Make your 2024 Taxes Less Taxing by giving yourself a Tax Checkup!

MainStreet Financial Planning

MARCH 14, 2024

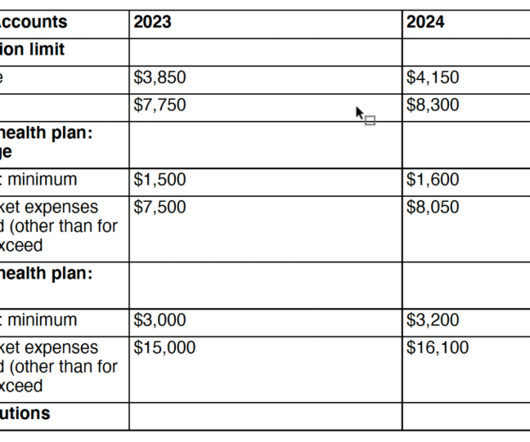

As April 15th approaches, taxpayers across the country are gearing up to fulfill their annual obligation – filing taxes. Whether you’ve already submitted your returns or are yet to tackle the paperwork, now is the perfect time for a tax check-up. Other Resources Should I do my own taxes?

Let's personalize your content