Steps Advisors Can Take Before Tax laws Change

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Nerd's Eye View

APRIL 5, 2023

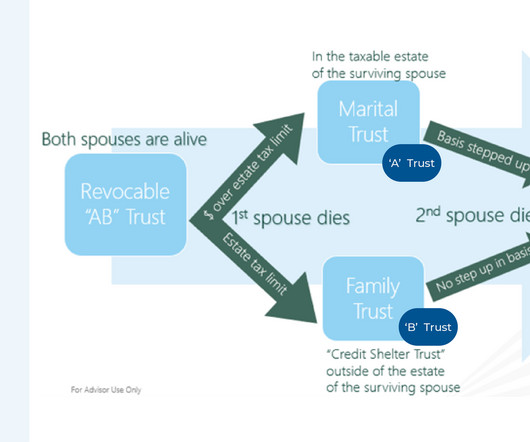

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Nationwide Financial

MARCH 6, 2023

For example, they could make most of their charitable contributions and medical expenditures in a year they plan to itemize. Even if a client believes they would not be subject to estate or gift tax under current law, you may want to re-examine the value of their assets to determine whether they exceed a lower exemption amount.

Let's personalize your content