2024 Trends in Trust and Estate Planning

Wealth Management

NOVEMBER 19, 2024

Prepare for the future with expert insights — explore the latest findings on trust and estate planning trends in 2024.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 19, 2024

Prepare for the future with expert insights — explore the latest findings on trust and estate planning trends in 2024.

Wealth Management

OCTOBER 23, 2024

Wednesday, November 20, 2024 | 1:00 PM Eastern Standard Time

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

OCTOBER 2, 2024

Five ways to turn potential tax scares into sweet savings.

Wealth Management

APRIL 26, 2023

An overview of some of the important estate-planning proposals included in the 2024 Greenbook.

Wealth Management

DECEMBER 27, 2024

There's a lot that can be learned from the estate mishaps of the rich and famous. 2024 was no different.

Abnormal Returns

SEPTEMBER 23, 2024

(podcasts.apple.com) Thomas Kopelman and Jacob Turner talks estate planning for business owners. podcasts.apple.com) Daniel Crosby talks money lessons from Presidents with Megan Gorman who is the founding partner of Chequers Financial Management. podcasts.apple.com) Future Proof A Future Proof 2024 wrap-up.

Nerd's Eye View

FEBRUARY 5, 2024

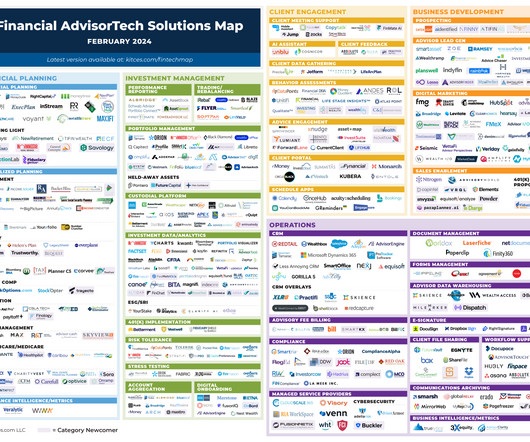

Welcome to the February 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

MARCH 15, 2023

What “fair share” taxation means for estate planning.

Abnormal Returns

JANUARY 22, 2024

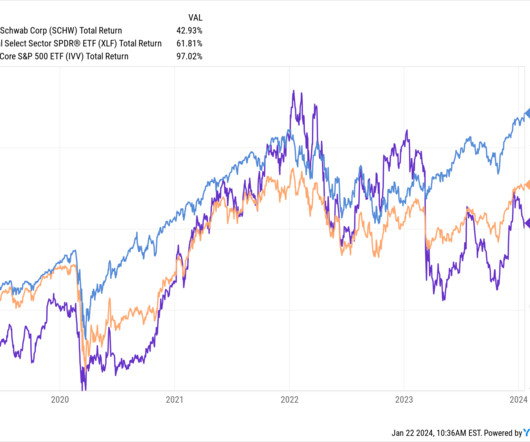

(morningstar.com) QCD limits have increased to $105,000 for 2024. riabiz.com) Vanguard is partnering with estate planning software provider Vanilla. citywire.com) RIA data management startup OneAdvisory has raised capital and re-branded as Dispatch. investmentnews.com) Americans want to retire gradually.

Dear Mr. Market

DECEMBER 31, 2024

Update Estate Plans If you have kids, own a business, or just want to make life easier for loved ones, make sure your will, trusts, and beneficiary designations are up to date. A little planning now avoids big headaches later. Ready to Tackle 2024? Happy Planning and best to you in 2025!

The Big Picture

MAY 29, 2024

At The Money: Your Financial Captain with Peter Mallouk (May 29, 2024) Who’s in charge of all of the details of your financial life? Not just the stocks and bonds, but your taxes, your will, your estate, any trusts, insurance, credit line, real estate, and anything that affects your financial health.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Independent wealth management firms have no affiliations or allegiances to a fund family or financial product. Advisors affiliated with a bank, broker dealer, or large asset manager might not be able to make a fully independent recommendation.

Abnormal Returns

OCTOBER 23, 2023

advisorperspectives.com) Vanilla is rolling out more AI tools for estate planning. kitces.com) The SEC's examination priorities for 2024 include the marketing rule and alternative assets. investmentnews.com) Advisers Why the myth of a big wealth transfer from Baby Boomers persists.

Darrow Wealth Management

MARCH 13, 2025

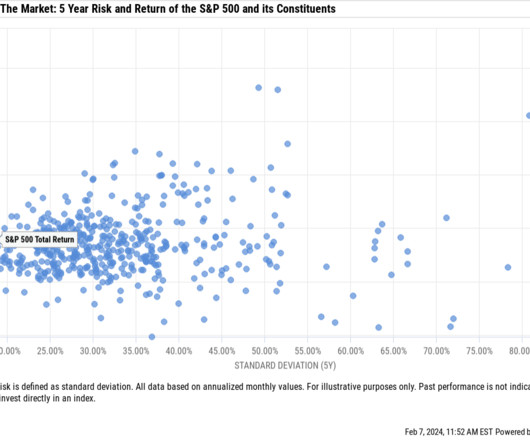

So if you have a large portion of your wealth tied to a single stock, here are six options to manage it. Over the most recent five year period ending in 2024, here’s the annualized returns and volatility of the 505 companies in the S&P 500 versus the index itself. Of the underperformers, 39% actually lost money.

Darrow Wealth Management

OCTOBER 28, 2024

It’s also important to implement other parts of your plan, such as ways to reduce tax from the sale, estate planning, charitable giving, and other goals. Financial planning and investing the proceeds from a business sale Any time you’re investing a lump sum in the market, there’s a lot to consider.

Darrow Wealth Management

JULY 1, 2024

Lowering the estate and gift tax limits The current exemption was raised dramatically in 2018. In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 appeared first on Darrow Wealth Management.

Darrow Wealth Management

FEBRUARY 19, 2024

Individuals who inherit a concentrated stock position should speak with their estate planning attorney to confirm whether they’ll receive a step-up in basis. In February 2024, Microsoft is the largest company by market cap in the world with a 7.3% Further estate planning objectives.

Darrow Wealth Management

JULY 1, 2024

Lowering the estate and gift tax limits The current exemption was raised dramatically in 2018. In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 appeared first on Darrow Wealth Management.

Harness Wealth

JUNE 9, 2023

In this article, we’ll go into detail on what to think about when it comes to financial planning, as well as a step-by-step process of how to build a sample financial plan that aligns with your personal goals and needs. Table of Contents What is a Financial Plan? Why is Financial Planning so Important?

Harness Wealth

JULY 29, 2024

covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. Now that the mid-point of 2024 has passed, we are faced with an environment where little has changed with respect to the wait-and-see posture of estate and wealth transfer planning.

Darrow Wealth Management

JANUARY 29, 2024

This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. The US has 50 states – each with their own tax laws and estate planning opportunities. non-attorney).

Darrow Wealth Management

OCTOBER 1, 2024

Choosing whether to fund a trust with your assets is an important decision in the estate planning process. A will and a trust are two different estate planning tools. But some states , like Massachusetts, have their own estate tax and a much smaller exemption amount. Do I need a living trust if I have a will?

The Big Picture

JANUARY 21, 2025

And I think you will also, if you are at all curious about estate planning or investing or personal finance, this is not the usual discussion and I think it’s very worthwhile for you to hear this and share it with friends and family. And that was in June of 2024. With no further ado my discussion with Jonathan Clements.

Darrow Wealth Management

MAY 6, 2024

Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan? Inform them of your parents passing and discuss options for support in settling the estate.

The Big Picture

JUNE 11, 2024

You know, whether a creative, whether you’re a CPA or an attorney, or a planner or a wealth manager, whatever, you’re sitting across the table from somebody. And we said, we have this opportunity to set the standard of what a, a client should receive from an independent wealth manager. We need money managers.

Darrow Wealth Management

MAY 6, 2024

Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan? Inform them of your parents passing and discuss options for support in settling the estate.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content