Unpacking 2024 Investment Trends

Wealth Management

MARCH 4, 2024

Michael Batnick explores how investors can navigate the changing landscape of cash investments in 2024.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 4, 2024

Michael Batnick explores how investors can navigate the changing landscape of cash investments in 2024.

The Big Picture

JANUARY 2, 2025

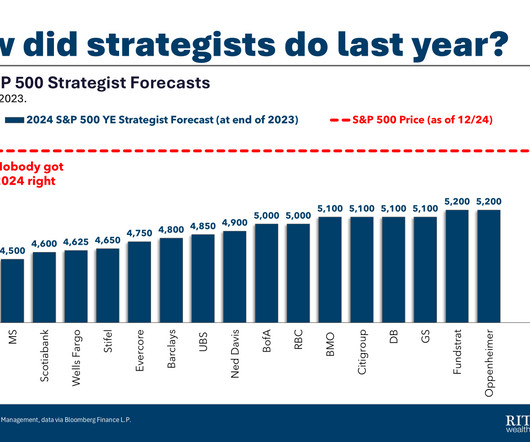

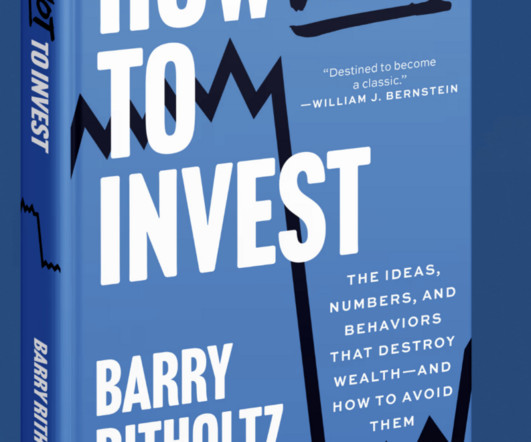

Consider this December 29, 2024, year-end review in Bloomberg : “By this time last year, the stock markets rally had blown past even the most optimistic targets, and Wall Street forecasters were convinced it couldnt keep up the dizzying pace. In “ How Not To Invest ” (coming March 18!)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

JANUARY 18, 2025

We have been designing a dedicated website for the How Not to Invest book, and working with the team at Off Menu has been much more fun than I expected. The post Audio Recording of “How Not to Invest” appeared first on The Big Picture. The past few weeks have been pretty busy and full of surprises.

Wealth Management

OCTOBER 29, 2024

Asset managers have been aggressive in rolling out AI-themed ETFs in 2024, reports Reuters. These are among the investment must reads we found this week for wealth advisors. Morningstar implemented its previously announced rating methodology change, affecting 15% of rated funds.

Calculated Risk

DECEMBER 22, 2024

Here is a review of the Ten Economic Questions for 2024. in 2024 (around 2.6% 2) Employment: Through November 2024, the economy added 2.0 million jobs in 2024. 4) Participation Rate: In November 2024, the overall participation rate was at 62.5%, down year-over-year from 62.8% Q4-over-Q4). Q4-over-Q4 in 2025.

Wealth Management

SEPTEMBER 3, 2024

YCharts profiled 10 active ETFs that have been particularly popular with RIAs so far in 2024. These are among the investment must reads we found this week for wealth advisors. ETF.com has published a guide to leveraged ETFs.

Wealth Management

JUNE 4, 2024

Wirehouses advisors are urging defensive equities strategies in the runup to the 2024 election, reports FundFire. These are among the investment must reads we found this week for wealth advisors. Morningstar explored how investors should consider allocating to private equity.

Wealth Management

NOVEMBER 26, 2024

Morningstar published its 2025 investment outlook for financial advisors. These are among the investment must reads we found this week for wealth advisors. Morgan Stanley has looked to add employees of startup companies as wealth management clients in anticipation of future IPOs, reports Inc.

Wealth Management

OCTOBER 22, 2024

Morgan Asset Management has split its alternative investment business into two segments, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Wealth Management

MARCH 26, 2024

Non-traded alternative funds have raised nearly $17 billion so far in 2024, according to the latest data from Robert A. These are among the investment must reads we found this week for financial advisors. Some hedge fund managers are looking to launch ETFs amid a boom in actively-managed funds, reports ETF Stream.

Wealth Management

NOVEMBER 5, 2024

Morgan Stanley launched an investing index tied to prominent sports leagues globally. These are among the investment must reads we found this week for wealth advisors. BlackRock became the latest and largest asset manager to seek approval for an ETF share class on existing mutual funds.

Wealth Management

NOVEMBER 19, 2024

Several of the largest equity index fund managers have extended proxy voting to mutual fund and ETF shareholders, reports Pensions & Investments. These are among the investment must reads we found this week for wealth advisors. Goldman Sachs disclosed $710 million in Bitcoin ETF holdings in its latest 13F filing.

Wealth Management

OCTOBER 8, 2024

These are among this week’s investment must reads for wealth advisors. S&P Dow Jones’ updated methodology for some of its indices has impacted $300 billion in ETFs, reports Financial Times. Mergers & Acquisitions looks at whether evergreen funds can scale up, given their promise of greater liquidity for investors.

Wealth Management

OCTOBER 1, 2024

These are among the investment must reads we found this week for wealth advisors. Wealth advisors and asset managers expect a boost in flows to actively managed fixed income strategies in the wake of lower interest rates, reports FundFire. Schwab Asset Management is splitting shares on two-thirds of its ETFs in an attempt to boost sales.

Nerd's Eye View

DECEMBER 30, 2024

And as 2024 draws to a close, we wanted to highlight 24 of the most popular and insightful articles that were featured throughout the year (that you might have missed!).

Wealth Management

JULY 9, 2024

ETFs in the first half of 2024, the highest six-month total since the second half of 2021, according to Morningstar. These are among the investment must reads we found this week for wealth advisors. Investors put $413 billion into U.S. A Bloomberg analyst said July 18 is his “best guess” as to when spot Ethereum ETFs could be approved.

Nerd's Eye View

NOVEMBER 4, 2024

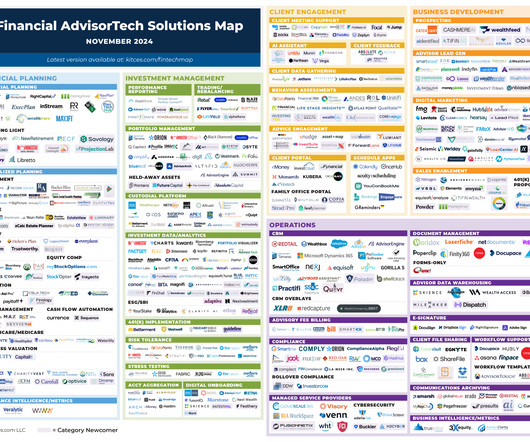

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

NOVEMBER 12, 2024

These are among the investment must reads we found this week for wealth advisors. It’s been a busy year for active ETFs in general, but the fluctuating interest rate environment has been a particular boon for active fixed-income ETFs.

Wealth Management

SEPTEMBER 24, 2024

These are among the investment must reads we found this week for wealth advisors. BlackRock’s Larry Fink sees a massive opportunity in using private indexes to build ETFs and other funds, but it’s still unclear how, reports Reuters.

Wealth Management

SEPTEMBER 17, 2024

These are among the investment must reads we found this week for wealth advisors. Morgan Chase Chairman Jamie Dimon called out institutions investors for their role in the rising popularity of private markets, reports FundFire. A Fed interest-rate cut could be a boon for small-cap stocks, according to MarketWatch.

Wealth Management

DECEMBER 17, 2024

Wirehouses are exploring how to combine direct indexing, manager-traded separate accounts and alternative investments into unified managed account platforms, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

Wealth Management

MARCH 7, 2024

Dive into the critical role of sustainable investments in the evolving financial landscapes.

The Big Picture

NOVEMBER 26, 2024

November 26, 2024 Are you crypto-curious? Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I know ETFs today are the apple pie of investing. Give us some investment strategies.

Calculated Risk

JANUARY 22, 2025

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: ABI December 2024: Business conditions end the year on a weak note The AIA/Deltek Architecture Billings Index (ABI) score fell to 44.1 for the month as the share of firms reporting a decline in firm billings increased.

Calculated Risk

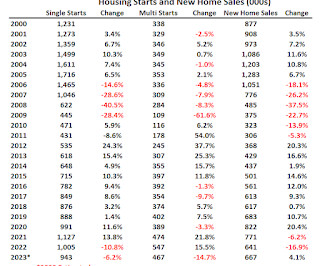

DECEMBER 26, 2024

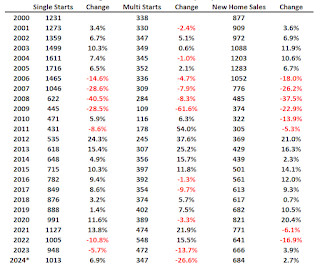

Today, in the CalculatedRisk Real Estate Newsletter: Question #8 for 2025: How much will Residential investment change in 2025? Here is a review of the Ten Economic Questions for 2024. 8) Residential Investment: Residential investment (RI) was slightly positive through the first three quarters of 2024.

Wealth Management

JANUARY 30, 2024

The secular shift from mutual funds to ETFs, including through conversions, shows no signs of letting up in 2024, according to FINSUM. These are among the investment must reads we found this week for wealth advisors.

The Big Picture

FEBRUARY 18, 2025

We are four weeks out from the publication of “ How Not To Invest: The ideas, numbers, and behaviors that destroy wealth – and how to avoid them.” The result: Bad investment outcomes that should not have occurred. ” Audio, ebook, and hard copies are all scheduled to drop on the same day, March 18, 2025.

Wealth Management

NOVEMBER 12, 2024

Top financial innovators at Nitrogen's 2024 Fearless Investing Summit highlight how student loan refinancing creates low-risk, high-return opportunities.

Wealth Management

NOVEMBER 26, 2024

A look at the asset managers who have raised the most capital for interval funds and tender offer funds this year.

The Big Picture

FEBRUARY 7, 2024

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. February 7, 2024) How much you pay for stocks really matters. Should value investing be part of that strategy? And on today’s edition of At the Money, we’re gonna discuss whether value investing should be part of your strategy.

Nerd's Eye View

MAY 1, 2024

The rule, colloquially referred to as the "Internet Adviser Exemption ", applied to "entities that exclusively provide investment advice through an interactive website ", save for a de minimis exemption of fewer than 15 clients served outside of the interactive website within the preceding 12 months.

Calculated Risk

FEBRUARY 27, 2025

From the BEA: Gross Domestic Product, 4th Quarter and Year 2024 (Second Estimate) Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in the fourth quarter of 2024 (October, November, and December), according to the second estimate released by the U.S. Residential investment was revised up from 5.3%

Calculated Risk

JANUARY 3, 2024

Today, in the Real Estate Newsletter: Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024? Brief excerpt: Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. How much will RI change in 2024?

Wealth Management

SEPTEMBER 20, 2024

Friday, September 20, 2024 | 10:00 AM ET

Abnormal Returns

OCTOBER 28, 2024

youtube.com) The biz Why Hightower Advisors is buying an institutional investment consultant. riabiz.com) M&A deals in 2024 have been increasing in size. (artofmanliness.com) Ben Carlson talks about the state of the retirement savings market with Shawn O'Brien, Director of Retirement at Cerulli Associates.

Wealth Management

FEBRUARY 23, 2024

Wednesday, March 06, 2024 | 2:00 PM ET

Wealth Management

FEBRUARY 23, 2024

Also, Advzyon and Apex announce integrations and AssetMark boosts it 2024 tech budget by $15 million.

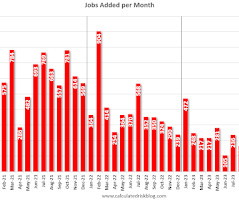

Calculated Risk

JANUARY 10, 2024

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. How much will job growth slow in 2024? The bad news - for job growth - is that a combination of a slowing economy, demographics and a labor market near full employment suggests fewer jobs will be added in 2024. million jobs in 2024.

Calculated Risk

FEBRUARY 21, 2024

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: AIA/Deltek Architecture Billings Index Reports Sluggish Conditions to Start 2024 rchitecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2

Abnormal Returns

NOVEMBER 3, 2024

(sherwood.news) How major asset classes performed, or didn't, in October 2024. wsj.com) Investment success is about small advantages compounded over time. capitalspectator.com) What's behind weakness in the long end of the curve? apolloacademy.com) Why mortgage rates are rising.

Calculated Risk

DECEMBER 24, 2023

Here is a review of the Ten Economic Questions for 2023 Below are my ten questions for 2024 (I've been doing this online every year for almost 20 years!). economy will likely perform in 2024, and if there are surprises - like in 2020 with the pandemic - to adjust my thinking. Q4-over-Q4 in 2024. range in Q4 2024.

Calculated Risk

JANUARY 1, 2025

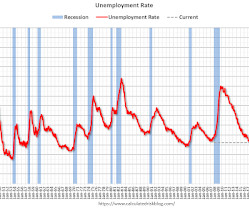

Here is a review of the Ten Economic Questions for 2024. Question #8 for 2025: How much will Residential investment change in 2025? I'm adding some thoughts and predictions for each question. 3) Unemployment Rate: The unemployment rate was at 4.2% in November, up from 3.7% in November 2023. range in Q4 2025.

The Big Picture

APRIL 25, 2024

Q1 2024 Gross Domestic Product expanded at a disappointing 1.6% — note this is seasonally and inflation-adjusted annual rate. Business investment grew at a 2.9% Residential investment grew at a 13.9% A quick note on the state of the economy in light of some recent data. That lagged economists’ consensus of 2.4%.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content