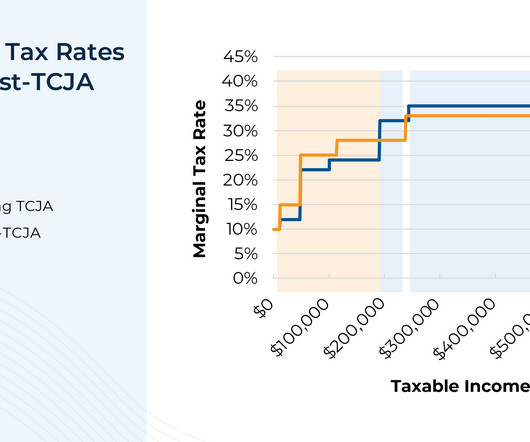

Planning For Changes In Client Marginal Tax Rates After TCJA’s Sunset

Nerd's Eye View

JULY 10, 2024

The Tax Cuts and Jobs Act (TCJA), passed in 2017, was one of the most extensive pieces of tax legislation to be passed in the last 30 years, touching many aspects of individual, corporate, and estate tax.

Let's personalize your content