The Inside ETFs Podcast: Nancy Davis on Portfolio Management For 2023

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

Wealth Management

MARCH 12, 2023

Watch as Shivani Vohra, Portfolio Manager and Senior Research Analyst, Parnassus Investments, discusses the outlook for growth stocks in 2023 and whether now is a good time to buy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

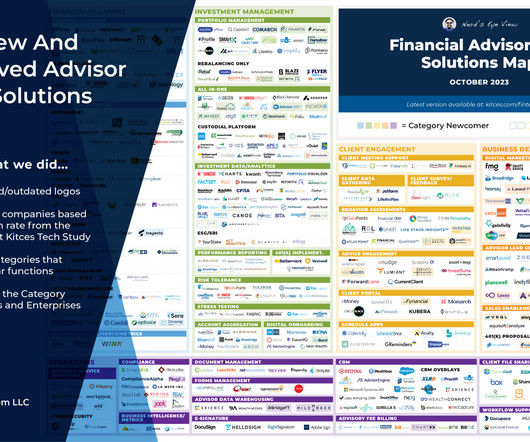

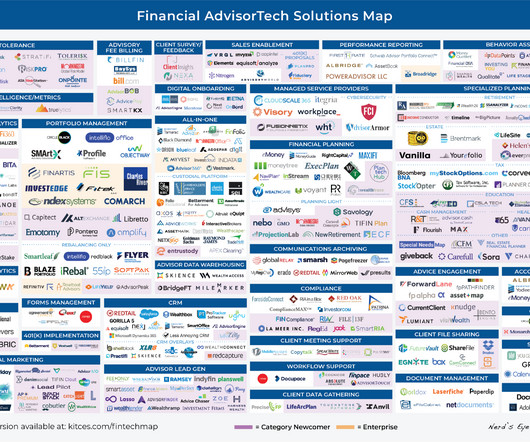

Nerd's Eye View

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

JULY 3, 2023

Welcome to the July 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

The Big Picture

JANUARY 3, 2025

She also earned a spot as one of the Twenty Trailblazing Women in Private Equity in 2023. Be sure to check out our Masters in Business next week with Brian Hurst founder and CIO of ClearAlpha , a multi strategy hedge fund managing $1 billion in client assets.

The Big Picture

MAY 11, 2023

SAVE THE DATE: Future Proof 2023, September 10-13 We hosted the first Future Proof conference last year, and it was quite delightful (see all of the reviews here ). I think for RIAs, it is the most important conference event of the year, as do others ( Best Conference Experience for 2023 ). Its only 4 months away! the curve.

Random Roger's Retirement Planning

JUNE 14, 2024

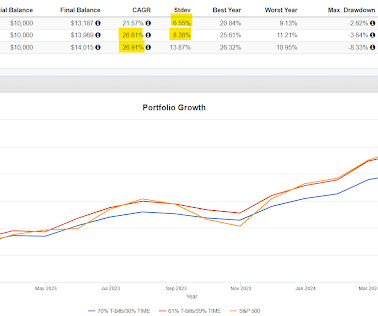

It turned out that a 39% allocation since the start of 2023 did the trick. With so much allocated to T-bills, it makes sense that the standard deviations of the barbell portfolios is so much lower. It doesn't get said often enough but really, the most important part of portfolio management is mitigating risk.

Abnormal Returns

AUGUST 14, 2023

humansvsretirement.com) Corey Hoffstein talks with Martin Tarlie, a Portfolio Manager at GMO, about bridging the gap between financial planning and portfolio management. thinkadvisor.com) IRAs IRS Notice 2023-54 answers some important questions for inherited IRAs.

Abnormal Returns

DECEMBER 1, 2023

washingtonpost.com) Lists The best podcasts of 2023 including “The Big Dig.” newyorker.com) The top podcasts of 2023 via Apple Podcasts, including the Huberman Lab. apple.com) The top podcasts of 2023 via Spotify, including the Joe Rogan Experience. (sixcolors.com) Substack is adding video creation tools.

The Big Picture

JANUARY 12, 2024

Finance in 2023 She discusses how from an early age, she was primarily interested in all aspects of real estate, from architecture to investments. She became Senior Portfolio Manager for PGIM Real Estate’s flagship core equity real estate fund. She was named one of Barron’s 100 Most Influential Women in U.S.

The Big Picture

APRIL 26, 2023

Desmond loved to ask professional portfolio managers “What percentage of stocks would you expect would be making new highs at the top day of the bull market when the Dow Jones was making its absolute high?” He noted that markets get increasingly narrow by cap size (capitalization) as longer secular bull markets approach their ends.

The Big Picture

APRIL 6, 2023

Is that a thing in March 2023? According to sources they claimed that these measures are part of their active portfolio management strategy which is premised on several factors amongst which include recent market volatility and potential risks associated with holding large positions in single stocks.” We released an explanation?

The Big Picture

JULY 18, 2023

Wall Street analysts think companies in the S&P 500 will see earnings per share rise just 1% in 2023, compared with 2022. Wired ) • Here are all the positive environmental stories from 2023 so far We’re going to be regularly updating this page with good news about our planet in an effort to combat climate anxiety.

Nerd's Eye View

JUNE 28, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent study found that at a time when the number of SEC-registered broker-dealers and their registered representatives is declining, the number of SEC-registered RIAs, their assets under management, and the number of (..)

The Big Picture

JANUARY 13, 2024

NOEMA ) • 12 Lessons the Market Taught Investors in 2023 : Market-timing, short-term thinking again cost investors. Previously, she was Senior Portfolio Manager for PGIM Real Estate’s flagship core equity real estate fund. dollar, it would reshape the global economy and geopolitical landscape.

Advisor Perspectives

DECEMBER 26, 2023

Advisors are being asked to provide their clients with a full suite of solutions, ranging from estate and tax planning to portfolio management, and everything in between. Clients are increasingly eager to gain access to fully customizable solutions that meet their individual needs.

A Wealth of Common Sense

NOVEMBER 27, 2023

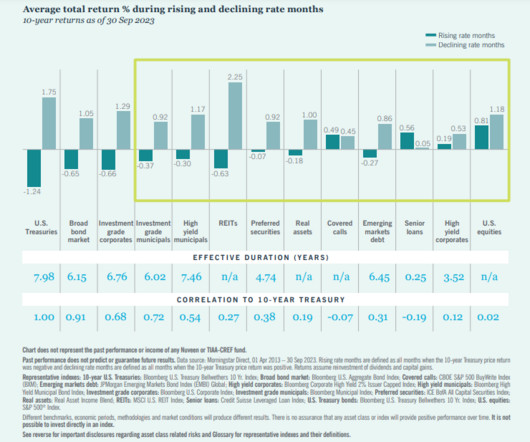

Today’s Talk Your Book is brought to you by Nuveen: On today’s show, we spoke with Nick Travaglino, Managing Director and Portfolio Manager at Nuveen to discuss the fixed-income market in 2023. On today’s show, we discuss: Will rates be higher for longer or has consensus changed?

The Big Picture

JULY 8, 2023

She also led the historic acquisition of Legg Mason in 2020, and Putnam in 2023, with the organization now managing more than $1.5 Be sure to check out our Masters in Business next week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital. trillion globally.

Carson Wealth

JANUARY 2, 2024

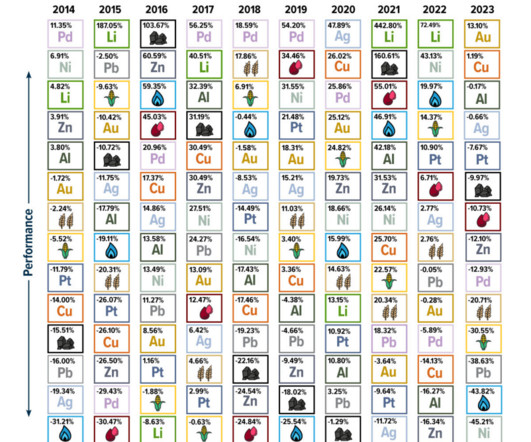

Some are perhaps unorthodox, but they tell us a lot about 2023 while setting the scene for 2024. Carson’s team provides its top charts that tell the story of 2023, including the four-year presidential cycle, high-tech manufacturing, bond yields, equity style performance, and a certain chipmaker that received a lot of attention.

Good Financial Cents

JANUARY 11, 2023

Because of this crucial role, financial managers command top dollar in big banks. Portfolio Manager. Portfolio Managers are responsible for developing investment strategies, tracking markets, evaluating documents and figures, and creating customer investment plans. Average Salary: $131,710 per year.

Trade Brains

NOVEMBER 4, 2023

In addition to this, it offers other services such as portfolio management, consultancy, etc. The latest version uses the Esper engine which operates at a high speed by processing 5 lakh events per second.

Brown Advisory

APRIL 21, 2023

Equity Beat: In Consideration of the Macro mhannan Fri, 04/21/2023 - 10:56 At Brown Advisory, we often describe ourselves as “bottom-up” investors. Our portfolio managers differ in how they incorporate “the macro” into their thinking on portfolio construction, although there are points in common.

SEI

JULY 25, 2023

Jim Solloway, Chief market strategist and senior portfolio manager, and Vivian Estadt, Client service director, present our economic outlook.

The Big Picture

DECEMBER 30, 2023

She also led the historic acquisition of Legg Mason in 2020, and Putnam in 2023, with the organization now managing more than $1.5 Be sure to check out our Masters in Business next week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital. trillion globally.

Meb Faber Research

AUGUST 30, 2023

Episode #497: Ulrike Hoffmann-Burchardi, Tudor Investments – AI, Digital, Data & Disruptive Innovation Guest: Ulrike Hoffmann-Burchardi is a Portfolio Manager at Tudor Investment Corporation where she oversees a global equity portfolio inside Tudor’s flagship fund focusing on Digital, Data & Disruptive Innovation.

Trade Brains

FEBRUARY 14, 2023

In this article, we’re going to take a look at the Top Mutual Funds For SIP in 2023. The asset management company charges a fee in the form of an expense ratio to compensate them. Let’s take a look at the top mutual funds for SIP in 2023. In Closing In this article, we took a look at some of the top mutual funds for SIP in 2023.

Meb Faber Research

NOVEMBER 8, 2023

Episode #507: Thomas George, Grizzle – Disruption at a Reasonable Price Guest: Thomas George is the President of Grizzle and Portfolio Manager of the DARP ETF. Date Recorded: 10/25/2023 | Run-Time: 50:37 Summary: In today’s episode, Thomas talks about investing in disruption at a reasonable price.

The Big Picture

JULY 19, 2023

BBC ) • ‘The Bear’ and the Need for a Place to Belong : In 2023, a very different character is revealing different truths, and the effect is, if anything, even richer and more meaningful. New York Times ) Be sure to check out our Masters in Business next week with Tom Wagner, Co-Portfolio Manager at Knighthead Capital.

Bell Investment Advisors

JANUARY 11, 2024

We were also delighted that three babies joined the broader Bell family: Relationship Manager Taylor Bogert welcomed baby Bret, Advisor Tiffany Blaho welcomed baby Neil, and Portfolio Manager Ryan Kelley welcomed baby Emma. We also had an important ending. It is our rallying cry for next year, too.

MarketWatch

MARCH 24, 2023

Seawolf Capital portfolio manager Porter Collins told the WSJ that Schwab has mismanaged its balance sheet. in premarket trades and has lost nearly 37% of its value so far in 2023, compared to a rise of 2.8% Seawolf Capital has disclosed it has a short position in Schwab. Schwab stock is down 1.7% by the S&P 500 SPX.

Advisor Perspectives

JANUARY 19, 2023

Dina Ting, our Head of Global Index Portfolio Management, offers her perspective on the allure of multifactor US mid-capitalization strategies for 2023.

Advisor Perspectives

JANUARY 21, 2024

The surge in small-cap stock performance in the final weeks of 2023 may signal a long-awaited turnaround for smaller companies that have lagged large-cap peers for a decade, according to Head of Global Index Portfolio Management Dina Ting.

Advisor Perspectives

JUNE 26, 2023

Howard Marks (Co-Chairman) and David Rosenberg (Co-Portfolio Manager, U.S. High Yield, Global High Yield, Global Credit) discuss topics from the June 2023 edition of The Roundup. They consider the evolution of the high yield bond market, investor optimism, and why this time might actually be different in financial markets.

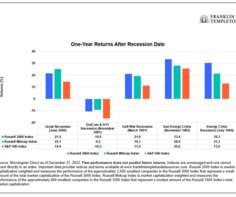

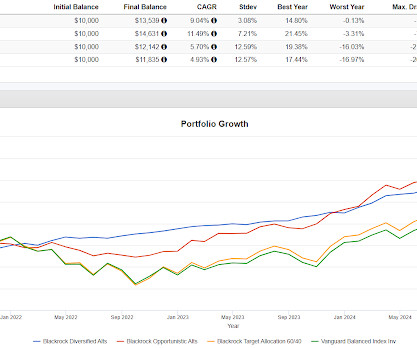

Random Roger's Retirement Planning

MARCH 4, 2025

The next time equities take off, I don't think they would keep up but Opportunistic Alts was way ahead of 60/40 in 2023 and slightly ahead in 2024. Diversified Alts and Opportunistic Alts are intended to differentiate from 60/40 and I'd say they do that.

Trade Brains

JANUARY 26, 2024

of its paid-up equity share capital as of March 31, 2023. As of March 31, 2023, Nippon AMC caters to 1.35 As of March 31, 2023, CDSL accounted for 73% of the market share with 8.3+ As of March 31, 2023, the current net worth is Rs 13821.97 in construction as of March 2023. crore folios. crore investor accounts.

Meb Faber Research

JUNE 14, 2023

Episode #485: Dan Niles on Big Tech Stocks and the AI Revolution Guest: Dan Niles is the Founder and Portfolio Manager of the Satori Fund, a US focused, technology biased, large capitalization, long-short equity fund.

Advisor Perspectives

DECEMBER 21, 2023

As 2023 is nearing its end, tax-loss harvesting season is in full swing. Courtney is a muni portfolio manager at Capital Group and the principal investment officer for the firm’s active muni ETF, CGMU. This is often top of mind for advisors and their clients.

Carson Wealth

JANUARY 16, 2024

What a strange year we had in 2023. Carson Investment Research took an unpopular contrarian stance in 2023, calling for the expansion to continue and stocks to post solid gains, based simply on what we were seeing in the data. While 2023 was a strong year, solid performance has not historically been a harbinger of market downside.

Good Financial Cents

FEBRUARY 17, 2023

You’ll create investment portfolios, referred to as “pies,” and fill them with up to 100 individual stocks and exchange-traded funds (ETFs). M1 Finance offers complete portfolio management, including periodic rebalancing. The post The 33 Best Money-Making Money Apps for 2023 appeared first on Good Financial Cents®.

Brown Advisory

AUGUST 3, 2023

Global Sustainable Total Return Bond Strategy: Reporting on the impact of our investment decisions 2022 bgregorio Thu, 08/03/2023 - 09:16 A Letter of Introduction From The Portfolio Managers Our 2022 impact report builds on our commitment to measuring, documenting and communicating the outcomes that our strategy produces for our clients.

Brown Advisory

MAY 1, 2023

Sustainable Core Fixed Income Strategy: Reporting on the impact of our investment decisions 2022 ajackson Mon, 05/01/2023 - 12:34 A Letter of Introduction From The Portfolio Managers Our 2022 impact report builds on our commitment to measuring, documenting and communicating the outcomes that our strategy produces for our clients.

Brown Advisory

MAY 1, 2023

Sustainable Core Fixed Income Strategy: Reporting on the impact of our investment decisions ajackson Mon, 05/01/2023 - 12:34 A Letter of Introduction From The Portfolio Managers Our 2022 impact report builds on our commitment to measuring, documenting and communicating the outcomes that our strategy produces for our clients.

Brown Advisory

MAY 1, 2023

2022 Impact Report: Sustainable Core Fixed Income Strategy ajackson Mon, 05/01/2023 - 12:34 A Letter of Introduction From The Portfolio Managers Our 2022 impact report builds on our commitment to measuring, documenting and communicating the outcomes that our strategy produces for our clients.

Brown Advisory

NOVEMBER 10, 2023

Sustainable Small-Cap Core Strategy: Reporting on the impact of our investment decisions 2022 bgregorio Fri, 11/10/2023 - 13:26 Download the Report A Letter of Introduction From The Portfolio Managers Brown Advisory has made a deep commitment to sustainable investing across a wide range of its equity and fixed income strategies.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content