ETFs Could Claim the Biggest Share of Client Portfolios by 2026

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

Nerd's Eye View

OCTOBER 16, 2024

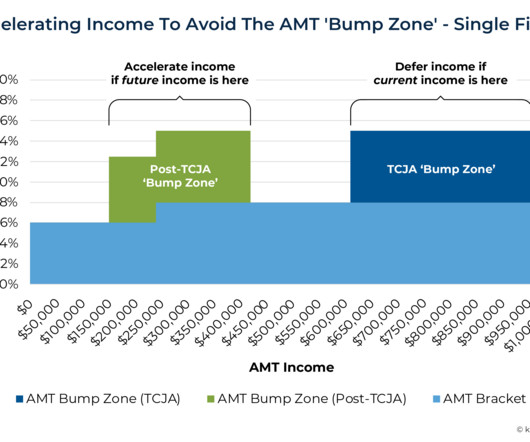

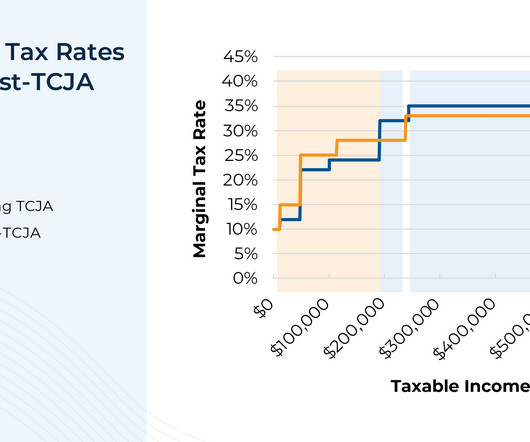

But with the anticipated sunset of TCJA in 2026 and the reversion to the pre-2018 AMT rules, a large subset of households will find themselves owing AMT – many of whom will do so for the first time. For example, clients with unexercised ISOs could exercise those options prior to TCJA's sunset without AMT exposure.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JULY 10, 2024

From an advisor's perspective, TCJA's impending expiration raises the importance of planning for clients who will potentially be impacted, which, given the law's broad scope, could be nearly every client. Read More.

Wealth Management

OCTOBER 4, 2024

To help your clients prepare for the real possibil The estate and gift tax exemption (set at $13.61 million per individual in 2024) is due to expire on Jan. If Congress doesn’t act, that tax exemption will be cut in half to about $6 million.

Nerd's Eye View

MARCH 3, 2025

Welcome to the March 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

MAY 29, 2023

1, 2026 and becomes a big problem for reactive RIAs who fail to help clients take action now." advisorperspectives.com) Advisers Clients don't walk in the door because everything is hunky dory. investmentnews.com) How to better screen for potential clients.

Nerd's Eye View

SEPTEMBER 2, 2022

Why private placement life insurance policies could become an increasingly popular option for ultra-high-net-worth clients. The upcoming debut of a new tontine product could add another option for advisors looking to mitigate their clients’ longevity risk.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Abnormal Returns

MAY 8, 2023

advisorperspectives.com) Advisers need to recognize that clients have different conversational styles. thinkadvisor.com) A number of tax provisions will sunset in 2026 including the lifetime exclusion amount. (sciencedaily.com) How tax-adjusting a portfolio works in practice.

Nerd's Eye View

APRIL 5, 2023

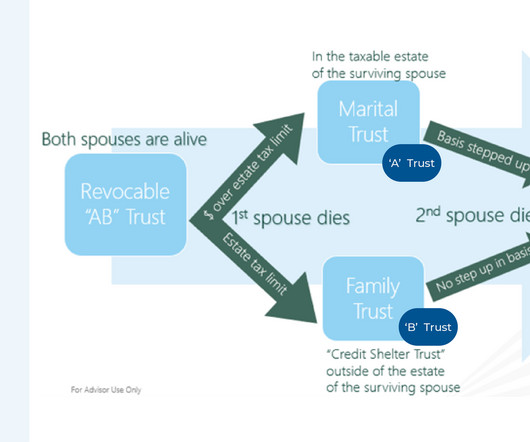

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Nerd's Eye View

JANUARY 13, 2025

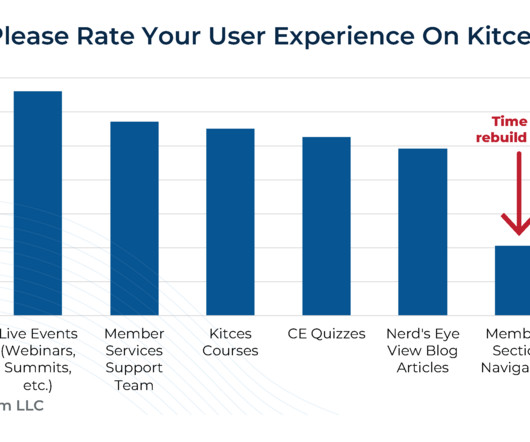

With another strong year in the markets, most advisory firms are near or at record highs for their revenue, their numbers of clients, and the headcounts of their teams. And also make it easier for us to redesign the Nerd's Eye View blog side of the website as well, in 2026!)

Abnormal Returns

JUNE 4, 2023

1, 2026 and becomes a big problem for reactive RIAs who fail to help clients take action now." (linkedin.com) The AI stock mania phase is here. herbgreenberg.substack.com) Steve Lockshin, "The dream becomes a nightmare for millions of high-net-worth investors on Jan. riabiz.com) There's nothing magical about dividend investing.

Nationwide Financial

MARCH 6, 2023

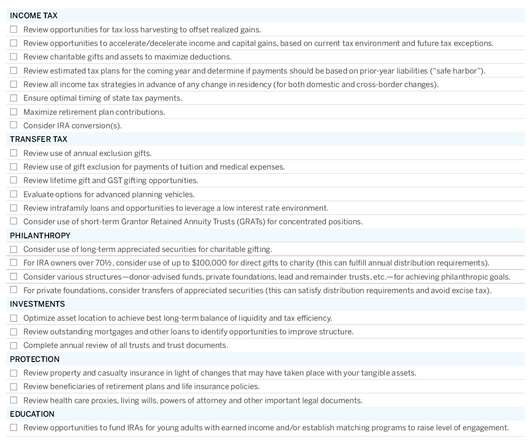

One strategy is to accumulate deductions that a client would normally take over 2 years into a single year. Even if a client believes they would not be subject to estate or gift tax under current law, you may want to re-examine the value of their assets to determine whether they exceed a lower exemption amount.

Steve Sanduski

SEPTEMBER 17, 2024

In a Nutshell: High-net-worth clients have high-net-worth needs. ” Megan Gorman and I discuss: How Megan draws on her background as an attorney and her passion for tax strategy when advising high-net-worth clients. Megan’s vision of the “perfect” client experience. Because never the two shall meet.

Carson Wealth

DECEMBER 8, 2023

The advantage to our clients is that we think about these things every day and are prepared to have the conversation with you whenever you are ready. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA).

The Big Picture

JUNE 22, 2024

Income from the licensing deal with UMG for the rest of the world will similarly go to Sony when that deal expires in 2026 or 2027, at which point SME will become the worldwide distributor and owner of all content.” At Canadian Music Week Don Passman said he advises his clients not to sell. So the value of old superstars goes up!

Nationwide Financial

AUGUST 29, 2022

Tax rates are unlikely to go down, so discuss tax implications and legislation with your clients today. This means if Congress does nothing, we will revert to 2017 tax rules for the 2026 tax year. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital.

Trade Brains

NOVEMBER 18, 2023

The industry is expected to grow at a CAGR of approximately 16% from 2022 to 2026. Marquee Client Record: Tata Tech’s clients include some of the most notable names such as Airbus, McLaren, Honda, Ford, and Cooper Standard. The top 5 clients of the Company contributed to 60.49%, giving rise to concentration risks.

Trade Brains

JANUARY 22, 2024

The Company’s Marquee list of clients includes Airbus , McLaren , Honda , Ford , and a new energy vehicle Company called VinFast. These anchor clients contribute to 40% of the Company’s revenue. The industry is expected to grow at a CAGR of approximately 16% from 2022 to 2026. Additionally, digital engineering spending.

Steve Feinberg

FEBRUARY 3, 2022

In 2022 the rate is 5%, and then 4% in 2023, 3% in 2024, 2% in 2025, 1% in 2026, and then completely repealed after 2026. Strategically, the S Corporation could even start ‘planning’ for this now, by simply letting their profits sit in the company and take them out in 2026 or later. So, what’s changing?

Harness Wealth

JANUARY 29, 2025

Effective ways to achieve this include: For employees : If your employer offers this option, request that your year-end bonus be deferred to January 2026. For self-employed individuals : Consider delaying invoicing or billing clients so that payments are received beyond the current tax year.

Trade Brains

SEPTEMBER 1, 2023

According to the Automobile Component Manufacturers Association (ACMA), India’s auto component exports are estimated to reach US$ 30 billion by 2026. By 2026, the auto component sector is expected to generate $200 billion in revenue. Furthermore, auto component exports rose 8.6%

MarketWatch

MARCH 22, 2023

in premarket trading Wednesday, after the company that connects freelancers with clients who need work performed said it would buy back a little more than one-third of its 0.25% convertible debt due 2026 outstanding. Shares of Upwork Inc. UPWK rose 1.2% million aggregate principal amount of the debt.

Trade Brains

MAY 21, 2024

As of December 31, 2023, Awfis has over 2,295 clients and has a presence in 52 micro markets in India. The Company’s 2nd largest revenue generator turns out to be Construction and fit-out projects, which are shared office space customized to the needs of larger clients. million sq. In FY23 Awfis reported a gross revenue of Rs.

Nationwide Financial

JANUARY 26, 2023

Without action by Congress, 2026 could usher in significantly higher tax rates. Helping clients leverage the opportunity to take advantage of designated Roth accounts now and create a tax diversified retirement portfolio for the future is a great way to add value to your relationships.

Harness Wealth

JULY 29, 2024

However, awareness is key, both for clients and advisors. In this article, we discuss six topics and trends that tax professionals should be aware of to win the information battle as a trusted resource for clients. Knowing and using these strategies before they are lost can be important for many advisors or clients.

BlueMind

APRIL 25, 2022

Category: Client Relations. The Power Of Female Clients Although the male-dominated mindset cannot be changed overnight, one can expect to bring change by coming to the realization that women no longer take the back seat in any sector. For Canada alone, the expected is 50% of accumulated wealth by 2026. What Women Want.

BlueMind

MARCH 10, 2022

Although there is a fierce ongoing debate on the overall impact of digitization on the world (especially regarding employment rates), there is no doubt that it comes with many benefits for both financial advisors and their clients. billion by 2026. If you’re lucky you are able to arrange a meeting on the first call with your client.

Steve Sanduski

NOVEMBER 26, 2022

How much money do your clients need to retire? Fifty years from Fuller’s talk puts us in 2026. With this transformational mindset, clients would no longer need to ask, “Do I have enough money to retire.” How much money do you need? Can you ever have “enough” money? His response, “Tithing.” How’s that?

Brown Advisory

NOVEMBER 1, 2019

Each year, we send a letter to clients to help guide year-end planning discussions and to offer ideas for them to consider with their other advisors. Our primary objective with all of our year-end thinking is to take actions that ensure a firm, stable, long-term foundation for our clients’ plans. 2019 Year-End Planning Letter.

Validea

DECEMBER 30, 2022

Direct indexing assets, currently at $462 billion, are expected to rise up to $825 billion by 2026, according to Cerulli Associates data that is cited in the article, making its growth forecast the biggest out of ETFs, mutual funds, and separately managed accounts.

Trade Brains

NOVEMBER 22, 2023

Suzlon has a vast client base of Companies from both the private & public sectors. Public sector clients include GAIL, ONGC, IPCL, etc. The sector is expected to grow at a CAGR of 16% doubling its capacity by 2026. At 160m Hub height, these become India’s largest turbines. The Government has allocated a budget of Rs.

Trade Brains

OCTOBER 23, 2023

In this Fundamental Analysis of Apollo Micro Systems, we look at the company, its clients, industry, financials, future plans & more. We will learn who are its biggest clients and move on to fundamentally analyzing the Company and finally reaching a conclusion. billion by 2026, compounding at 7.7% billion in 2021.

Trade Brains

JULY 5, 2024

billion and it is estimated to reach US $ 8 billion by 2026. It also offers an all-in-one data center-in-a-box solution called the Secure Edge Data Center, developed by partnering with HPE, for clients in need of data and applications locally. As of 2020, the data center industry was valued at US $ 4.4

Trade Brains

FEBRUARY 29, 2024

Having Automotive OEMs as its clients, it enjoys the benefits of long-term contracts with these clients reducing the cost to acquire new customers. Industry Overview As per the Automobile Component Manufacturers Association (ACMA), India’s Component exports will reach USD 30 billion by 2026.

Trade Brains

JULY 31, 2023

Of this, $5 billion accounted towards API and $12 billion was attributed to APIs required for formulation manufacture, Between 2022 and 2026, the entire domestic India API market is predicted to rise at an 11.1% Any major decrease in demand for its products from such clients may have a negative impact on the business.

Fortune Financial

AUGUST 7, 2023

trillion by 2021, it is expected to rise to $23 trillion by 2026. We provide in-depth research, due diligence and ongoing monitoring of investment options, ensuring that clients have access to high-quality opportunities and are equipped with the information needed to make informed investment decisions. between 2015 and the end of 2021.

Fortune Financial

AUGUST 7, 2023

trillion by 2021, it is expected to rise to $23 trillion by 2026. We provide in-depth research, due diligence and ongoing monitoring of investment options, ensuring that clients have access to high-quality opportunities and are equipped with the information needed to make informed investment decisions. between 2015 and the end of 2021.

Trade Brains

AUGUST 27, 2023

It counts renowned names such as Bharat Electronics, ISRO, Bharat Dynamics, Larsen & Toubro, Coal India, and many others as its clients. CAGR growth over the next three years till 2026 as nations across the world put an emphasis on upgrading and adding new units to their weapon systems, aircraft, aerospace projects, etc.

Trade Brains

JULY 5, 2024

billion and it is estimated to reach US $ 8 billion by 2026. It also offers an all-in-one data center-in-a-box solution called the Secure Edge Data Center, developed by partnering with HPE, for clients in need of data and applications locally. As of 2020, the data center industry was valued at US $ 4.4

Trade Brains

JUNE 21, 2023

India’s EMS sector is developing at the fastest rate of any country, with a CAGR of 32.3%, and is estimated to contribute 7.0% (USD 80 billion) of the worldwide EMS market by 2026. Since the industry is highly regulated, it is difficult for new players to enter the market.

Fortune Financial

MAY 4, 2023

billion by 2026, according to a report by Hubs. Subscribe to Our Playlist to Stay Up-to-Date on the Latest Alternative Investment Opportunities Work with a Fortune Financial Advisor Our focus at Fortune Financial is on locating solid alternative investment opportunities so clients aren’t riding the emotional roller coaster of market cycles.

Trade Brains

AUGUST 1, 2024

Sealmatic Ltd is one of the few Indian companies that has been approved/registered as a vendor with both national and international clients. It is India’s only domestic manufacturer or monopoly company in mechanical seal production.

WiserAdvisor

JANUARY 23, 2024

For example, there is going to be an increase in tax rates in 2026 due to the onset of the Tax Cuts and Jobs Act. For instance, events like a market downturn in June 2013 allowed some services to capture losses promptly, providing tax savings for clients. Annual Roth conversions can be one measure to tackle the changes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content