The Best and Worst States to Retire in 2025

Wealth Management

JANUARY 30, 2025

Florida is the best state to retire in in 2025. But after that, states out West like Colorado and Wyoming rank high for retirement.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 30, 2025

Florida is the best state to retire in in 2025. But after that, states out West like Colorado and Wyoming rank high for retirement.

Calculated Risk

DECEMBER 27, 2024

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. How much will wages increase in 2025? My sense is nominal wages will increase close to mid-to-high 3% range YoY in 2025 according to the CES. How about housing starts and new home sales in 2025? year-over-year as of November.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Big Picture

MARCH 31, 2025

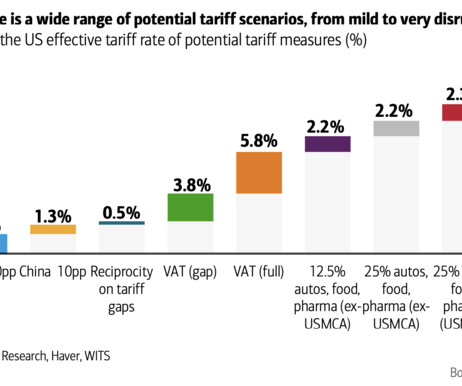

Its not the same thing in theory, but in practice, especially with the chatter of reducing income taxes, it feels that way: European consumption tax minus the universal health care, education, and retirement benefits. I hope this take is wrong. appeared first on The Big Picture.

Nerd's Eye View

FEBRUARY 12, 2025

Notably, estimating benefits in this way isn't a simple 'back-of-the-envelope' calculation, given the complexity of the rules determining the calculation of Social Security retirement, spousal, and survivor benefits.

Calculated Risk

OCTOBER 10, 2024

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2025. Percent Benefit Increase for 2025 Social Security benefits and Supplemental Security Income (SSI) payments for more than 72.5 percent in 2025 , the Social Security Administration announced today.

Dear Mr. Market

DECEMBER 31, 2024

Write Down Your 10 Financial Goals for 2025! Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. For 2025, the IRS has increased contribution limitsdont miss out. Whether youre fine-tuning your budget or planning your retirement roadmap, dont go it alone. Submit a form.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Abnormal Returns

DECEMBER 25, 2024

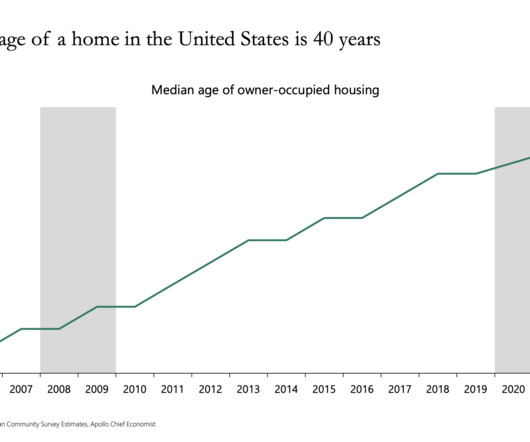

awealthofcommonsense.com) Retirement Seven hidden traps of retirement including 'Not focusing on creative endeavors to maximize your fulfillment.' theretirementmanifesto.com) What's changing for retirement in 2025. wsj.com) Owning a home isn't for everyone.

MainStreet Financial Planning

JANUARY 10, 2025

As we enter 2025, its the perfect moment to take stock of your financial journey and map out your path for the year ahead. Whether you’re focused on building a retirement fund, saving for a big purchase, or simply improving your financial habits, setting clear, realistic goals and crafting a solid plan are the keys to success.

Wealth Management

MARCH 26, 2025

Open, honest and candid discussion about retirement plan assets, PE funds in workplace plans, the future of the DOL fiduciary rule and more.

Darrow Wealth Management

FEBRUARY 9, 2025

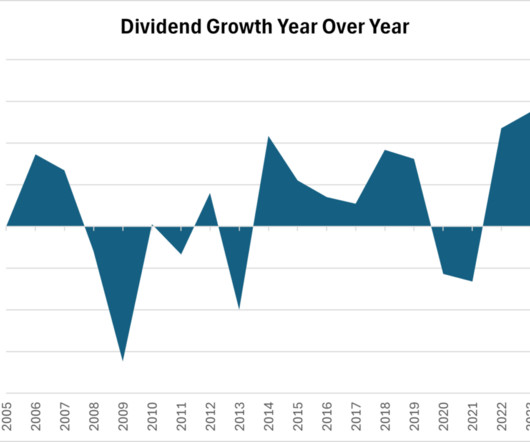

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. You may need more money than you think to retire on dividends. Retire on dividends?

NAIFA Advisor Today

JANUARY 16, 2025

Advisor Today Guest Column January of 2025 is the 50th anniversary to one of the most important pieces of legislation in the retirement planning arena ever put into law by Congress. What Im referring to is the enactment of ERISA, the Employee Retirement Income Security Act.

Abnormal Returns

JANUARY 1, 2025

(contessacapitaladvisors.com) Personal finance Whether you have an advisor or not, a financial checklist for 2025. readthejointaccount.com) The case for never retiring. disciplinefunds.com) Money is a taboo subject, especially when friend groups have different income levels. wggtb.substack.com) In life, losses pile up.

A Wealth of Common Sense

JANUARY 16, 2025

We also answered questions about 2025 retirement account limits, Coast FIRE strategies, when to take money off the table from the stock market, how to account for pension and Social Security income during retirement and how other economies impact the U.S.

Wealth Management

JANUARY 8, 2025

Announcement 2025-2 applies to employer retirement plans.

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." morningstar.com) Dan Haylett talks with Christine Benz, author of "How to Retire: 20 Lessons For a Happy, Successful, And Wealthy Retirement." humbledollar.com) Have you signed up for daily e-mail newsletter?

Abnormal Returns

JANUARY 20, 2025

Podcasts The 22 financial adviser podcasts to listen to in 2025. wsj.com) Vanguard is having to pony up for target date retirement fund debacle. citywire.com) Putting some numbers on the coming wave of adviser retirement. riabiz.com) Five ways to boost your business in 2025 including 'Proactive communication.'

Abnormal Returns

MAY 1, 2024

peterlazaroff.com) Retirement Why the media loves to tout a looming 'retirement crisis.' morningstar.com) The best thing to have in retirement is optionality. rogersplanning.blogspot.com) On the benefits of simplicity in retirement. humbledollar.com) What does success (or failure) look like in retirement?

Carson Wealth

FEBRUARY 6, 2025

Every year brings changes in tax rules, and 2025 is no exception. Whether you are saving for retirement, running a business, or planning for your family’s future, these updates could affect your financial decisions throughout the year. These 2025 updates provide fresh chances to protect and grow your wealth.

Abnormal Returns

OCTOBER 16, 2024

financialducksinarow.com) IRS Direct File is expanding to more states in 2025. contessacapitaladvisors.com) Six lessons learned from a 6-week mini-retirement including 'Appreciate what you have.' sherwood.news) A look at six phases of retirement. (vox.com) Climate change risk by county. bloomberg.com)

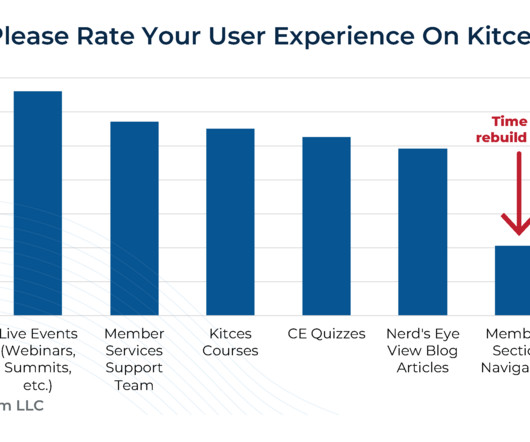

Nerd's Eye View

JANUARY 13, 2025

And so we're excited to announce that, for 2025, our major company initiative will be a complete redesign and rebuild of our Members Section! And we continue to expand the types of CE we provide as well, including the ability for Canadian CFP certificants to earn CE credit from Kitces (effective immediately for 2025!), Read More.

The Big Picture

MARCH 20, 2025

The latter is crucial exactly due to Ritholtzs empirically correct view that one neednt be a great or market-beating investor to have a happy retirement as much as one must avoid the errors that sap the genius of compound returns. Slow and steady wins the race, or something like that.

Harness Wealth

MARCH 7, 2025

Additionally, we have news that FinCEN has announced an extension of the BOI reporting deadline and a temporary halt in enforcement, an analysis on the implications of wealth taxes in Europe, and a refresher on how the new ‘Savers Match’ program aimed at enhancing the retirement savings of millennials and Gen Z functions.

NAIFA Advisor Today

FEBRUARY 6, 2025

Mike McGlothlin , CFP, CLU, ChFC, LUTCF, NSSA, Executive Vice President, Retirement, at Ash Brokerage , is the 2024 recipient of the Kenneth Black Jr. NAIFA and our FSP community congratulate Mike McGlothlin as the 2025 winner of the Ken Black Leadership Award, said NAIFA CEO Kevin Mayeux , CAE. Leadership Award.

oXYGen Financial

JANUARY 12, 2025

This might just be true for 401(k) plans in 2025 for those striding into their golden years. Planning for retirement just got a significant boost for Americans aged 60 to 63, thanks to provisions in the SECURE Act 2.0. [CDATA[ They say you get better as you get older.

MainStreet Financial Planning

JANUARY 23, 2025

The post Start the Year Strong: Get Your Financials in Shape for 2025 appeared first on MainStreet Financial Planning. Starting the year with these updates will give you peace of mind, knowing your finances are secure and organized.

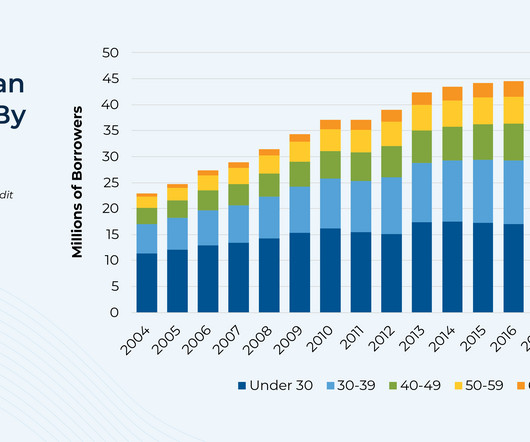

Nerd's Eye View

SEPTEMBER 27, 2023

Which not only cuts into a parent's current cash flow, but also limits their ability to save for their (potentially fast-approaching) retirement. Nonetheless, Parent PLUS borrowers (and their advisors) have an opportunity (until July 1, 2025) to access more generous IDR plans by using a "Double Consolidation" loan strategy.

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. These contributions not only provide immediate tax relief but help secure longer-term financial stability during retirement. Individual Retirement Accounts (IRAs): Contribute up to $7,000 for 2024 ($8,000 if aged 50+). Available to taxpayers aged 70.5

MainStreet Financial Planning

NOVEMBER 8, 2024

Maximize Your Retirement Contributions: Enhancing your retirement savings not only secures your future but also offers immediate tax benefits. While IRA contributions for 2024 can be made until April 15, 2025, contributing before year-end allows you to benefit from tax-deferred growth sooner.

The Big Picture

MARCH 10, 2025

David Nadig, “ Rabbithole ” March 7, 2025 I had fun chatting with Dave Nadig about philosophy, behavior, and investing ( video after the jump). But the second part is the contextualizing side of the equation: You dont spend 1925 dollars today; you spend 2025 dollars. Money Delusions: What Do People Get Wrong About Money?

Abnormal Returns

AUGUST 4, 2024

spyglass.org) Work How a national retirement savings plan would work. papers.ssrn.com) Taxes No matter who is President in 2025, taxes will be at the top of the agenda. (sherwood.news) Should a startup ever spend $1.8 million on a URL? morningstar.com) Paid sick leave mandates help employees better maintain work-life balance.

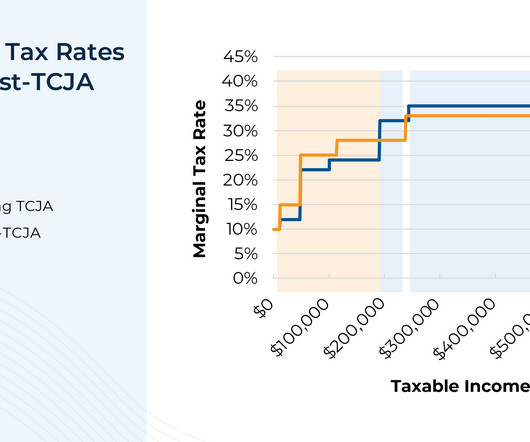

Nerd's Eye View

JULY 10, 2024

However, most of TCJA's provisions are set to 'sunset' at the end of 2025 – an event that would have at least as much impact as TCJA's initial passage. And yet, the timing of the sunset provision at the end of 2025 means that the actual fate of TCJA will largely hinge on the uncertain outcome of the 2024 U.S.

Abnormal Returns

MAY 29, 2023

thereformedbroker.com) 2025 If nothing changes legislation-wise, there will be a run on estate planning going into 2025. kitces.com) Social Security retirement ages are always a political decision. (ritholtz.com) Are you a Texas-based adviser interested working with Ritholtz Wealth Management? advisorperspectives.com)

FMG

JANUARY 23, 2025

Marketing for financial advisors in 2025 will require a sharp focus on effective communication, personalized client experiences, and smart use of technology. Why Marketing for Financial Advisors Matters in 2025 Marketing for financial advisors is not just a task; its a way to ensure sustained business growth. Clarify your objectives.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Fully Utilize Tax-Advantaged Retirement and Savings Accounts There are multiple steps you can take using retirement accounts to reduce your taxable income. GET STARTED 1.

Zoe Financial

DECEMBER 28, 2024

New Year, New Wealth: A Guide to Financial Resolutions for 2025 Updated December 30th, 2024 Reading Time: 7 minutes Written by: The Zoe Team As the New Year approaches, many of us set personal goals to make the coming year better than the last. Boost Retirement Contributions Maximize contributions to your retirement accounts.

Good Financial Cents

JANUARY 26, 2023

Early retirement has become a popular financial goal. Even if you never retire early, just knowing that you can is liberating! Can You Really Retire at 50? Can You Really Retire at 50? Table of Contents Can You Really Retire at 50? FAQs on Retiring Early at 50 It’s a big bold claim – retire at 50?

FMG

FEBRUARY 13, 2025

Client events are evolving in 2025, offering unparalleled opportunities to connect with clients, strengthen relationships, and drive quality leads. Why a Client Event is a Must-Have in 2025 The landscape of client engagement is more dynamic than ever, and client events have become an essential part of building long-lasting relationships.

FMG

FEBRUARY 13, 2025

Client events are evolving in 2025, offering unparalleled opportunities to connect with clients, strengthen relationships, and drive quality leads. Why a Client Event is a Must-Have in 2025 The landscape of client engagement is more dynamic than ever, and client events have become an essential part of building long-lasting relationships.

Nerd's Eye View

OCTOBER 18, 2024

Also in industry news this week: 43% of wealth management firms are frustrated with the effectiveness of their CRM software, spurred on by challenges with integrations and workflows, according to a recent survey The Social Security Administration this week announced a 2.5%

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. retirement changes. retirement changes. In the new bill, the age when retirees must begin drawing from non-Roth tax-deferred retirement accounts would increase to 73 in 2023 and 75 in 2033. Stay tuned.

Nerd's Eye View

JULY 19, 2024

Also in industry news this week: A new survey of RIAs indicates that about 1/3 of respondents have been in serious M&A negotiations during the past 3 years and that many firms are embracing a hybrid work environment, with employees splitting time between working from home and from the office The IRS on Thursday issued final regulations regarding (..)

NAIFA Advisor Today

JANUARY 6, 2025

A much-anticipated feature of this edition is the annual indexed retirement and Social Security numbers for 2025, conveniently presented in an easy-to-reference table. The J anuary issue of the Journal of Financial Service Professionals has arrived, and its a must-read for anyone in the financial services community.

Advisor Perspectives

JANUARY 31, 2025

The growth in US retirement assets offers potential opportunities for retirement plan advisors to likewise expand their business. Our Mike Dullaghan discusses growth opportunities in the retirement market and how to enhance client engagement.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content