2019 Year-End Planning Letter

Brown Advisory

NOVEMBER 1, 2019

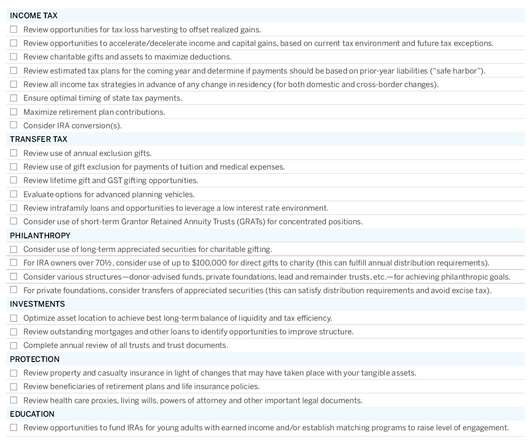

This year, two factors will be important considerations in our year-end planning work: 1) current market dynamics (specifically, ongoing market volatility, low interest rates and a flat yield curve), and 2) the 2017 tax overhaul and our ongoing integration of new tax rules into clients’ long-term plans. Non-Taxable Gifts.

Let's personalize your content