is already 2 months old, dated October 3, 2023. This came up yesterday on Portfolio Rescue with Ben Carlson. Economy, State by State (November 22, 2023) Can Economists Predict Recessions? It was before the very encouraging CPI, Unemployment, and GDP data releases.

Abnormal Returns

JANUARY 1, 2023

abnormalreturns.com) Top clicks this week Here is Eddy's 2023 Buy List. humbledollar.com) Three ways to simplify your portfolio in 2023. Also on the site Why you should choose simplicity over complexity: the case against FSAs. crossingwallstreet.com) The best books Ben read in 2022 including "Die With Zero" by Bill Perkins.

Abnormal Returns

DECEMBER 26, 2023

cnbc.com) A round-up of recent research on portfolio design including 'Outperforming Equal Weighting.' cato.org) Some of the best books of 2023 including "Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis" by Scott Patterson. Quant stuff You don't want your AI model to 'hallucinate' when analyzing SEC filings.

The Big Picture

MAY 11, 2023

SAVE THE DATE: Future Proof 2023, September 10-13 We hosted the first Future Proof conference last year, and it was quite delightful (see all of the reviews here ). I think for RIAs, it is the most important conference event of the year, as do others ( Best Conference Experience for 2023 ). Its only 4 months away! the curve.

The Irrelevant Investor

JANUARY 2, 2023

I’m not doing anything with my portfolio based on t. The post 10 Predictions For 2023 appeared first on The Irrelevant Investor. That’s all I’m trying to do with this post. Entertain and educate. Needless to say, but I have to say it anyway, nothing in this list is investment advice.

Calculated Risk

APRIL 17, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55% in March The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.60% of servicers’ portfolio volume in the prior month to 0.55% as of March 31, 2023.

The Big Picture

OCTOBER 20, 2023

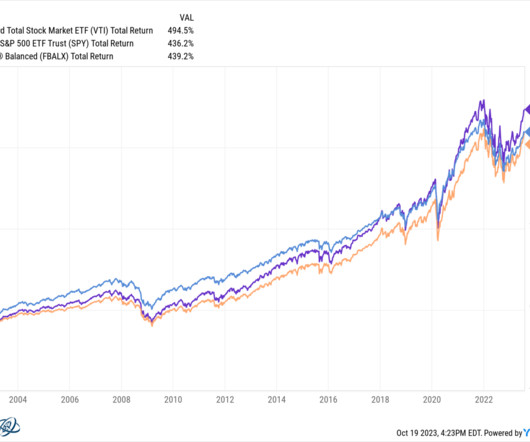

Instead of cherry-picking the S&P 500, what about a simple 60/40 portfolio (e.g., Their descendants each take possession of these in July 2023. by Shri Khalpada PerThirtySix, August 14, 2023 _ 1. Fidelity Balanced Fund, FBALX )? You would have done slightly worse, gaining about 6.7% annually over the same period.

Abnormal Returns

SEPTEMBER 24, 2023

Top clicks this week How Morgan Housel invests his portfolio. tonyisola.com) Leveraged loans have put corporate bonds to shame in 2023. etf.com) The hardest thing about being an investor is deciding what to focus on. behaviouralinvestment.com) Why selling a stock is harder than buying.

The Reformed Broker

MARCH 13, 2023

Follow Samir on: Twitter Linkedin Substack Let us know if we can help you with your financial plan or portfolio: [link]. The post The Bank Run of 2023 appeared first on The Reformed Broker.

The Reformed Broker

NOVEMBER 30, 2022

Let’s assume we’re going to have a recession in 2023. Are there changes you could make to a portfolio in order to gird yourself for a worsening economy? I don’t know if we will, but everyone seems to think so, so let’s just say. What can you do to stop it? Absolutely.

The Big Picture

JANUARY 3, 2025

She also earned a spot as one of the Twenty Trailblazing Women in Private Equity in 2023. Hurst was Cliff Asness first hire in the Quantitative Research Group at Goldman Sachs Asset Mgmt, where he built the portfolio management and trading technology for the Global Alpha Fund.

Abnormal Returns

DECEMBER 29, 2023

Science Derek Thompson with Dr. Eric Topol about some big scientific breakthroughs in 2023. jordanharbinger.com) AI What happened in AI in 2023? ritholtz.com) Corey Hoffstein talks with Nick Baltas, Managing Director at Goldman Sachs about building multi-strategy portfolios.

The Big Picture

OCTOBER 19, 2023

I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. This has enormous ramifications for everything from our portfolios, policies and politics… See also , Failures’ Fallout (Mehlman, August 21, 2021) Teens Spend Average of 4.8

Calculated Risk

MARCH 11, 2025

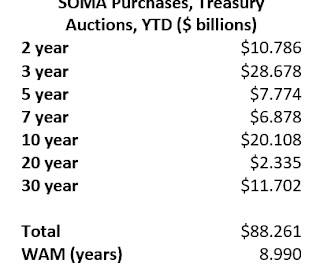

a 10-year Treasury purchase at the end of February 2023 would be have an 8 year maturity at the end of February 2025). trillion) Agency MBS portfolio with an estimate weighted average life of 8 - 9 years to just slowly roll off adds even more to this private-sector maturity transformation. And by letting its still sizable ($2.2

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content