401(k) Real Talk Episode 145: March 26, 2025

Wealth Management

MARCH 26, 2025

Open, honest and candid discussion about retirement plan assets, PE funds in workplace plans, the future of the DOL fiduciary rule and more.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 26, 2025

Open, honest and candid discussion about retirement plan assets, PE funds in workplace plans, the future of the DOL fiduciary rule and more.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

NAIFA Advisor Today

JANUARY 16, 2025

Advisor Today Guest Column January of 2025 is the 50th anniversary to one of the most important pieces of legislation in the retirement planning arena ever put into law by Congress. What Im referring to is the enactment of ERISA, the Employee Retirement Income Security Act.

Wealth Management

JANUARY 8, 2025

Announcement 2025-2 applies to employer retirement plans.

Dear Mr. Market

DECEMBER 31, 2024

Heres your top 10 financial planning checklist for the new year. Write Down Your 10 Financial Goals for 2025! Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. For 2025, the IRS has increased contribution limitsdont miss out. Happy Planning and best to you in 2025!

Nerd's Eye View

FEBRUARY 12, 2025

When the Social Security Fairness Act was signed into law on January 5, 2025, it came as a relief to many recipients of state or local government pensions whose Social Security benefits had been, up until now, reduced by the Windfall Elimination Provision (WEP) for individuals claiming retirement benefits under their own name, or the Government Pension (..)

NAIFA Advisor Today

FEBRUARY 6, 2025

He is the author of several books, including Free Throws for Financial Professionals: Winning Principles for Unlocking Business Success, Above the Clouds: Winning Strategies from 30,000 Feet, and The New Rules of Retirement Planning.

Harness Wealth

MARCH 7, 2025

Additionally, we have news that FinCEN has announced an extension of the BOI reporting deadline and a temporary halt in enforcement, an analysis on the implications of wealth taxes in Europe, and a refresher on how the new ‘Savers Match’ program aimed at enhancing the retirement savings of millennials and Gen Z functions.

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. Individual Retirement Accounts (IRAs): Contribute up to $7,000 for 2024 ($8,000 if aged 50+). Contributions made by April 15, 2025, can be applied to your 2024 return, reducing taxable income. Timing RMDs : Begin taking RMDs by April 1 of the year after you turn 73.

FMG

FEBRUARY 13, 2025

Client events are evolving in 2025, offering unparalleled opportunities to connect with clients, strengthen relationships, and drive quality leads. In this guide, well walk you through actionable strategies, creative ideas, and promotion tips to ensure every event you plan is a success. It’s a win-win for you and the experts.

FMG

FEBRUARY 13, 2025

Client events are evolving in 2025, offering unparalleled opportunities to connect with clients, strengthen relationships, and drive quality leads. In this guide, well walk you through actionable strategies, creative ideas, and promotion tips to ensure every event you plan is a success. It’s a win-win for you and the experts.

Zoe Financial

JANUARY 27, 2025

The Five Phases of Retirement Planning Published January 29, 2025 Reading Time: 2 minutes Written by: The Zoe Team Retirement is a journey with distinct phases, each requiring its own focus and preparation. Its about striking a balance between enjoying your retirement and ensuring long-term security.

Darrow Wealth Management

FEBRUARY 9, 2025

Living off dividends in retirement: hypothetical income today for portfolios between $2M and $15M Investors may wonder how much money they could expect in dividend income annually given today’s market. As of January 31st, 2025, the dividend yield on US Aggregate bonds (AGG ETF) was 3.73% and the S&P 500 (SPY ETF) was 1.17%.

Carson Wealth

DECEMBER 8, 2023

Attorneys are telling us that 2024 is the time to review and change your estate plan as the lines may be out the door in 2025 for taxpayers wanting to make last minute changes to take advantage of the higher exemption amount. Lastly, I allocate the retirement plan contributions between Roth and Traditional 401(k) accounts.

Darrow Wealth Management

DECEMBER 23, 2022

would keep the age 50 catch-ups and allow new ones: 401(k) & 403(b) plans: starting in 2025, the catch-up contribution will become the greater of $10,000 or 150% of the catch-up limit for individuals between age 60 – 63. Under current law, SEP and SIMPLE retirement plans cannot have a designated Roth IRA account.

Your Richest Life

JANUARY 20, 2023

Emergency Savings Beginning in 2024, some retirement plans could add an emergency savings component. Additionally, contributions to the 529 plan within the last 5 years cannot be moved to a Roth IRA. also allows retirement plan service providers to transfer some low-balance workplace retirement accounts to a plan at a new job.

Cordant Wealth Partners

SEPTEMBER 8, 2022

These are target date funds with a range of target retirement date options and levels of risk. The Microsoft 401(k) retirement plan offers many excellent choices among actively managed and index funds. The Plan is subject to change by Microsoft. Please see your latest Plan document for the most up-to-date information.

Harness Wealth

APRIL 16, 2025

The qualified business income deduction under Section 199A adds another layer of consideration, offering pass-through entities a potential 20% deduction through 2025. This strategy requires careful planning and documentation to ensure all prepaid expenses qualify for immediate deduction.

Advisor Perspectives

JANUARY 31, 2025

The growth in US retirement assets offers potential opportunities for retirement plan advisors to likewise expand their business. Our Mike Dullaghan discusses growth opportunities in the retirement market and how to enhance client engagement.

Harness Wealth

APRIL 17, 2025

Understanding business meal deductions Business meals continue to serve as a valuable tax deduction in 2025, with most qualifying expenses being 50% deductible when they involve legitimate business discussions with clients, customers, or associates. Partner with Harness for top-tier advisory services in financial, tax, and estate planning.

Darrow Wealth Management

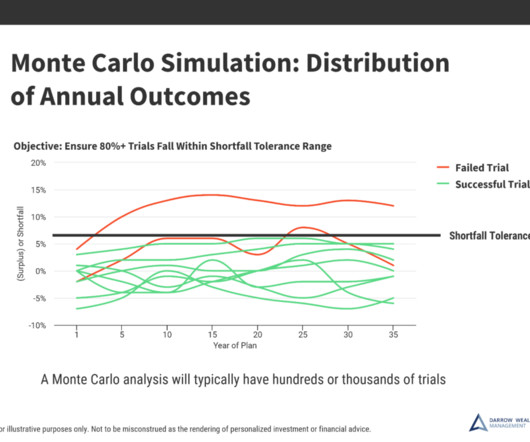

MARCH 3, 2025

Retirement planning, like any type of robust financial planning, should include stress testing your investment strategy and financial plan. Last reviewed February 2025] The post Stocks vs. Bonds: Historical Returns, Risk, and the Case for Both appeared first on Darrow Wealth Management.

NAIFA Advisor Today

FEBRUARY 10, 2025

Join us on Thursday, February 27, 2025, at 12 PM Eastern for Journal Live, where we explore how consumer research can enhance retirement planning.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. Estate Planning : Ensuring your wealth is passed on according to your wishes. What Do Financial Advisors Do?

Advisor Perspectives

FEBRUARY 7, 2025

In 2025, SECURE 2.0 introduces mandatory automatic enrollment in new retirement plans, increased catch-up limits for certain workers, and reduced participation requirements for long-term part-time workers. Our Mike Dullaghan highlights the details of the new provisions.

Random Roger's Retirement Planning

MARCH 30, 2025

Is 2025 going to be a good year for SCHD as a broad based or core holding relative to other strategies or factors? There's no way to know of course but if 2025 turns out to be a bad year for the S&P 500 then there's a pretty good probability of SCHD doing better than market cap weighting (MCW) and maybe most of the other factors.

Darrow Wealth Management

FEBRUARY 26, 2025

Retirement planning, like any type of robust financial planning, should include stress testing your investment strategy and financial plan. Last reviewed February 2025] The post Are Bonds Safe During a Recession or Market Crash? After all, volatility is a when , not an if.

Harness Wealth

OCTOBER 24, 2024

To plan your tax timeline, see our article, 2025 Tax Deadline Information for Individual Filers. Retirement Contributions: Proof of contributions to IRAs, 401ks, or other retirement plans, which may be deductible. Need to Find a Tax Professional for 2025? This is a product of Harness Tax LLC.

NAIFA Advisor Today

AUGUST 13, 2024

Doug Massey has 40 years of experience in the financial industry, specializing in retirement planning and life insurance. As NAIFA's President-Elect for 2025, he is committed to advancing the organization's influence and protecting advisors' interests.

NAIFA Advisor Today

AUGUST 1, 2024

Doug Massey has 40 years of experience in the financial industry, specializing in retirement planning and life insurance. As NAIFA's President-Elect for 2025, he is committed to advancing the organization's influence and protecting advisors' interests.

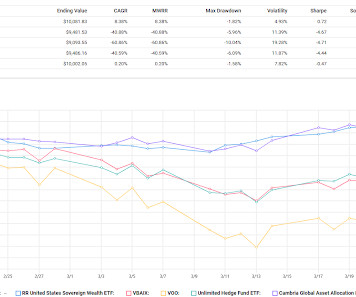

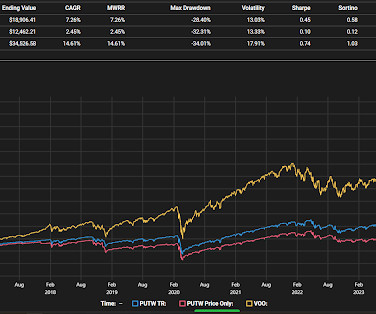

Random Roger's Retirement Planning

MARCH 28, 2025

The tradeoff is that it usually goes down more when the market goes down including so far in 2025. PUTW has gone down less than the market in some events but has fared worse in other events including YTD 2025. It is a straightforward tries to beat the market stock picking fund which it usually does to the upside.

Tobias Financial

OCTOBER 16, 2024

The Medicare industry is facing major disruptions ahead of the 2025 open enrollment, with insurers cutting benefits, raising premiums, and exiting certain markets. This has led to increased confusion for beneficiaries, particularly in deciding between Medicare Advantage and Medigap plans.

Good Financial Cents

JANUARY 26, 2023

The stock market has returned an average of between 9% and 11% over the past 90 years and that’s the kind of growth that you’ll need to tap into if you want to retire at 50. Your retirement plan shouldn’t be. Get in touch with an Independent Financial Professional to see if you're on track to meet your retirement goals.

Darrow Wealth Management

JULY 1, 2024

The TCJA has many provisions that are set to expire (sunset) at the end of 2025. Mortgage interest will once again be tax-deductible on larger loans As a result of the 2017 legislation, between 2018 and 2025, interest on new mortgages is only tax-deductible up to $750,000 of mortgage debt on a primary or second home.

Darrow Wealth Management

FEBRUARY 18, 2025

Don’t stress out about every headline, stress test your retirement plan instead.Markets move every day and the news cycle is 24-7. Even if actual average returns meet targets over time, market volatility can still derail your portfolio and retirement plans.

Financial Symmetry

APRIL 9, 2025

Outline of This Episode (00:00) Understand how to make informed tax planning decisions and minimize surprises (07:18) Regular contributions help make saving manageable and aligned with your long-term financial goals 10:23 Significant life changes such as retirement or marriage can drastically alter tax plans (12:58) Be mindful of contribution limits (..)

Indigo Marketing Agency

FEBRUARY 19, 2025

Check out our Top 30 Influencers for Financial Advisors in 2025 here.) Blog posts, social media updates, webinars , and email campaigns that speak to market uncertainties, retirement planning, or financial goal-setting will resonate more with potential clients.

Random Roger's Retirement Planning

MARCH 11, 2025

How great have the returns been for the Mag 7 stocks for the last couple of years, but so far in 2025 most of them look like they are down mid-teens to mid-20's percent. Another dynamic that might be weighing the stocks down is the possible ending of the carried interest tax break.

Nationwide Financial

JANUARY 26, 2023

Additional ways to fund a Roth IRA For workers with access to a 401(k) or other qualified retirement plan, a designated Roth account can be a fantastic opportunity to create a larger Roth account balance for retirement. But what if you want to get more money into a Roth IRA? Is there a better way? The answer may be yes.

Validea

MARCH 27, 2023

legislation, all new retirement savings plans will automatically enroll workers beginning in 2025, unless they opt out, and gradually increasing their savings rates as the years roll on. After all, investments are customized to the individual, and retirement plans should be personalized as well, Benartzi posits.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. Estate Planning : Ensuring your wealth is passed on according to your wishes. What Do Financial Advisors Do?

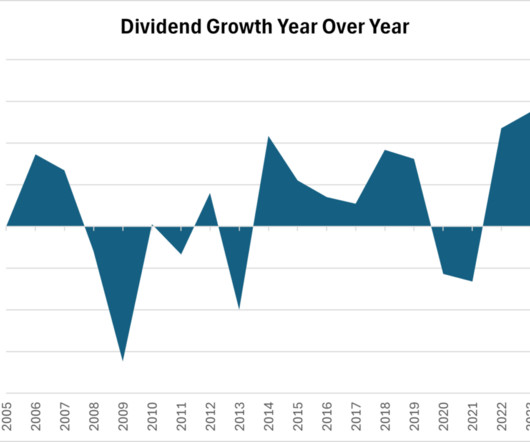

Random Roger's Retirement Planning

MARCH 9, 2025

The Wall Street Journal has an article up this weekend about investors rotating to dividend centric stocks and funds because they are doing well in 2025 as market cap weighting has struggled, especially since mid-February. The Schwab US Dividend Equity ETF (SCHD) seems to garner the most attention.

Zoe Financial

MARCH 19, 2025

Published: March 20th, 2025 Reading Time: 6 minutes Written by: The Zoe Team Have you ever stood in a grocery aisle, staring at a wall of options, unable to pick one? Budgeting & saving (23%): Uncertainty about creating a plan that works. Retirement Planning (22%): Fear of running out of money or not saving enough.

Zoe Financial

MARCH 19, 2025

Published: March 20th, 2025 Reading Time: 6 minutes Written by: The Zoe Team Have you ever stood in a grocery aisle, staring at a wall of options, unable to pick one? Budgeting & saving (23%): Uncertainty about creating a plan that works. Retirement Planning (22%): Fear of running out of money or not saving enough.

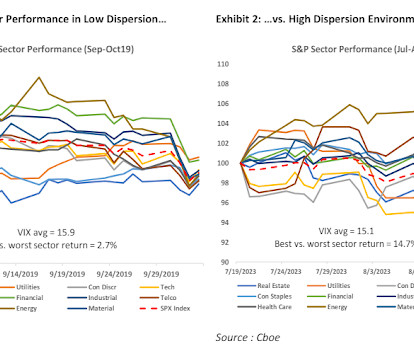

Random Roger's Retirement Planning

APRIL 23, 2024

The plan is to create a futures contract based on DSPX in Q1 2025 which could then be a path to some sort of exchange traded product. The process to derive the Dispersion Index is kind of similar as the process to derive VIX but the information is much different.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content