The Best Of Weekend Reading 2024: Top 24 Articles You Might Have Missed

Nerd's Eye View

DECEMBER 30, 2024

Read More.

Nerd's Eye View

DECEMBER 30, 2024

Read More.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. What is the Lifetime Gift Tax Exemption? million ($27.22

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Darrow Wealth Management

JANUARY 16, 2025

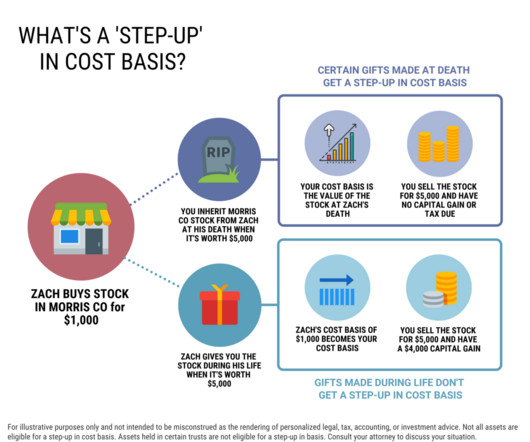

At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. This can get very tricky so it’s important to work with the estate planning attorney settling the estate. Assets that bypass the estate through a trust or another mechanism are usually not eligible.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension?

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. contained a number of changes relevant to estate planning. citizens and residents. citizens and residents.

Nationwide Financial

MARCH 6, 2023

Informally fund nonqualified deferred compensation plans If the business has a nonqualified deferred compensation plan for key employees, it may make sense to informally fund that plan in 2023 to ensure the company has the cash flow to meet the future obligation. A few have already been mentioned.

Let's personalize your content