CFP Board Chooses New Chair-Elect for 2023

Wealth Management

AUGUST 11, 2022

Matthew Boersen, the head of the Michigan RIA Straight Path Wealth Management, will become the CFP Board’s youngest chair when he takes over at the start of 2024.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 11, 2022

Matthew Boersen, the head of the Michigan RIA Straight Path Wealth Management, will become the CFP Board’s youngest chair when he takes over at the start of 2024.

Wealth Management

JULY 19, 2023

Elizabeth Miller, the founder and president of Summit Place Financial Advisors is the 2024 CFP Board Chair-elect, set to take leadership for a year in 2025.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Abnormal Returns

SEPTEMBER 16, 2024

thinkadvisor.com) Advisers Future Proof 2024 is bigger and better. investmentnews.com) Startups, like Cashmere, are using AI to identify wealth management prospects. riabiz.com) CFP professionals make more money. (morningstar.com) Custodians How many custodians is too many? kitces.com)

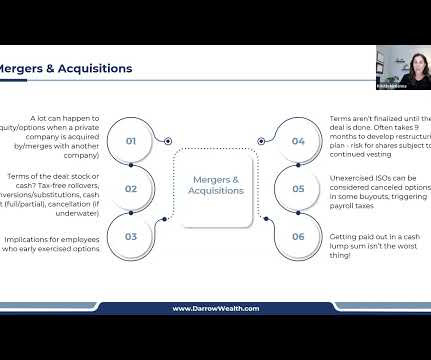

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Independent wealth management firms have no affiliations or allegiances to a fund family or financial product. Advisors affiliated with a bank, broker dealer, or large asset manager might not be able to make a fully independent recommendation.

Darrow Wealth Management

OCTOBER 21, 2024

Nationally Recognized Wealth Advisor in Stock Compensation Selection of media appearances by Kristin McKenna CFP®, President of Darrow Wealth Management and a nationally recognized specialist in employee stock options and equity compensation. appeared first on Darrow Wealth Management.

Darrow Wealth Management

DECEMBER 23, 2023

In 2023, the annual gift tax exclusion is $17,000 per person, increasing $1,000 in 2024. And most recently, starting in 2024, some 529 plan beneficiaries will be able to roll excess funds from a college savings account into a Roth IRA in their own name. For non-parents considering this route, consider looping the parents in beforehand.

Darrow Wealth Management

APRIL 15, 2024

According to the 2024 State of Retirement Planning Study by Fidelity Investments, the rise of remote and hybrid work has shifted retirement preferences for working Americans under age 42. This article was written by Kristin McKenna, CFP® and originally appeared on Forbes.

Darrow Wealth Management

MARCH 11, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Last reviewed March 2024 The post Using a Securities-Backed Line of Credit to Buy a Home appeared first on Darrow Wealth Management.

Carson Wealth

MARCH 7, 2024

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? The current limit for contributions to a 401(k) in 2024 is $23,000, which is generally above the amount of an employer match. How much should I be saving?

Darrow Wealth Management

DECEMBER 23, 2022

IRAs: the $1,000 catch-up limit will be indexed by inflation for tax years starting in 2024. In the bill, Roth 401(k) plans would also be freed of mandatory distributions starting in 2024. The bill would also require participants to make catch-up contributions to a Roth account in 401(a), 403(b), and 457(b) plans starting in 2024.

Tobias Financial

MAY 22, 2024

Stay updated with our monthly market updates featuring our Portfolio Manager, Charles “Chad” NeSmith , CFA, CFP®. Tap into Chad’s wealth of experience and analytical acumen, as he provides valuable perspectives to help you navigate the markets with confidence.

Darrow Wealth Management

JULY 1, 2024

In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Are You Ready?

Darrow Wealth Management

MAY 6, 2024

Deciding What to Do When You Inherit A House Published in Forbes by Kristin McKenna, CFP® Real estate considerations If your parent was still in their home and living alone, notify the insurance company. Darrow Wealth Management specializes in helping individuals manage sudden wealth from an inheritance.

Darrow Wealth Management

MAY 17, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Last reviewed May 2024 The post How Much Should Parents Contribute to College? appeared first on Darrow Wealth Management.

Darrow Wealth Management

JULY 30, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Nationally Recognized Sudden Wealth Advisors Darrow Wealth Management specializes in working with individuals experiencing a windfall or sudden wealth event.

Indigo Marketing Agency

JANUARY 24, 2024

Michael Kitces Reason to Follow: Unparalleled insights and thought leadership in financial planning and wealth management Michael Kitces, a legend among financial advisors, is an industry name who needs no introduction. So, here are the top influencers to watch this year. You can check out his podcast and books for more info.

Darrow Wealth Management

JANUARY 29, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Darrow Wealth Management does not offer legal or tax advice. The post 2 Key Benefits of Living Trusts appeared first on Darrow Wealth Management.

Indigo Marketing Agency

JANUARY 24, 2024

Michael Kitces Reason to Follow: Unparalleled insights and thought leadership in financial planning and wealth management Michael Kitces, a legend among financial advisors, is an industry name who needs no introduction. So, here are the top influencers to watch this year. You can check out his podcast and books for more info.

Darrow Wealth Management

NOVEMBER 20, 2023

As part of the new rules, non-spouse beneficiaries inheriting a pre-tax retirement account after 2020 must drain the account within 10 years (and potentially take RMDs within that time also, though further guidance is expected in 2024). appeared first on Darrow Wealth Management.

Darrow Wealth Management

NOVEMBER 5, 2024

Remember, this is a summary of the tax implications for section 1202 of the tax code (as of 11/2024); it’s not tax advice! Darrow Wealth Management is a financial fiduciary and fee-only registered investment advisor. Darrow Wealth Management specializes in stock options and equity compensation.

Darrow Wealth Management

JULY 24, 2023

But just last week, the IRS again waived penalties on missed distributions for 2023 and indicated that final guidance won’t come until 2024. Post Secure Act distribution rules for beneficiaries of Roth IRAs, as Roth IRAs don’t have RMDs (Roth 401(k)s do until 2024). A final ruling was expected by early 2023.

Darrow Wealth Management

JANUARY 9, 2023

The ability to do 529 plan to Roth IRA rollovers goes into effect January 2024. Starting in 2024, individuals who left assets in a Roth employer plan won’t be subject to mandatory distributions during their life. The changes will apply to 401(k), 401(a), 403(b), and 457(b) plans starting in 2024.

Darrow Wealth Management

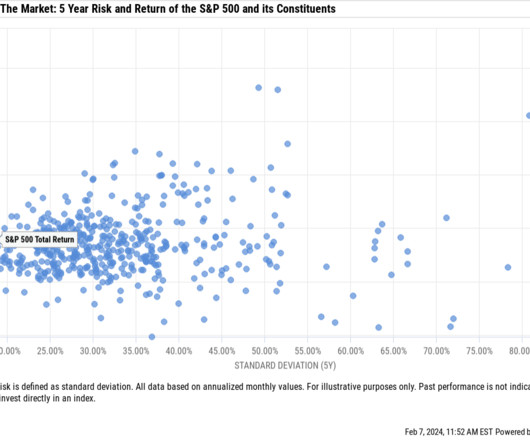

FEBRUARY 19, 2024

In February 2024, Microsoft is the largest company by market cap in the world with a 7.3% Kristin McKenna, CFP® originally published an abbreviated version of this article at Forbes References ¹ Dimensional, using data from CRSP and Compustat. weighting in the S&P 500.

Darrow Wealth Management

APRIL 15, 2024

According to the 2024 State of Retirement Planning Study by Fidelity Investments, the rise of remote and hybrid work has shifted retirement preferences for working Americans under age 42. This article was written by Kristin McKenna, CFP® and originally appeared on Forbes.

Darrow Wealth Management

JULY 1, 2024

In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Are You Ready?

Darrow Wealth Management

JULY 30, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Nationally Recognized Sudden Wealth Advisors Darrow Wealth Management specializes in working with individuals experiencing a windfall or sudden wealth event.

Darrow Wealth Management

MAY 17, 2024

Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. Last reviewed May 2024 The post How Much Should Parents Contribute to College? appeared first on Darrow Wealth Management.

Darrow Wealth Management

MAY 6, 2024

Deciding What to Do When You Inherit A House Published in Forbes by Kristin McKenna, CFP® Real estate considerations If your parent was still in their home and living alone, notify the insurance company. Darrow Wealth Management specializes in helping individuals manage sudden wealth from an inheritance.

Your Richest Life

MARCH 8, 2024

However, about 58 percent of women still leave the major financial decisions up to their male partners, according to a study from UBS Global Wealth Management. In 2024, for every dollar men earn, women earn 84 cents. If you do assume some or full control of the finances, make sure you’re still keeping your partner in the loop.

FMG

FEBRUARY 22, 2023

Events Emory Hendrix, AAMS of Crescent Wealth Management , has found great success in event hosting. Podcasts Ryan Burklo, RICP and Alex Collins, CHFC, CFP’s podcast “ Beer and Money ” is described on their site as a “financial fireside chat.” 5 Marketing Tactics Bringing Real Results 1.

The Big Picture

JULY 29, 2024

There are few people who have her unique insights into the inside baseball of what drives change in actual wealth management, not only working with FINRA and the SEC on the regulatory side and working on the technology side, but having some insight into behavioral finance and understanding what advisors need to help their clients obtain their goals.

Indigo Marketing Agency

JANUARY 25, 2025

Michael Kitces Reason to Follow: Deep insights into financial planning and wealth management Michael Kitces continues to dominate as a thought leader in financial planning. Samantha was also a finalist in the 2024 Wealthies. ( Here are the 30 voices to follow in 2025, along with rising stars you shouldnt miss.

Your Richest Life

MARCH 26, 2025

However, about 58 percent of women still leave the major financial decisions up to their male partners, according to a study from UBS Global Wealth Management. In 2024, for every dollar men earn, women earn 84 cents. One of the main reasons for that disparity is that women make less money to save during their careers.

Darrow Wealth Management

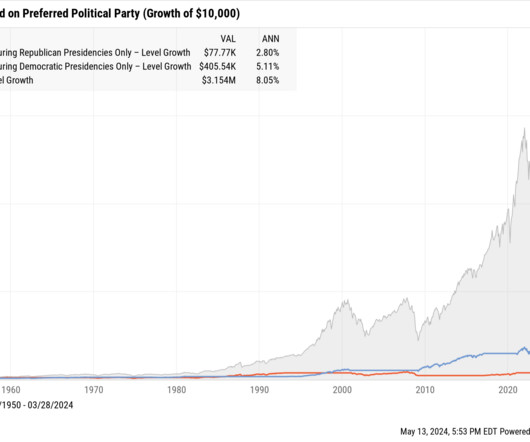

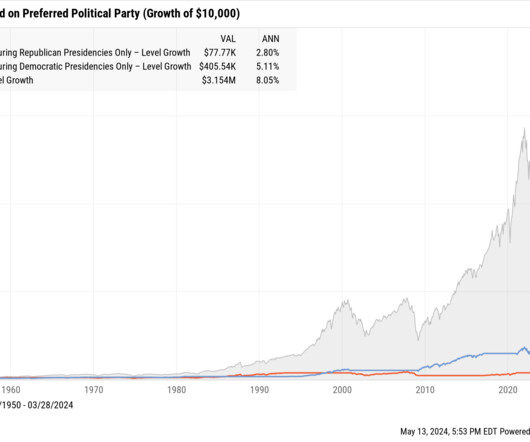

JUNE 10, 2024

According to YCharts, a $10,000 investment in the S&P 500 back in 1950 would equal over $3 million by March 2024 (excluding dividends) for an average annual return of roughly 8%. Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes.

Darrow Wealth Management

JUNE 10, 2024

According to YCharts, a $10,000 investment in the S&P 500 back in 1950 would equal over $3 million by March 2024 (excluding dividends) for an average annual return of roughly 8%. Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content