How Biden’s Budget Proposals Impact Pre-2026 Planning

Wealth Management

APRIL 16, 2024

Shenkman and Joy Matak discuss proposals in the 2025 Green Book.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 16, 2024

Shenkman and Joy Matak discuss proposals in the 2025 Green Book.

Wealth Management

OCTOBER 21, 2024

Craft plans to avoid application of the step transaction doctrine before the exemption potentially gets reduced.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

OCTOBER 16, 2024

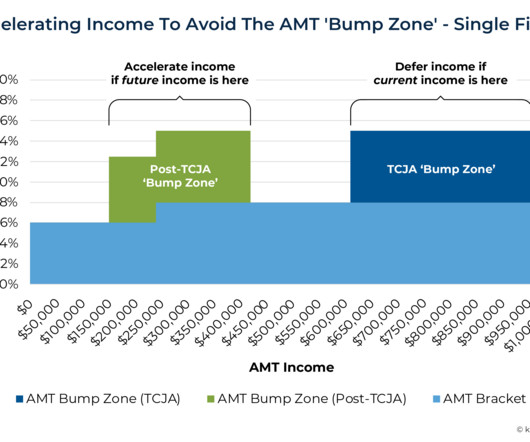

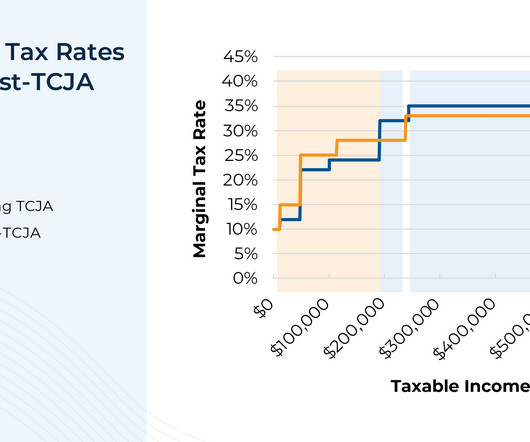

But with the anticipated sunset of TCJA in 2026 and the reversion to the pre-2018 AMT rules, a large subset of households will find themselves owing AMT – many of whom will do so for the first time. However, if they were to wait until 2026, they would owe AMT (and need to find or borrow funds to pay the AMT triggered by the exercise).

Nerd's Eye View

JULY 10, 2024

From an advisor's perspective, TCJA's impending expiration raises the importance of planning for clients who will potentially be impacted, which, given the law's broad scope, could be nearly every client. elections. Read More.

Nerd's Eye View

MARCH 3, 2025

Welcome to the March 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

APRIL 5, 2023

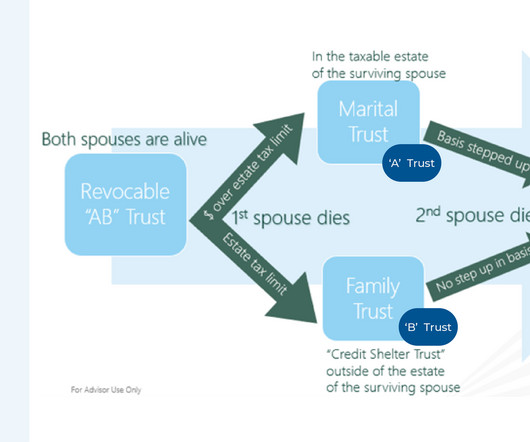

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Wealth Management

FEBRUARY 6, 2025

Keller will step down on April 30, 2026, with the Board planning a search for his successor in the coming year. In a LinkedIn post, Keller wrote that leading well means leaving well.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Abnormal Returns

JULY 3, 2023

kitces.com) Estate planning Four things to consider in anticipation of 2026. financial-planning.com) Wealth.com's Ester will help you read estate planning documents. riaintel.com) Why you should flip your plan presentation meetings on their head. (matts-newsletter-7a3f46.beehiiv.com) Thankfully advisers lead the list.

Abnormal Returns

MAY 8, 2023

kitces.com) Practice management Why succession planning is important to firm owners whether they plan to sell or not. kitces.com) How personality traits affect estate planning decisions. thinkadvisor.com) A number of tax provisions will sunset in 2026 including the lifetime exclusion amount. investmentnews.com)

Nerd's Eye View

SEPTEMBER 2, 2022

From there, we have several articles on investments: How Morningstar plans to simplify its rating system amid continued concerns about its effectiveness. A study suggests that some fund companies are misleading investors by changing their benchmark indices to make their performance look better.

Abnormal Returns

MAY 29, 2023

Podcasts Michael Kitces talks with Meg Bartelt of Flow Financial Planning about evolving her practice. thereformedbroker.com) 2025 If nothing changes legislation-wise, there will be a run on estate planning going into 2025. 1, 2026 and becomes a big problem for reactive RIAs who fail to help clients take action now."

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

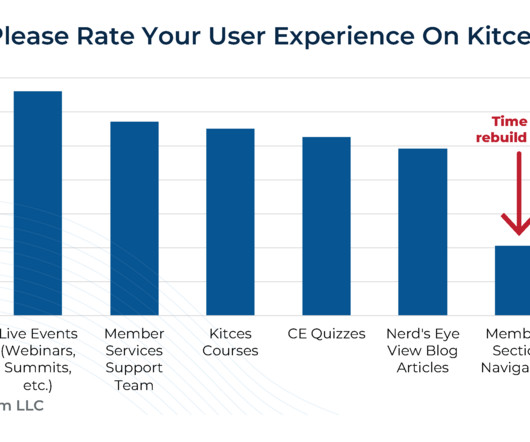

JANUARY 13, 2025

And also make it easier for us to redesign the Nerd's Eye View blog side of the website as well, in 2026!) Which means over the next 12 months, we're going to rebuild it all from scratch, with a modern technology foundation that will allow us to better scale over the next decade.

Wealth Management

FEBRUARY 6, 2025

Keller will step down on April 30, 2026, with the Board planning a search for his successor in the coming year. In a LinkedIn post, Keller wrote that leading well means leaving well.

Carson Wealth

DECEMBER 8, 2023

Petersen, CPA, CFP ® , CP, Affluent Wealth Planning The holidays are upon us! That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. Lastly, I allocate the retirement plan contributions between Roth and Traditional 401(k) accounts.

Zajac Group

NOVEMBER 7, 2024

Creating wealth that can provide financial security for generations to come is an incredible feat, and it requires careful planning, consideration, and communication among family members. And for those with equity compensation in the mix, some extra consideration is required. 200/share (today’s fair market value) – $188.44/share

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Harness Wealth

NOVEMBER 12, 2024

Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Checklist: Year-end Tax Planning Strategies Review the following tax strategies with your tax advisor and/or financial advisor before the end of the year.

Abnormal Returns

SEPTEMBER 30, 2024

Podcasts Michael Kitces talks with Ann Garcia, partner of Independent Progressive Advisors, about planning for mid-work professionals. kitces.com) Tax strategies if the TCJA expires in 2026. flowfp.com) Don't let the potential for estate law changes be an excuse to not do estate planning.

Trade Brains

SEPTEMBER 1, 2023

The article concludes with a highlight of future plans and a summary. According to the Automobile Component Manufacturers Association (ACMA), India’s auto component exports are estimated to reach US$ 30 billion by 2026. By 2026, the auto component sector is expected to generate $200 billion in revenue.

Carson Wealth

SEPTEMBER 27, 2023

But life insurance can benefit your financial planning in many other ways. For individuals, a permanent life insurance plan can play a key role in estate planning by helping reduce estate taxes. million for couples), but it will revert to its pre-2018 level of $5 million (adjusted for inflation) in 2026. million ($25.84

Trade Brains

MARCH 3, 2024

Operating Profit Margin 7.00% Net Profit Margin 2.50% Fundamental Analysis Of Shakti Pumps: Future Plans The company has a plan to continuously provide innovative solutions through its advanced R&D support. Implementation of the Uganda project has started which aligns with the green energy plans in Africa. 2020 0.73 -0.04

Trade Brains

JUNE 6, 2023

A highlight of the future plans of both the companies and a summary conclude the article at the end. billion in value by 2026. Gujarat Fluorochemicals Vs Navin Fluorine – Future Plans So far we looked at the previous fiscals data for our comparative study of Gujarat Fluorochemicals Vs Navin Fluorine.

Trade Brains

MAY 23, 2023

A highlight of the future plans and a summary conclude the article at the end. FY 2021-22 Annual Report The structural shift is expected to benefit the nation immensely and increase its share in the global specialty chemicals industry to 6% by 2026 from 4%. Next, we’ll look at the market size and opportunities.

Nationwide Financial

MARCH 6, 2023

For example, they could make most of their charitable contributions and medical expenditures in a year they plan to itemize. In 2026, the current larger exemption will be reduced from $12,920,000 in 2023 to about $6 million per person ($5 million per person adjusted for inflation). Also consider the capital gains rates brackets.

Trade Brains

JANUARY 22, 2024

The industry is expected to grow at a CAGR of approximately 16% from 2022 to 2026. Tata Technologies Vs KPIT Technologies – Future Plans KPIT Technologies The Company aims to achieve international product leadership in EV Architecture, Middleware Consulting, Autonomous Drive, and Cloud Based Connected Services. .) Stock P/E 82.14

Trade Brains

NOVEMBER 22, 2023

The sector is expected to grow at a CAGR of 16% doubling its capacity by 2026. The Ministry of New and Renewable Energy (MNRE) has outlined a wind-specific renewable purchase obligation (RPO) plan for 2030 with a target of 8 GW onshore wind tender every year between 2023 and 2030. The Government has allocated a budget of Rs.

Trade Brains

OCTOBER 12, 2023

Future Plans KPIT Technologies > The Company management is actively in pursuit of strategic partnerships which resulted in the onboarding of Renault and Honda Japan for the development of Software Defined Vehicles (SDV) & expected to provide services till 2026 and 2030. > Tata Elxsi - Interest Coverage 418.73

Harness Wealth

JANUARY 29, 2025

401(k) Plans: Contribute the maximum allowable amount for 2024 : $23,000 if youre under 50, or $30,500 if youre 50 or older. Effective ways to achieve this include: For employees : If your employer offers this option, request that your year-end bonus be deferred to January 2026.

Carson Wealth

DECEMBER 27, 2023

By Ryan Egolf, EA, Senior Tax Planner As the New Year quickly approaches, it’s time to put a bow on your 2023 financial plan. While this is by no means an exhaustive or comprehensive list of financial planning tools, these three broad areas will get you headed in the right direction. Rates are more accessible than ever before.

MarketWatch

JUNE 21, 2023

DLTR set goals for the next few years in a statement released ahead of an analyst day, and said it’s targeting $10+ per-share earnings in fiscal 2026. The company is also aiming to improve sales productivity and margins at its Family Dollar chain. “We

Harness Wealth

JULY 29, 2024

covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. Now that the mid-point of 2024 has passed, we are faced with an environment where little has changed with respect to the wait-and-see posture of estate and wealth transfer planning. citizens and residents.

Trade Brains

OCTOBER 20, 2024

Nevertheless, this appeal extends the case’s timeline, potentially dragging the legal battle into 2026. The company plans to file a cross-appeal, challenging the ruling on institutional sales. However, an SEC spokesperson later clarified that the process is proceeding as planned.

MarketWatch

JUNE 14, 2023

IMAX said Wednesday it extended its stock repurchase program for years, as the movie experiences company said it pushed back the program’s expiration to June 30, 2026 from June 30, 2023. The company said its buyback program doesn’t include shares repurchased in connection with share-based compensation plans. million remaining.

Trade Brains

DECEMBER 18, 2023

With this belief and with the vision to be the most valuable company in the recycling space globally by 2026, Gravita India has been recycling and creating value for its stakeholders for more than 3 decades. growth rate between 2020 and 2026. The company has a target to increase its manufacturing capacity to 4,25,000 MTPA by FY 2026.

Trade Brains

DECEMBER 15, 2023

Industry Analysis The Indian automobile industry is expected to be worth $300 billion by 2026. The Indian government is one of the largest automaker producers and exporters, which is encouraged by policies such as the Automotive Mission Plan 2026, scrappage policy, and production-linked incentive schemes. .) ₹ 4,221.98

Darrow Wealth Management

JANUARY 30, 2023

just upended retirement planning…again. Raising the age when withdrawals must begin is great as it gives investors more planning opportunities. Here are some tax planning strategies to consider when you should start drawing from your IRA. Retirees in a low tax bracket for the year have several planning options to consider.

Darrow Wealth Management

DECEMBER 23, 2022

Some of the measures in the bill include increasing the required minimum distribution age, raising catch-up contribution limits, permitting some rollovers from 529 plans to Roth IRAs, and expanded access to employer plans. Starting in 2026, the catch-up will be indexed by inflation. 529 plan to Roth IRA rollovers.

Trade Brains

FEBRUARY 25, 2024

The Indian automotive industry is expected to reach US$ 300 billion by 2026. The Automotive Mission Plan 2016-26 is a joint initiative of the Government of India and the Indian automotive industry to lay out a roadmap for the industry’s development. .) ₹ 2,51,612.23

MainStreet Financial Planning

JUNE 23, 2023

in 2026, the eligibility age will be adjusted to 46. The beneficiary may only make this contribution if they are not participating in any employer sponsored retirement plan. The current tax law also allows for a rollover from a 529 plan to an ABLE account up to the annual limit amount. With the passing of Secure Act 2.0,

Trade Brains

DECEMBER 25, 2023

The industry is experiencing significant demand, and according to studies conducted under the national electricity plan, the estimated power capacity for 2026–27 would be 6,09,591 MW, with conventional capacity contributing 44.79% and renewable capacity contributing 55.20%. crore in FY23, up from Rs. crore in FY22, a 9.38% rise.

Trade Brains

OCTOBER 18, 2024

Zomato plans to consider fundraising through equity share issuance through qualified institutions placement (QIP) subjected to Shareholder’s approval. Market analysts suggest that Blinkit is driving the upside in Zomato’s valuation as it extends its aggressive expansion plan. Food Aggregator shares fell by around 5.6%

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content