Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

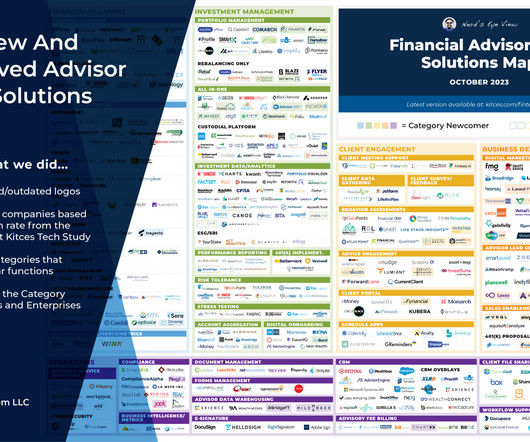

Nerd's Eye View

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

DECEMBER 28, 2022

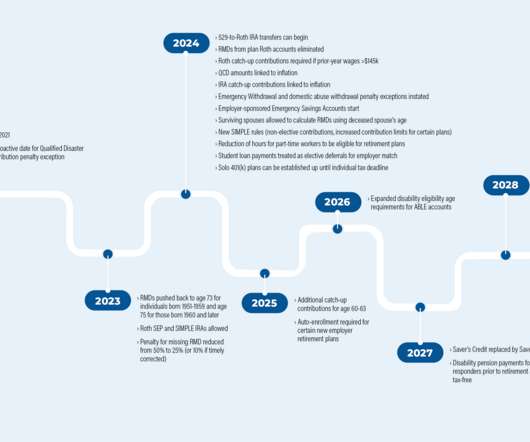

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. What is the Lifetime Gift Tax Exemption? million in 2023.

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Abnormal Returns

APRIL 10, 2023

blog.xyplanningnetwork.com) Technology Highlights from the 2023 T3 Advisor Conference including the growing importance of tax planning software. (etf.com) Onboarding Evan Harp, "To move the needle on diversity, organizations must not simply hire diverse talent and call it a day — they must develop that talent as well."

Abnormal Returns

NOVEMBER 6, 2023

papers.ssrn.com) Taxes A 2023 year-end tax planning guide. kitces.com) Advisers How the profession of financial planning has changed over time. (investmentnews.com) M&A The RIA model continues to take share. riaintel.com) How to prep an RIA for sale. (fa-mag.com) fa-mag.com) Research into how RIAs grow.

Nationwide Financial

MARCH 6, 2023

Key Takeaways: Because the 2022 and 2023 standard deductions are relatively high ($27,700 in 2023 and $25,900 in 2022 for married couples filing jointly), it isn’t worthwhile for many taxpayers to itemize deductions. Tax season has begun, and it’s not too early to think about planning for the 2023 tax year.

Nerd's Eye View

NOVEMBER 18, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that AdvisorTech giant Envestnet has announced a partnership with New Zealand-based FNZ that will allow Envestnet to offer custodial services to advisors beginning in the second half of 2023.

Nerd's Eye View

OCTOBER 14, 2022

for 2023, the largest COLA since 1981. While this will help seniors keep pace with rising prices, it also creates tax planning opportunities for advisors and raises the possibility that the Social Security Trust Fund could be depleted sooner than expected.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Harness Wealth

DECEMBER 8, 2022

Ensure that you are utilizing the tax-advantaged retirement accounts such as IRA and your company’s 401(k) to stack funds away for retirement and either pay tax now and let the fund grow tax-free or reduce your current year taxable income and pay tax later. at the federal level. Get started here.

Abnormal Returns

JANUARY 16, 2023

thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game. blogs.cfainstitute.org) How Merit Financial Advisors is building out its tax practice. thinkadvisor.com) The biz The M&A has shifted in 2023 with a focus on firms with alts capacity. citywire.com) A CPA shortage is looming.

Talon Wealth

NOVEMBER 12, 2024

Here’s how it breaks down for 2023-2024: If a couple’s total retirement income is between $32,000 and $44,000, up to 50% of Social Security benefits could be taxable. If their income is over $44,000, up to 85% could be taxed!

Abnormal Returns

SEPTEMBER 26, 2022

Podcasts Christine Benz and Jeff Ptak talk with Tim Steffen, director of tax planning for Baird. bpsandpieces.com) The 2nd annual Future Proof conference is set for Huntington Beach, CA, on September 10-13, 2023. morningstar.com) Michael Kitces and Carl Richards talk about repurposing lessons from clients for content.

Cordant Wealth Partners

NOVEMBER 18, 2024

We also get you up to speed on the tax benefits of using a DAF. If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you. Key Takeaways: Contributions to a donor-advised fund reduce your tax bill in the year your contribution is made.

Darrow Wealth Management

JANUARY 30, 2023

just upended retirement planning…again. The age when retirees must begin drawing from non-Roth retirement accounts increases to 73 in 2023, then 75 in 2033. Raising the age when withdrawals must begin is great as it gives investors more planning opportunities. The Secure Act 2.0

Darrow Wealth Management

OCTOBER 21, 2022

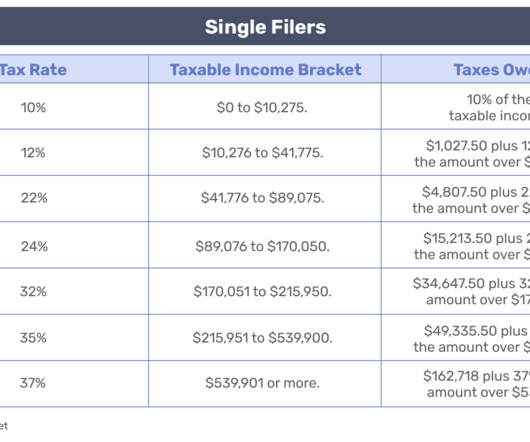

The IRS has released the 2023 contribution limits for retirement plans and other cost-of-living adjustments. The agency also released tax brackets for ordinary income and long-term capital gains. Contribution Limits for 401(k)s, IRAs and More in 2023. Income Tax Rates in 2023.

Advisor Perspectives

DECEMBER 26, 2023

Advisors are being asked to provide their clients with a full suite of solutions, ranging from estate and tax planning to portfolio management, and everything in between. Clients are increasingly eager to gain access to fully customizable solutions that meet their individual needs.

Zoe Financial

MAY 16, 2023

Income Tax Planning and 529 Plans Published May 16th, 2023 Reading Time: 6 minutes Written by: CAPTRUST Zoe Financial Services Partner Income Tax Planning and 529 Plans Published May 16th, 2023 Reading Time: 6 minutes Written by: CAPTRUST Zoe Financial Services Partner The income tax benefits offered by 529 plans make these plans attractive to parents (..)

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. Starting in 2023, a 4% surtax will be applied to taxable income and capital gains over $1M.

MainStreet Financial Planning

MAY 31, 2022

Tax Planning: Things to work on before year-end. Though it may seem that we’ve just put last tax season to rest, now is the time to work on adjustments to optimize your 2022 taxes! Don’t wait until April 15th, 2023, to think about your taxes…there are things that need to get done by year-end! 30-45 minutes.

Carson Wealth

AUGUST 1, 2024

Making the right decisions around claiming Social Security — based on your spending needs, longevity and tax planning — could mean the difference between meeting your retirement goals or not. However, the average monthly benefit in 2023 is only $1,905, meaning many retirees get by on less than $23,000 a year ($22,860 to be exact).

Zoe Financial

FEBRUARY 14, 2023

Zoe’s Tell-All: 2023 Tax Season Published February 14th, 2023 Reading Time: 5 minutes Written by: The Zoe Team If you’re a golfer, you know a lot goes into the brilliant game. Similarly, filing taxes includes many steps and details everyone needs to know about. January 23 – Tax season began.

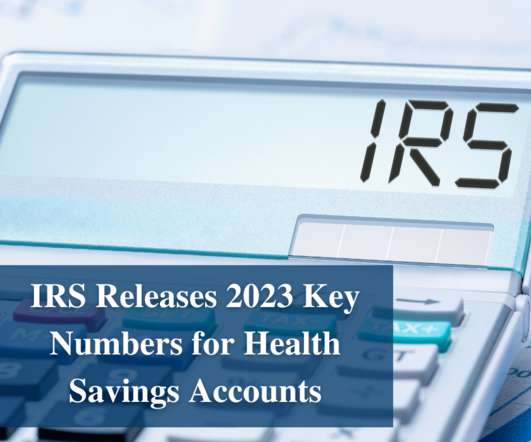

James Hendries

AUGUST 10, 2022

The IRS has released the 2023 contribution limits for health savings accounts (HSAs), as well as the 2023 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). An HSA is a tax-advantaged account that’s paired with an HDHP. High-deductible health plan: self-only coverage.

Harness Wealth

JANUARY 24, 2023

Content in this blog regarding financial planning, investment, tax, or legal topics should not be relied upon, standing alone or without the guidance of a capable professional, to support personalized decision-making by or affecting individual clients.

Indigo Marketing Agency

FEBRUARY 2, 2023

For instance, the Heath Walters Institute offers on-demand tax planning and support for financial advisors who want to better serve their high-net-worth clientele.

Advisor Perspectives

FEBRUARY 8, 2023

With the new year in its infancy, it may be too early to think about where to spend Thanksgiving or booking your car’s fall tune-up.

WiserAdvisor

NOVEMBER 7, 2022

In addition to the tax brackets, the IRS also announces deductions and allowances that help you lower your tax liability for the year. Keep reading to find out more about the 2023 tax brackets in the United States. The tax system explained. The more you earn, the more income tax is levied on your income.

Harness Wealth

MARCH 10, 2023

Under this structure, fund managers can defer paying taxes on their carried interest for up to three years after the profits are realized. For instance, suppose a fund manager invests in a startup that generates $1 million in profits in 2023. Tax services provided through Harness Tax LLC.

Nationwide Financial

JANUARY 25, 2023

On the other hand, not having a plan can lead to emotional investment decisions during periods of high volatility – something every investor should avoid. However, strategies such as asset location and tax loss harvesting can significantly minimize taxes on investments.

WiserAdvisor

JANUARY 27, 2023

2023 may see several changes with respect to retirement plans, Social Security, etc., Consider consulting with a wealth advisor who can guide you on how to preserve as well as increase your wealth in 2023. HNW wealth management – Tips for 2023 1. under the Securing a Strong Retirement Act of 2022 (SECURE 2.0).

Carson Wealth

FEBRUARY 16, 2024

By Mike Valenti, CPA, CFP ® , Director of Tax Planning It’s that time of year again! W-2s, 1099s and mortgage statements have been to hit your mailbox: a daily reminder that it is, once again, Tax Season. Overall, it was a relatively quiet year on the tax front. Please consult with your tax professional!

Harness Wealth

MARCH 17, 2023

This classification may impact tax liabilities for DAO participants, as self-employment income is subject to self-employment tax in addition to regular income tax. Tax Code Changes for DeFi in 2023 For the 2023 tax year, the U.S. Be sure to consider these changes when planning for your DeFi taxes.

Harness Wealth

MARCH 31, 2023

The Igloo Company Pudgy Penguin #7625 – source: sothebys.com As non-fungible tokens (NFTs) have gained mainstream popularity, it’s essential to understand the tax implications associated with these crypto assets. Table of contents Introduction to NFTs How are NFTs taxed Taxes when buying NFTs Can NFTs be taxed as collectibles?

Harness Wealth

MARCH 9, 2023

Reddit is planning an IPO for the second half of 2023. But between subpar macroeconomic conditions and a lackluster IPO market, the plans were soon put back on the shelf. As of now, Reddit has yet to announce a date for its initial public offering (IPO), but all signs are pointing to the second half of 2023.

Zoe Financial

JUNE 5, 2023

Market Drama Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA June 5, 2023 Watch Time: 2 minutes Welcome to this week’s Market Drama! The Stock Market: The S&P 500 was up 1.8% for the week. May was fairly flat at 0.4%, but year-to-date at 11.5%. Nasdaq was up 2% for the week and is now up more than 26% year-to-date.

Zoe Financial

MAY 18, 2023

5 Reasons Why You Should Hire a Financial Advisor Published May 18th, 2023 Reading Time: 3 minutes Written by: The Zoe Team Hiring a financial advisor is a big decision that can be crucial in helping you grow your wealth and achieve your goals.

Zoe Financial

MAY 23, 2023

Market Drama Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA May 23, 2023 Watch Time: 3 minutes Welcome to this week’s Market Drama! The Stock Market: The S&P 500 was up 1.6% for the week.

Harness Wealth

MAY 25, 2023

Here’s a deep dive into the average fees of financial advisors, in 2023. Average Financial Advisor Fees in 2023 Understanding the costs involved in financial planning is critical to making the most of your wealth and financial potential. Tax services provided through Harness Tax LLC.

Integrity Financial Planning

AUGUST 28, 2023

Also, if your pre-tax contributions are helping you stay within a desired tax bracket currently and are a part of a larger integrated retirement saving plan, you may not want to change your retirement account plans as it would require you to re-examine the rest of your strategy as well.

Darrow Wealth Management

JANUARY 9, 2023

Before the passing of the Act, SIMPLE IRAs and SEP IRAs could only accept pre-tax funds. Now, for tax years starting in 2023 (e.g. Then, employers need to update plan documents, so again, it may take time to truly be in effect. Starting with the 2017 Tax Cuts and Jobs Act, then the 2019 Secure Act 1.0,

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content