The 10 Best and 10 Worst States for Retirement in 2024

Wealth Management

JULY 23, 2024

Delaware tops the list of best states to retire in 2024, while California and New York bring up the rear.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 23, 2024

Delaware tops the list of best states to retire in 2024, while California and New York bring up the rear.

A Wealth of Common Sense

JANUARY 16, 2025

We also answered questions about 2025 retirement account limits, Coast FIRE strategies, when to take money off the table from the stock market, how to account for pension and Social Security income during retirement and how other economies impact the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Abnormal Returns

OCTOBER 28, 2024

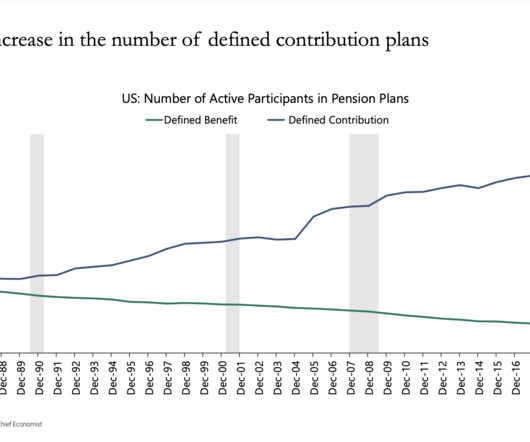

(artofmanliness.com) Ben Carlson talks about the state of the retirement savings market with Shawn O'Brien, Director of Retirement at Cerulli Associates. riabiz.com) M&A deals in 2024 have been increasing in size. advisorperspectives.com) Does risk tolerance change in retirement?

Wealth Management

NOVEMBER 27, 2024

The top 30 safest and wealthiest retirement cities in the United States in 2024.

Wealth Management

JUNE 24, 2024

DC leaders at the 2024 RPA Retirement Income Roundtable discuss how and when adoption will come.

Nerd's Eye View

FEBRUARY 12, 2025

The new law repeals both the WEP and GPO, restoring full Social Security benefits to affected individuals, retroactive to January 2024. To help with this, we've developed a downloadable calculator that simplifies the process of estimating an individual's unreduced Social Security benefits, whether or not a full earnings history is available.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Nerd's Eye View

MAY 15, 2024

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

NAIFA Advisor Today

FEBRUARY 6, 2025

Mike McGlothlin , CFP, CLU, ChFC, LUTCF, NSSA, Executive Vice President, Retirement, at Ash Brokerage , is the 2024 recipient of the Kenneth Black Jr. NAIFA and FSP merged in January 2024. Leadership Award. McGlothlin manages a staff of more than 65 employees and has maintained a 90% retention rate.

Calculated Risk

OCTOBER 12, 2023

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2024. Percent Benefit Increase for 2024 Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2 From Social Security: Social Security Announces 3.2

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

Wealth Management

JANUARY 2, 2024

Seven ideas for how to save smarter, from automation to rollovers and Roths.

Wealth Management

SEPTEMBER 18, 2024

Open, honest and candid discussion about One America's deal with Voya, Alera Retirement's growth, August job jumbers, the Wealthies and more.

Wealth Management

JUNE 5, 2024

Monday, July 01, 2024 | 2:00 PM Eastern Daylight Time

Nerd's Eye View

JANUARY 31, 2025

Which could include measures such as additional time to comply with rules that have been adopted but not yet enforced and perhaps, more broadly, an approach from the SEC that focuses more on whether a firm has robust program controls and a strong fiduciary culture rather than seeking out specific, (sometimes minor) missteps and producing enforcement (..)

Wealth Management

AUGUST 27, 2024

Open, honest and candid discussion about DOL Jobs growth numbers, phased retirement and more.

Wealth Management

SEPTEMBER 25, 2024

Open, honest and candid discussion about retirement plan assets, Fidelity's crackdown on credential sharing, Commonwealth's new PEP and more.

Nerd's Eye View

OCTOBER 2, 2024

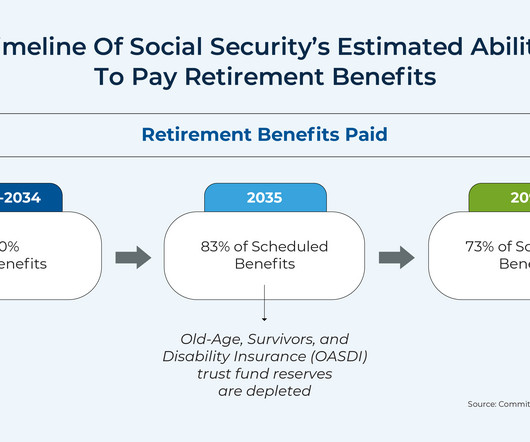

on up to $168,600 of income in 2024 for the Social Security portion of FICA). raising the payroll tax wage cap or increasing the Full Retirement Age) that would close the funding gap. Such options include single-policy solutions that would wipe out the entire 75-year shortfall (e.g., the board of trustees report estimates that a 3.33

The Big Picture

MARCH 24, 2025

The text accompanying that chart reads: “ Consumption: in 2024, one third of GDP came from government spending, a record high excluding periods of war or crisis; this was financed by 6-7% budget deficits, another unwelcome peacetime record.” How can this be? Maybe my animus toward DOGE is misplaced.

Abnormal Returns

JUNE 9, 2024

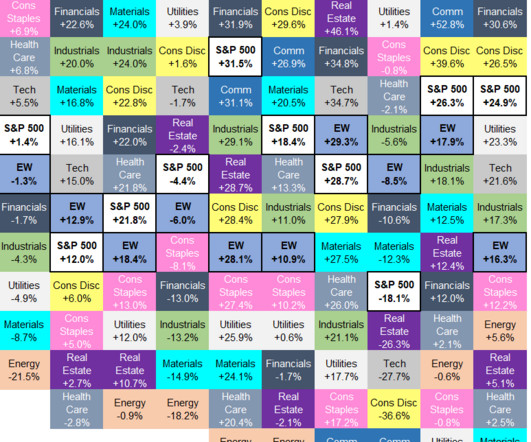

awealthofcommonsense.com) A review of major asset class performance in May 2024. marginalrevolution.com) The best podcasts of 2024 including 'Stick the Landing' from The Ringer. time.com) Edmunds' top EV and hybrid vehicles for 2024. marginalrevolution.com) Ed Slott talks about his book "The Retirement Savings Bomb Ticks Louder."

Wealth Management

AUGUST 14, 2024

Open, honest and candid discussion about lawsuits against TIAA and Morningstar, CITs bigger than mutual funds in TDFs, private equity in retirement plans and more.

Wealth Management

APRIL 3, 2024

Open, honest and candid discussion about flexPATH's victory in court, Empower's new product for small plans, how people fail at retirement and more.

Wealth Management

MARCH 27, 2024

Open, honest and candid discussion about Empower's retirement income platform, the latest retirement megatrend, advisors warming to DC plans and more.

Darrow Wealth Management

FEBRUARY 9, 2025

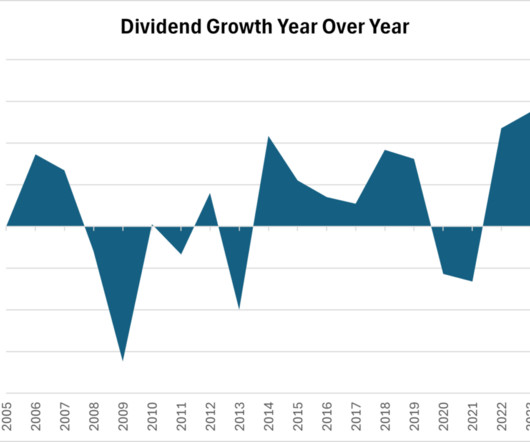

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. You may need more money than you think to retire on dividends. Retire on dividends?

Abnormal Returns

DECEMBER 11, 2024

(peterlazaroff.com) Christine Benz Ben Carlson talks with Christine Benz, author of "How to Retire: 20 lessons for a Happy, Successful, and Wealthy Retirement." awealthofcommonsense.com) Steve Chen talks with Christine Benz about her book "How to Retire: 20 Lessons for a Happy, Successful, and Wealthy Retirement."

Abnormal Returns

JANUARY 1, 2025

Podcasts Peter Lazaroff talks with Michael Batnick about lessons learned from the stock market in 2024. readthejointaccount.com) The case for never retiring. peterlazaroff.com) Khe Hy talks with Dr. Jordan Grumet about finding your life purpose. youtube.com) Taxes Trading crypto? Pay your taxes. humbledollar.com)

Nerd's Eye View

JANUARY 1, 2024

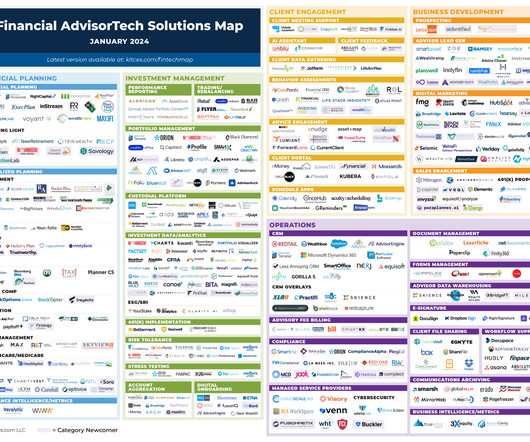

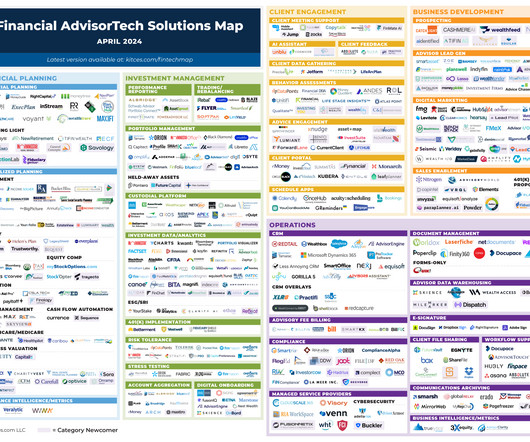

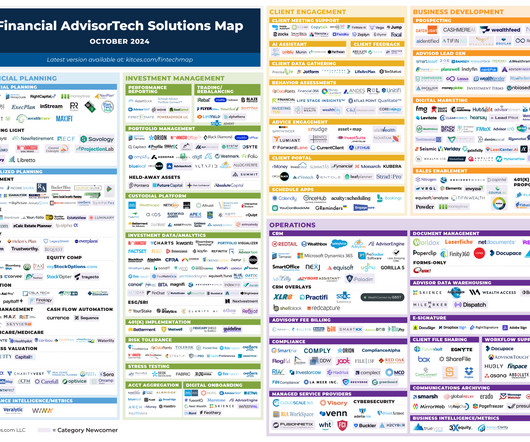

Welcome to the January 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

MARCH 20, 2024

Open, honest and candid discussion about 401(k) led retirements, the DOL fiduciary rule, the changing business models for record keepers and more.

Wealth Management

FEBRUARY 28, 2024

Open, honest and candid discussion about the demise of 401(k) plans, consolidating retirement accounts, tech in DC plans and plan sponsors demanding more from their advisors.

Wealth Management

APRIL 17, 2024

Open, honest and candid discussion about the DOL rule, Pontera's new retirement plan leadership, the resurgence of senior workers and more.

Wealth Management

MARCH 6, 2024

Open, honest and candid discussion about the flexPATH lawsuit verdict, AI in DC plans, employee engagement, convergence and retirement plan advisor due diligence.

Nerd's Eye View

MAY 6, 2024

Welcome to the May 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." morningstar.com) Dan Haylett talks with Christine Benz, author of "How to Retire: 20 Lessons For a Happy, Successful, And Wealthy Retirement." humbledollar.com) Have you signed up for daily e-mail newsletter?

Abnormal Returns

SEPTEMBER 16, 2024

standarddeviationspod.com) Retirement Retirees go back to work for any number of reasons. investmentnews.com) A checklist if a client gets laid off near retirement age. thinkadvisor.com) Investing William Bernstein on the challenges for investors nearing retirement. morningstar.com) Custodians How many custodians is too many?

Calculated Risk

DECEMBER 27, 2024

Here is a review of the Ten Economic Questions for 2024. 7) Wage Growth: Wage growth was solid in 2024, up 4.0% YoY in November 2024. In November 2024, the smoothed 3-month average wage growth was at 4.3% I'm adding some thoughts and predictions for each question. year-over-year as of November. in July 2022.

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. nytimes.com) The S&P 500 returned 2.43% in August 2024. Top clicks this week High yields come with risk. Don't let anyone tell you otherwise. wsj.com) Three reasons why the stock market declines. ritholtz.com) How pour-over coffee got so good.

Calculated Risk

JANUARY 5, 2024

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. How much will wages increase in 2024? YoY in 2024 according to the CES. Here are the Ten Economic Questions for 2024 and a few predictions: • Question #8 for 2024: How much will Residential investment change in 2024?

Calculated Risk

OCTOBER 10, 2024

On average, Social Security retirement benefits will increase by about $50 per month starting in January. percent in 2024. The contribution and benefit base will be $168,600 in 2024. From Social Security: Social Security Announces 2.5 million Americans will increase 2.5 The COLA was 3.2 in 2023, up 4.4% from $63,795.13

Abnormal Returns

JULY 1, 2024

Markets How major asset classes performed in June 2024. capitalspectator.com) Large caps trounced mid and small-caps in June 2024. on.spdji.com) Momentum leads the factor race in 2024 YTD. blockworks.co) Earlier on Abnormal Returns Adviser links: phased retirements. abnormalreturns.com) Top clicks last week on the site.

Abnormal Returns

NOVEMBER 18, 2024

wealthmanagement.com) The biz The 2024 Fidelity RIA Benchmarking Study is out. advisorperspectives.com) 7 areas where advisers may be falling short with retired clients. (justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand.

Nerd's Eye View

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

DECEMBER 20, 2023

(podcasts.apple.com) Retirement How to find a new you in retirement. ofdollarsanddata.com) What's changing for retirement accounts in 2024. morningstar.com) Why it's so hard to stay retired when you retire early. tonyisola.com) More retirees are seeing their Social Security benefits taxed.

Abnormal Returns

JUNE 3, 2024

Markets A review of major asset class performance in May 2024. bloomberg.com) Ed Slott talks about his book "The Retirement Savings Bomb Ticks Louder." capitalspectator.com) Not surprisingly, Nvidia ($NVDA) has been the biggest index contributor YTD.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content