Five Questions For Financial Markets Heading into 2025

Wealth Management

DECEMBER 20, 2024

From inflation to the fixed income tug of war to whether the market will continue to rely on the 'Magnificent 7' for performance.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 20, 2024

From inflation to the fixed income tug of war to whether the market will continue to rely on the 'Magnificent 7' for performance.

Your Richest Life

FEBRUARY 24, 2025

Even though 2025 has only just begun, there are already big changes unfolding that could impact your wallet. That decision is a departure from their announcement at the September meeting to cut rates a full percentage point in 2025. 2025 Inflation creeps up The U.S. This was also higher than the 2.9

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Advisor Perspectives

JANUARY 8, 2025

As we turn the page on 2024 and look ahead into 2025, the key question on investors' minds is: can 2024’s positive momentum in the economy and financial markets continue into 2025?

Advisor Perspectives

FEBRUARY 5, 2025

The DeepSeek blip notwithstanding (our initial take on the news is here), January 2025 was a good month for financial markets. The S&P 500 was up a robust 2.7%, though Nasdaq lagged (largely due to DeepSeek, in our opinion) with “only” a 1.7% monthly return.

Advisor Perspectives

DECEMBER 26, 2024

For 2025, the financial markets will be entering a new chapter in the ever-evolving policy story. Indeed, not only will the U.S. economy be operating under a new political and attendant fiscal backdrop, but it will also be in the midst of a different monetary policy setting—rate cuts, not the after-effects of rate hikes.

Walkner Condon Financial Advisors

JANUARY 14, 2025

Syl Michelin, Expat Financial Advisor at Walkner Condon, evaluates AI's impact on financial market performance. He highlights its influence on momentum investing and the concerns it generates over valuations and productivity in a complex economic landscape.

Indigo Marketing Agency

MARCH 20, 2025

Recession Concerns & Market Volatility: How Financial Advisors Should Communicate With Clients As financial advisors , youre well aware that so far the 2025 financial market has been more unpredictable than a toddler.

Advisor Perspectives

MARCH 12, 2025

Volatility across financial markets has become a persistent theme in 2025. The recent volatility has stemmed from a range of factors, including:

Trade Brains

SEPTEMBER 19, 2024

Written By Fazal Ul Vahab By utilizing the stock screener , stock heatmap , portfolio backtesting , and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks, also get updated with stock market news , and make well-informed investments.

International College of Financial Planning

FEBRUARY 3, 2024

The Government’s extension of certain tax benefits to Start-ups and investments made by sovereign wealth funds/pension funds to March 2025, is also progressive in spirit. The post Investing in the Future: Budget 2024’s Impact on Financial Markets appeared first on International College of Financial Planning.

Darrow Wealth Management

FEBRUARY 26, 2025

Swings in the financial markets also highlight the benefitsand limitationsof diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. Last reviewed February 2025] The post Are Bonds Safe During a Recession or Market Crash?

Advisor Perspectives

DECEMBER 19, 2024

Almost exactly one year after sparking a furious rally in financial markets, Federal Reserve Chair Jerome Powell did the exact opposite on Wednesday, staking out a cautious view on interest-rate cuts in 2025 that stunned investors.

Advisor Perspectives

DECEMBER 30, 2024

I will be looking at a few indicators in 2025 to tell me where financial markets are going. Most of them relate to the bond market, because it is both a window into the overall economy and an important component of how stocks and other risky assets are valued.

Advisor Perspectives

JANUARY 8, 2025

The question for investors will be to what degree US outperformance will extend to the financial markets.

Advisor Perspectives

SEPTEMBER 6, 2023

An electronic trading revolution is finally coming to corporate bonds, years after reaching other financial markets.

Trade Brains

JULY 8, 2024

This investment could also help Ultratech Cement enhance its market share in the south region since ICL has a strong presence in South India. million tons of total capacity by the end of FY 2027 and for FY 2025, the company expects to add 15 – 17 million tons of new capacity.

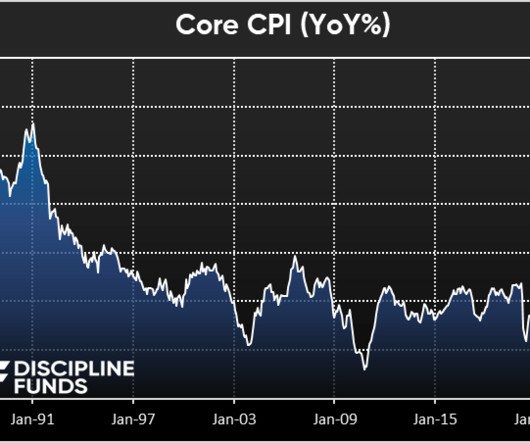

Discipline Funds

JUNE 6, 2023

Our general view on inflation is that the Fed won the battle already and they won’t declare victory until 2024 or 2025. In the meantime, the overnight rate at 5% puts a lot of pressure on credit markets and this increases the probability of an outlier credit event.

Carson Wealth

DECEMBER 8, 2023

Attorneys are telling us that 2024 is the time to review and change your estate plan as the lines may be out the door in 2025 for taxpayers wanting to make last minute changes to take advantage of the higher exemption amount. This excludes financial market changes in the value of our investments, which we track separately.

Discipline Funds

JULY 11, 2024

We’ve got unemployment ticking up modestly, softening labor markets, frothy equity markets and high expectations that rate cuts will save everything, but the problem is that even if the Fed starts cutting in September their policy rate will still be extremely tight at 5%.

Trade Brains

JUNE 25, 2023

Source: Indian Chemicals and Specialty Chemicals Market Report, Frost & Sullivan As for the growth opportunities, international demand is projected to expand at a CAGR of 6.2% to reach $ 6,780 by 2025. to become a $ 330 billion industry by 2025.

Indigo Marketing Agency

FEBRUARY 19, 2025

Samantha Russell , a financial marketing expert, emphasizes tailoring content to your ideal audience, using platforms like LinkedIn for outreach. Check out our Top 30 Influencers for Financial Advisors in 2025 here.)

Trade Brains

MAY 31, 2023

The Indian chemicals market was worth $178 billion in 2019 and is projected to grow by 9.3% annually to $304 billion by 2025. By 2025, the demand for chemicals is anticipated to increase by 9% annually, and by 2030, it is anticipated that the chemical sector would contribute $383 billion to India’s GDP.

Trade Brains

MAY 23, 2023

Talking about specialty chemicals, the worldwide market was valued at $ 847 billion in 2020 and is expected to grow at a CAGR of 5.2% to $ 1,090 billion by 2025. Thus, India’s commodity chemicals industry is anticipated to touch $137 billion in value by 2025 while the specialty chemicals sector is expected to hit the $148 billion mark.

Trade Brains

JUNE 6, 2024

Several key drivers are fuelling this growth-rising disposable incomes of a burgeoning middle class, India becoming the world’s youngest nation by 2025 with an average age of 25 years, increasing vehicle penetration expected to reach 72 vehicles per 1,000 people by 2025, and India’s position as a major R&D hub with the automotive sector (..)

Trade Brains

JULY 1, 2023

The company has plans to expand its multi-brand car service centers to over 1,000 locations by 2025 and a network strength of approximately 4000 outlets by 2027.

Trade Brains

JANUARY 4, 2024

This allows them to enter the international CPaaS market, estimated to be valued at over ₹ 200 billion. Achieve Net Carbon Neutrality by 2025. Certification of all office locations and data centers with ISO 14001 by 2025. Working towards creating a safer, more secure environment for millions of users.

Trade Brains

AUGUST 12, 2023

The management has given a target of a cumulative portfolio of 1000 MW by 2025, in line with the Central government’s audacious target of 500 GW of green energy target by 2030. Furthermore, it has more than 116 orders for IPP and CPP projects, out of which 74+ are for CPP further strengthening the future income prospects.

Trade Brains

OCTOBER 5, 2023

India is anticipated to achieve a total of US$ 65 billion in textile exports by FY 2025-26 due to the revival in global demand and the implementation of crucial initiatives by the government. This industry contributes 13% of industrial production, 12% of exports and 2.3% of the country’s GDP.

Trade Brains

AUGUST 9, 2023

As per the estimates of the ICRA, there was a 13-15% growth in the domestic demand for the Indian Tire industry in FY22 and is expected to maintain is expected to expand at a pace of 7-9% between 2022 and 2025.

Trade Brains

JUNE 2, 2024

Initially the plant will have a capacity to produce 6GWh by 2025 and they are planning to expand its capacity by 12GWh. The plant is said to manufacture cylindrical cells and radial prismatic cells to cater various applications.

Trade Brains

AUGUST 6, 2023

As per the surveys, the steel sector is expected to generate a US$ 5 trillion economy by 2025 with a CAGR of 5-6 YoY. The steel industry in India has always had an integral role in the economic development of the country.

Trade Brains

JULY 5, 2024

By the end of 2025, India is expected to have 45 new data centers adding 13 million sq feet of space and 1,015 MW of capacity. This expansion is important as India’s digital economy is expected to surge from US $ 200 billion in 2017-18 to an estimated US $ 1 trillion by 2025. billion for this expansion.

Trade Brains

JANUARY 11, 2024

The Ministry of Defence has set a target of achieving a turnover of US $25 million in aerospace and defense manufacturing by 2025, which includes US $5 billion in exports. By 2025, the Ministry of Defense has set a target to see US $25 million in aerospace and defense industry revenue, including US $5 billion in exports. billion).

Trade Brains

JULY 8, 2024

This investment could also help Ultratech Cement enhance its market share in the south region since ICL has a strong presence in South India. million tons of total capacity by the end of FY 2027 and for FY 2025, the company expects to add 15 – 17 million tons of new capacity.

Nationwide Financial

MAY 30, 2023

trillion debt ceiling limit through January 2025. trillion debt ceiling limit through January 2025, after the next presidential election. This would be highly disruptive for the economy and financial markets. see more below) What we’re watching this week: (pg.

Trade Brains

JANUARY 31, 2024

With its solid macroeconomic fundamentals and smart fiscal policies, India ranks fifth in the world in GDP, with a target of USD 5 trillion by 2025. Net zero NPA company by the year 2025. The diverse business climate and large consumer base in India are driving the country’s rapid economic expansion. growth rate for 2023-24.

Trade Brains

JANUARY 25, 2024

The electrical equipment market share in India is expected to grow by US$33.74 billion at a CAGR of 9% between 2021 and 2025. The domestic electrical equipment market is expected to grow at an annual rate of 12% to reach US$ 72 billion by 2025. Electrical machinery and equipment shipments increased by nearly 90% to Rs.

Trade Brains

SEPTEMBER 21, 2024

trillion in investments by 2025, enhancing roads, airports, and power generation. These initiatives, coupled with public-private partnerships, are driving India’s ambitious goal of becoming a US $5 trillion economy by 2025. His total investment in the company amounts to ₹114 crore in the June quarter of the financial year 2025.

Trade Brains

MAY 26, 2024

As the nation aims to become the third largest automotive market by 2030, the two wheeler segment has been the frontrunner, catering to the aspirations of the burgeoning middle class. The current industry valuation stands at $222 billion, the EV market is poised for exponential growth, with an expected net worth of $7.09

Harness Wealth

FEBRUARY 19, 2025

While the CTA remains law, BOI reporting obligations are currently on hold (Feb 2025) due to an ongoing nationwide injunction (Smith v. It’s important to determine if your specific business structure qualifies for an exemption under the CTA to ascertain your reporting obligations. Do I need to file a BOI report?

Trade Brains

JULY 5, 2024

By the end of 2025, India is expected to have 45 new data centers adding 13 million sq feet of space and 1,015 MW of capacity. This expansion is important as India’s digital economy is expected to surge from US $ 200 billion in 2017-18 to an estimated US $ 1 trillion by 2025. billion for this expansion.

Trade Brains

AUGUST 14, 2023

The Indian chemicals industry was valued at $178 billion in 2019 and is expected to grow to $304 billion by 2025, at a CAGR of 9.3%. Given that India is the world’s sixth-largest producer of chemicals and Asia’s third, the Indian chemical sector is well-positioned to capitalize on future opportunities.

Trade Brains

JUNE 28, 2023

Railway demand is estimated to more than triple by fiscal 2025, accounting for 20% of new demand for the metal between fiscal 2023 and fiscal 2025. Increasing usage of stainless steel in railways as well as increased application in the automobile and construction sectors is said to increase its demand.

Trade Brains

FEBRUARY 20, 2024

With an increasingly large workforce and a growing middle- and lower-income demographic, the need for financial services is set to rise sharply. The Indian electric vehicle market is forecasted to reach USD 113.99

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content